Knowledge Centre

What’s Driving Golds Prices?

September 2020

The gold market is incredibly difficult to predict. There are obvious factors like supply and demand for physical gold. There are many other speculative factors that affect gold prices which are also important: the U.S. Dollar, political climate and central bank activity. However, there is one factor that is vastly more important than any other: real interest rates.

The most important driver of gold prices in the short term are the expectations for real interest rates. The real yield measures the actual return of a bond or any interest-bearing investment adjusted for inflation. If a bond yields 1.0%, but the inflation rate is 2.0%, the real yield on that bond is negative -1.0%. Quite simply, when real yields go down, gold goes up and when real yields go up, gold goes down. This correlation explains why inflation is gold's best friend while rate hikes are its worst enemy. When interest rates increase, real yields also increase because higher rates defray inflation.

Gold has gained 30% so far this year. It first broke US$1,000 an ounce during the global financial crisis in 2008 before reaching a record high of $1,921 in September 2011. This year’s rally puts it on course for its biggest annual gain in a decade. With investors looking for safe-haven assets that will not lose value, they are pouring record amounts of money into the precious metal.

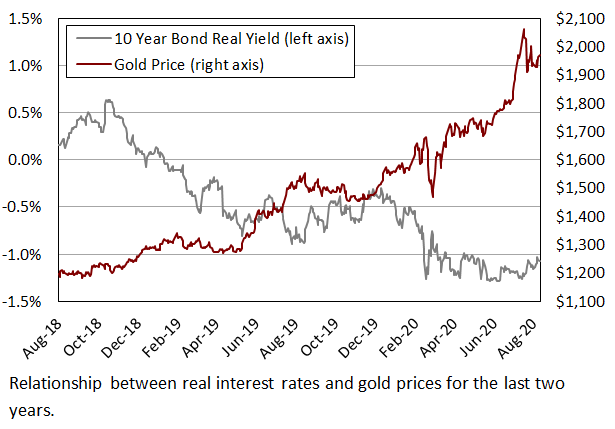

Deepening negative real yields in the bond market are fueling a frenetic rally in gold. The chart to the right shows that real interest rates peaked in 2018 and started a downward trend in February 2019 when they fell below zero. It is not a coincidence that the gold prices jumped in 2019. The 10 Year Canadian Bond index currently yields 0.63% and the most recent seasonally adjusted annual inflation rate is 1.7%; so, the real yield is -1.07%. The 10 Year Canadian Bond real yield hit its record low of -1.29% in June.

Obviously, when real interest rates are high, investors lose out if they choose to hold onto gold, which does not pay them any dividends or interest. But when real interest rates go down, gold becomes much more attractive; as it becomes very cheap to hold.

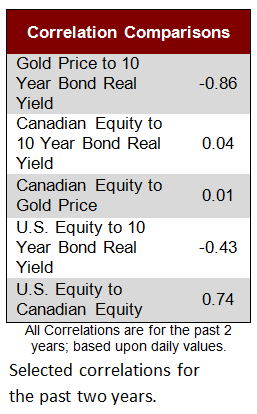

Gold prices are clearly inversely correlated with inflation expectations. As such, a very strong negative correlation exists between real interest rates and gold prices; between 1997 to 2018 it was -0.82 (-1.0 means a perfect negative correlation). Currently, the correlation is -0.86. As the table above left shows, this is amongst the most significant correlation between any two asset classes or market indicators.

Clearly, the price of gold tends to increase significantly during periods of negative real interest rates. The decline of bond market yields has driven increased risk-taking and has triggered a surge into traditional safe havens like gold. However, in the absence of high consumer and commodity prices, it’s appeal should decline. The deeply depressed nature of real interest rates has effectively caused gold prices to overshoot to the upside relative to commodities and consumer prices. History has shown that the financial markets hate extremes and sooner or later things normalize; and extremes are reversed. Rising interest rates could likely be the trigger to burst this bubble.

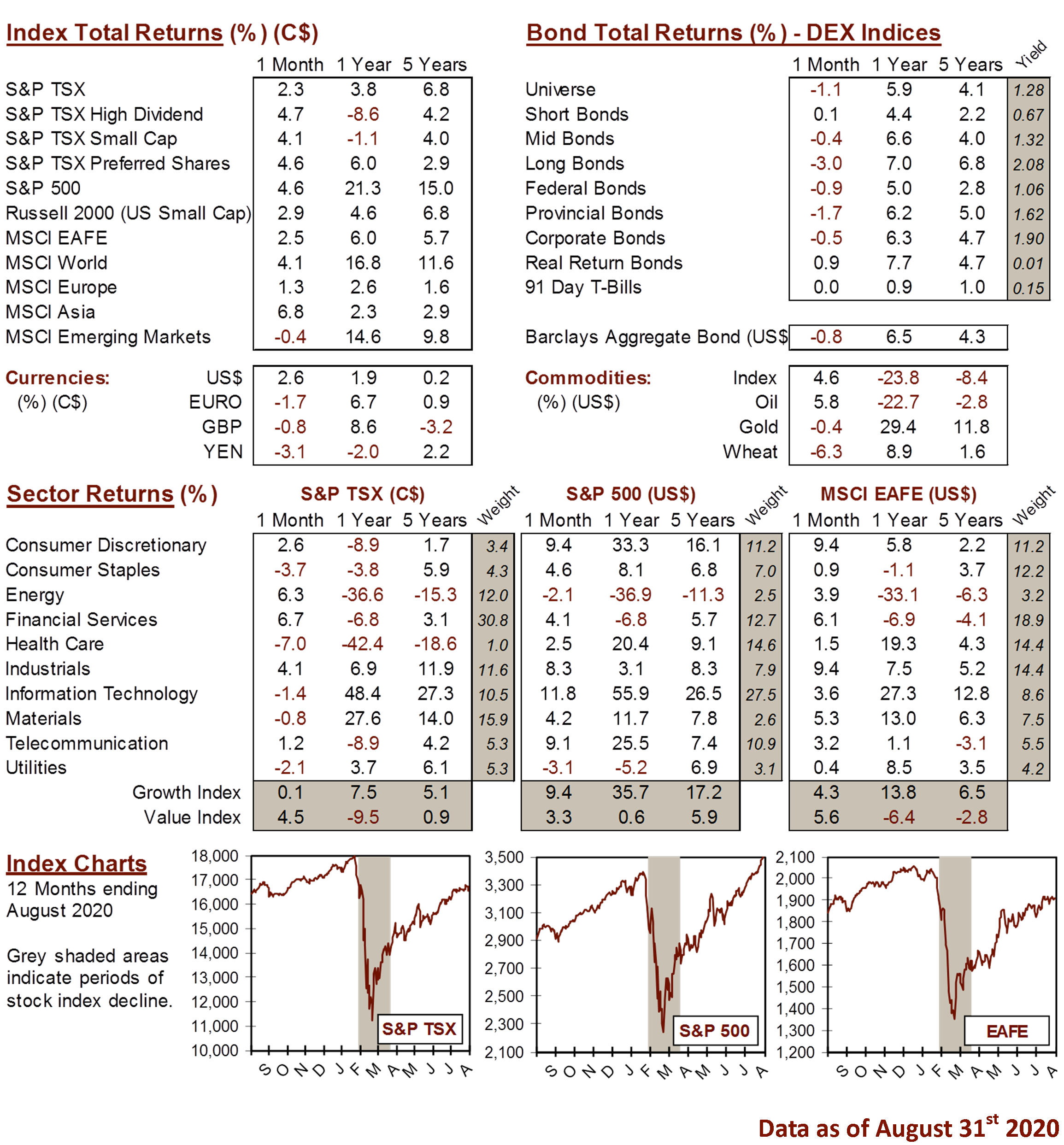

MARKET DATA

This report may contain forward looking statements. Forward looking statements are not guarantees of future performance as actual events and results could differ materially from those expressed or implied. The information in this publication does not constitute investment advice by Provisus Wealth Management Limited and is provided for informational purposes only and therefore is not an offer to buy or sell securities. Past performance may not be indicative of future results. While every effort has been made to ensure the correctness of the numbers and data presented, Provisus Wealth Management does not warrant the accuracy of the data in this publication. This publication is for informational purposes only.

Contact Us

18 King St. East Suite 303

Toronto, ON

M5C 1C4