Knowledge Centre

Using History as our Guide

November 2022

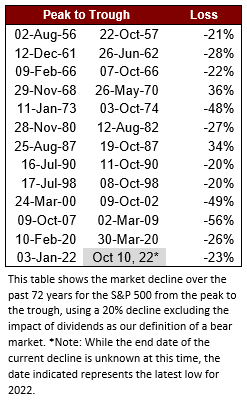

History has a way of repeating itself and history might be about to deliver a welcome relief from the equity market turmoil in the form of a turning point; in what, until now, has been a one-sided slide. In the U.S., eight of the last thirteen bear markets over the last 72 years (defined as a 20% decline in the S&P 500 excluding the impact of dividends) hit their low in October.

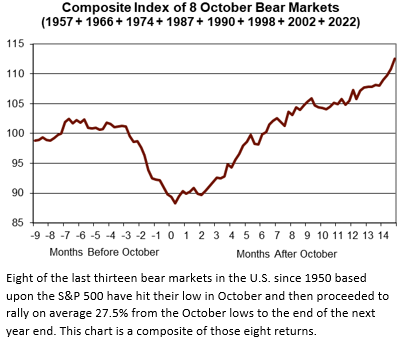

The chart to the right is a composite of the average performance of the eight bear markets (if we use the assumption that the current bear market is coming to an end in October 2022) which had October lows or near-lows (the data incorporates two near-low periods: the 1987 Crash where the October 19th low was less than 1% above the absolute low set in December and the 1998 bear market where the October 8th low was less than 1% above the August 31st low). These historically aggregated returns have been laid over the current period to illustrate how this rebound could appear.

This seasonal pattern illustrates the S&P 500 typically setting a V-shaped low in October. After the initial bounce in October and early November, markets moved sideways through yearend before beginning a powerful rally. The October losses were often recouped by the following May.

The October V-shaped low normally corresponds to the end of the third quarter pre-announcement season. The pattern of pre-announcing earnings warnings followed by positive surprises during the reporting season has been clear for many years. Flat or weak markets after the initial bounce from the October low can be partly attributed to tax loss selling and year end “window dressing” (trading done by mutual fund managers to dump losers and only show strong-performing stocks just ahead of the required posting of portfolio holdings). This year end effect could also explain why January returns can be robust as tax loss selling ends and investors move to increase equity exposure in anticipation of economic recovery.

Eventually investors will step forward to take advantage of the lows, but markets will likely continue to be volatile over the next few months. The cause of the recovery cannot be predicted and may not be particularly evident until after the fact, but it will occur. Bear markets normally occur in three stages. The first is when a few prudent investors recognize that despite the overwhelming bullishness things will not always be rosy. The second is when most investors recognize the economy is deteriorating; and the third occurs when the consensus is that things can only get worse. On the other hand, a bull market also goes through three stages. Initially only a few forward-looking investors begin to believe things will get better. In the second phase the majority of investors come to realize that improvement is underway, and the final stage is when most everyone is sure markets will get better indefinitely. Bull markets begin when investors become increasingly forward looking. With history as a guide, the S&P 500 (and hopefully all stock markets will join into the recovery) may well bounce off a bottom in October before staging a sustained rally in early 2023.

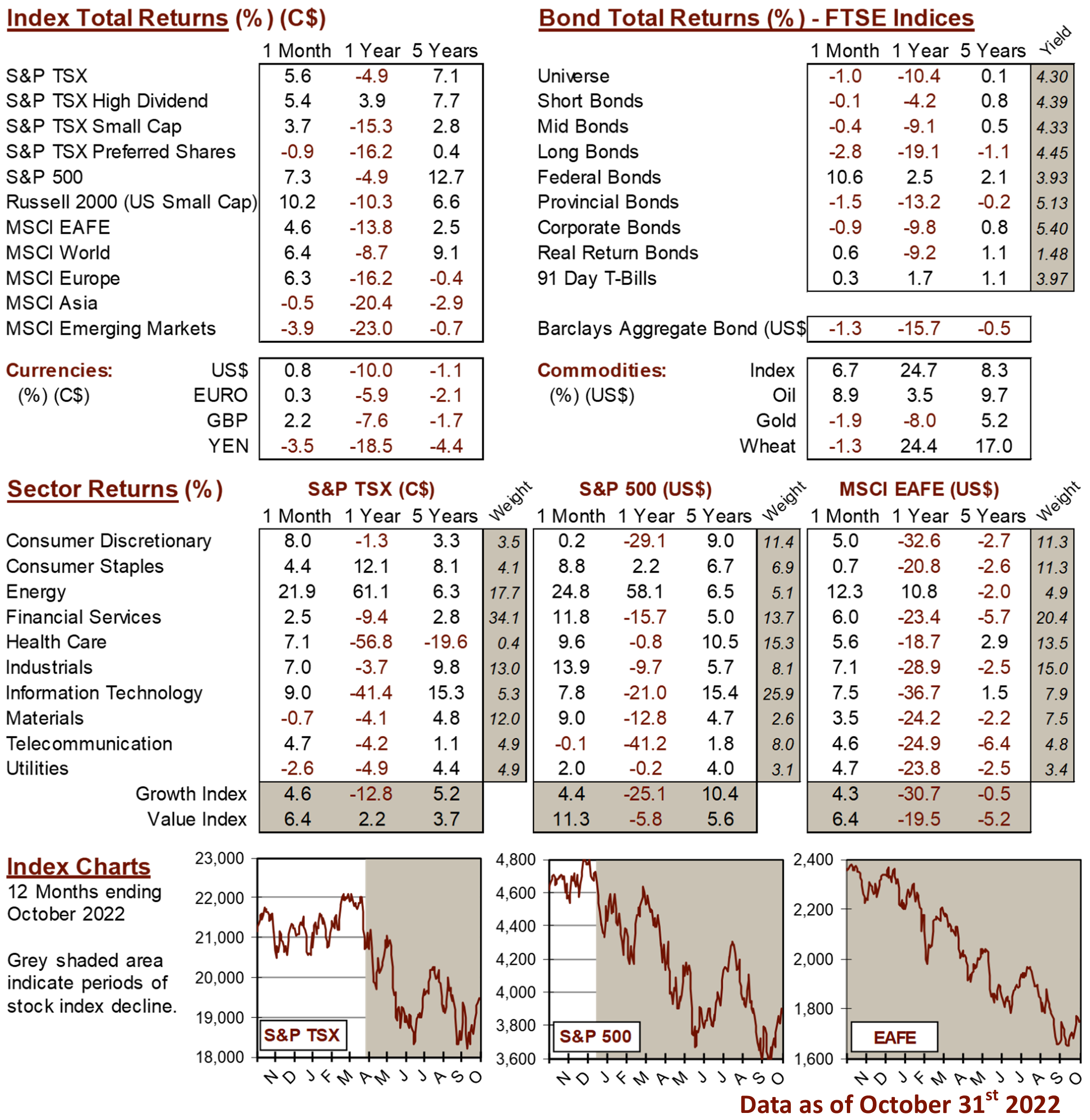

MARKET DATA

This report may contain forward looking statements. Forward looking statements are not guarantees of future performance as actual events and results could differ materially from those expressed or implied. The information in this publication does not constitute investment advice by Provisus Wealth Management Limited and is provided for informational purposes only and therefore is not an offer to buy or sell securities. Past performance may not be indicative of future results. While every effort has been made to ensure the correctness of the numbers and data presented, Provisus Wealth Management does not warrant the accuracy of the data in this publication. This publication is for informational purposes only.

Contact Us

18 King St. East Suite 303

Toronto, ON

M5C 1C4