Knowledge Centre

Two Sides Of January

January 2018

Most investors have heard of the January Effect which is the observation that January has historically been one of the best months to be invested in stocks. However there is another January Effect which states that, “as goes January, so goes the year”. While January has produced positive performance 66% of the time between 1968 and 2017 for the S&P/TSX Stock Index, it has also produced negative performance one-third of the time.

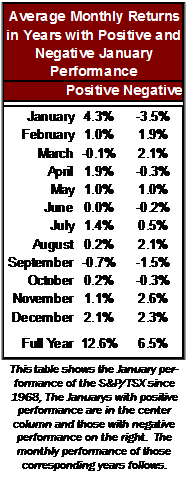

What is striking is that in years when January had a positive return, those returns were well above average relative to the returns in other months of the positive January years. For example, of the 33 Januarys with positive performance, the S&P/TSX was up an average of 4.3%. The next best performing month in those years, as can be seen in the table to the left, was December which returned half that amount at 2.1%. Conversely, when January had negative returns, -3.5% on average; the remainder of the months of the down January years produced better returns. Although in total only 7 months had positive returns, they were more than enough to lift the overall years performance into positive territory but still well behind the 50 year average market performance and still further behind the years where stocks came roaring out of the gate in January.

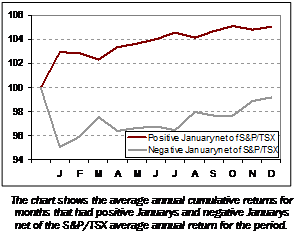

The chart below depicts the average annual cumulative returns for months that had positive Januarys and negative Januarys net of the S&P/TSX average annual return for the period. While the relative performance between good and bad months of January time periods did narrow over the course of the year, it clearly shows that the opening month of the year often sets the pace and influences the remaining months of the year. We then looked at how these markets performed for the full year. In those years where January was positive the S&P/TSX (including dividends) returned 12.6% versus an average of 10.7% for all 50 years reviewed; a 17.8% improvement. On the other hand, negative Januarys underperformed the market as a whole by -39.3%. These numbers confirm that “as goes January, so goes the year”, translating into above or below average annual performance in those years.

The most widely accepted explanation for the January Effect is tax-loss selling. The tax circumstances of taxable investors are often more important than a security’s fundamental valuation, as such investors will sell whatever securities are required at the end of the calendar year to establish capital losses for income tax purposes and then repurchase the shares after a prescribed waiting period. As the waiting period most often expires early in the next year, the repurchase orders flood the market in January, hence creating abnormal returns in the month. In addition to tax issues, researchers have also suggested other reasons for the January effect. One is “window-dressing”, as portfolio managers unload their embarrassing stocks at year-end so that they don’t appear on their annual report, and then redeploy the proceeds in January. Another reason, which we may see more of in 2018, is short sellers covering their successful short positions early in the next year so they usually do not have to pay taxes on the gains until April of the following year.

Whatever the explanation, predicting the future is impossible (even if it is only one month’s prospects), but it is good to know the end result is just a question of how large the annual gain will be on average. Because it is clear that investors should not be out of the market if January is a good or bad month because the returns over the rest of the year are just a question of magnitude. Of course one must always bear in mind that past performance does not mean this trend will continue. It will be interesting to see how it plays out in 2018.

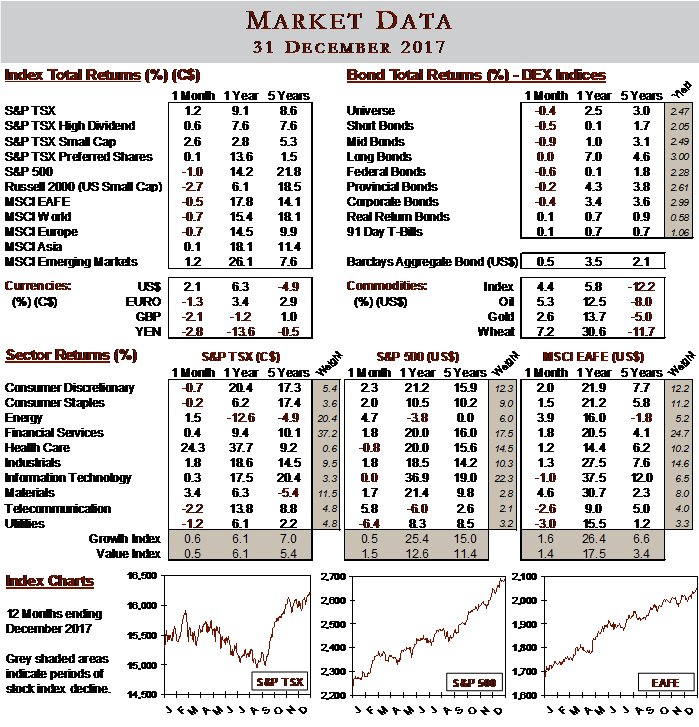

MARKET DATA

This report may contain forward looking statements. Forward looking statements are not guarantees of future performance as actual events and results could differ materially from those expressed or implied. The information in this publication does not constitute investment advice by Provisus Wealth Management Limited and is provided for informational purposes only and therefore is not an offer to buy or sell securities. Past performance may not be indicative of future results. While every effort has been made to ensure the correctness of the numbers and data presented, Provisus Wealth Management does not warrant the accuracy of the data in this publication. This publication is for informational purposes only.

Contact Us

18 King St. East Suite 303

Toronto, ON

M5C 1C4