Knowledge Centre

Strength Through Dividends

July 2023

As the flight to quality reached a fever pitch, even the highest quality dividend paying equities were ignored in favour of money market funds and bonds last year and earlier this year. Nevertheless, there were investors who continued to add new cash to their portfolios, seeking out the largest and most established companies for both safety and valuation purposes. Companies with conservative investment profiles and sound dividend policies are better able to ride out difficult times relative to their weaker peers, so the fundamentally strongest of these stocks could be added to portfolios at attractive valuations.

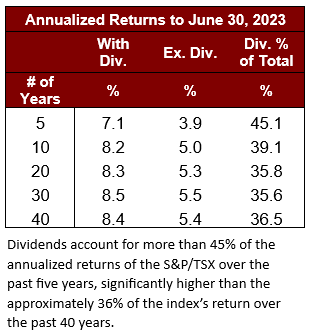

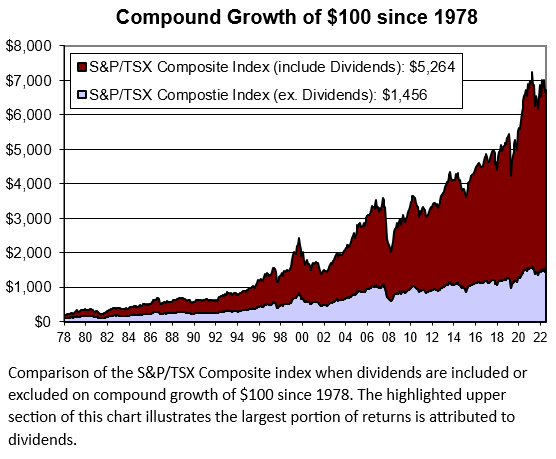

Relative to the pain many clients experienced last year, dividends may seem to be of secondary concern but their long term impact is both meaningful and compelling. Given the recent downside pressure on stock prices, dividends have become even more meaningful in terms of overall performance, accounting for more than 45% of the annualized returns of the S&P/TSX Composite Index over the past five years. This is significantly higher than the 36% of the index’s return that dividends have accounted for over the past 40 years (as the table to the left indicates). The chart to the right also illustrates the substantial improvement to client portfolios from the compounding power of high dividends over the past 45 years: $100 invested in non-dividend paying stocks would be worth $1,456 today versus $5,264 for dividend paying stocks. This is a staggering difference.

Dividend paying companies are generally conservative and investors should take advantage of the stability of these blue chips which continue to pay out a portion of their free cash. Not only do investors receive a tax advantaged income stream, but they are also “paid to wait” while riding out periods of weakness. Furthermore, dividends help soften the magnitude of up and down stock price movements. As a company’s stock price declines, its dividend yield rises, which in turn helps support the share price by attracting yield oriented investors seeking downside support and protection. Over the long run a diligent dividend policy also acts as a safeguard against company mismanagement because if there is one thing dividend seeking investors detest, it is a company cutting its dividend.

While dividend yields have risen dramatically over the past few quarters, it is important not to chase high yielding stocks just for yield’s sake as these premium yields can sometimes vanish quickly. Consistent dividends and dividend growth are the characteristics of a good business. Be mindful that just paying a dividend is not as important as being able to fund the dividend from “free cash flow”, which is the money left over after making the appropriate allocation to maintain or grow the firm’s asset base and assuring continued prosperity.

Studies show that continuously growing, dividend paying stocks have historically been amongst the best returning investments. Companies with the highest free cash flow have significantly trumped all other stocks returns. A recent study in the U.S. confirmed that stocks with the highest free cash flow outperformed the S&P 500 by more that 4% per year over the last 35 years compared to roughly a 1% outperformance for companies that grew their dividend by 15% per year over the same period.

To many investors dividends are indeed the “Breakfast of Champions.” Not only do they generate a sizable portion of a portfolio’s long term performance, but they are also an important factor for judging a stock’s intrinsic strength. Unlike capital gains, which can disappear quickly, dividends cannot be taken away once you’ve received them. As well, dividends may provide the only source of return during periods of sideways and bear markets.

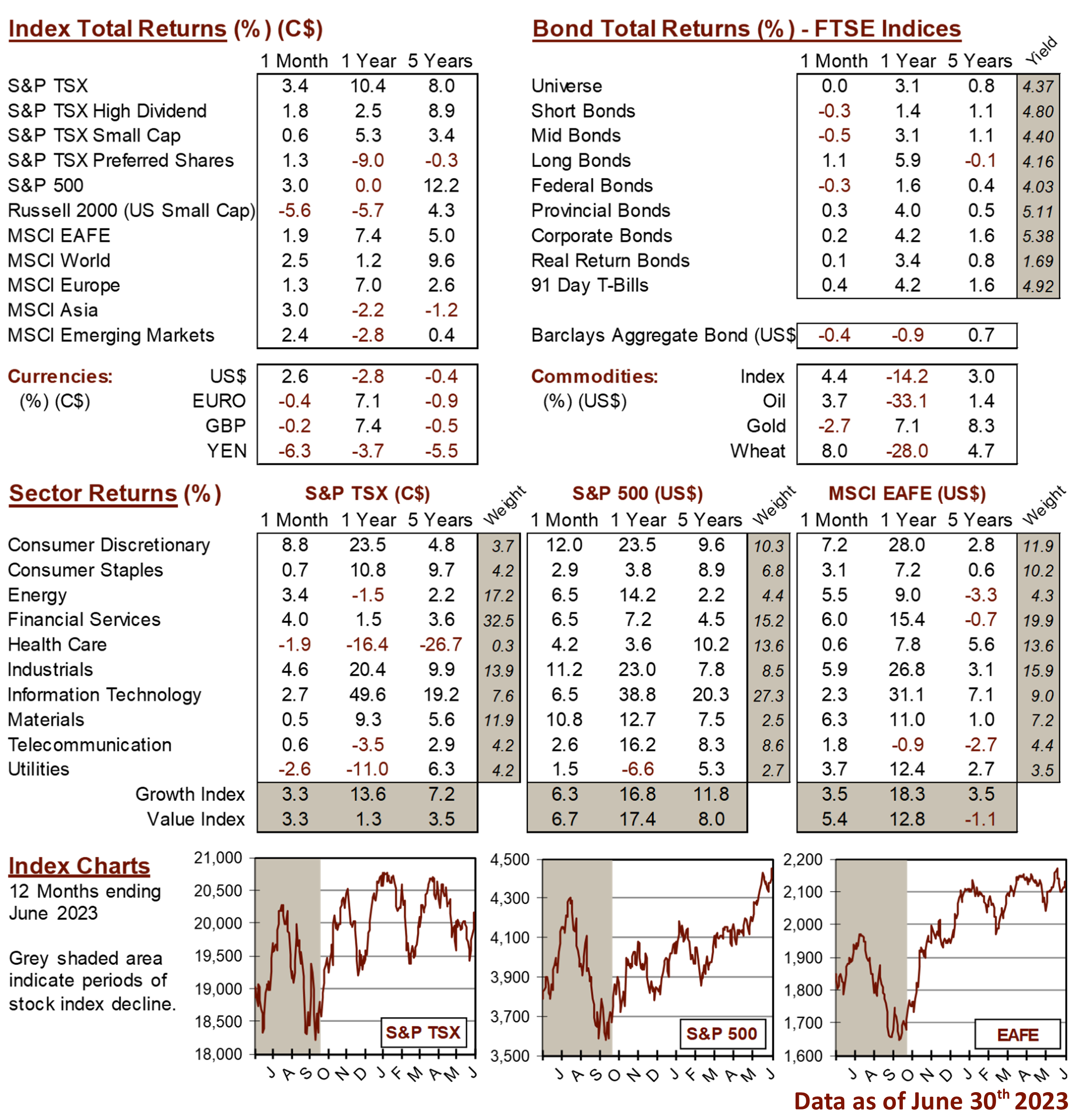

MARKET DATA

This report may contain forward looking statements. Forward looking statements are not guarantees of future performance as actual events and results could differ materially from those expressed or implied. The information in this publication does not constitute investment advice by Provisus Wealth Management Limited and is provided for informational purposes only and therefore is not an offer to buy or sell securities. Past performance may not be indicative of future results. While every effort has been made to ensure the correctness of the numbers and data presented, Provisus Wealth Management does not warrant the accuracy of the data in this publication. This publication is for informational purposes only.

Contact Us

18 King St. East Suite 303

Toronto, ON

M5C 1C4