Knowledge Centre

Rate Hikes and the Stock Market

April 2022

Historically there has been a strong inverse relationship between interest rates and stock prices. Specifically, whenever interest rates rise, stock prices eventually fall and investors become worried that a rate hike is long overdue. But equity bull markets do not end after the first rate hike. The data confirms that stock markets have continued to appreciate for extended periods after an initial central bank interest rate hike. In fact, stocks peak and roll over well after rate hikes have begun.

When central banks raise rates there is a reduction in the amount of money in circulation which makes borrowing more expensive. The initial result of a higher bank rate is that commercial banks increase their rates for borrowing money. Individuals are affected through mounting credit card and mortgage rates which decreases the amount of money they have to spend. Businesses are affected as they also borrow money to run and expand their operations, so they have less to spend and grow the company, which results in less profitability. This of course makes the stock market a less attractive place for investors which ultimately leads to reduced stock prices.

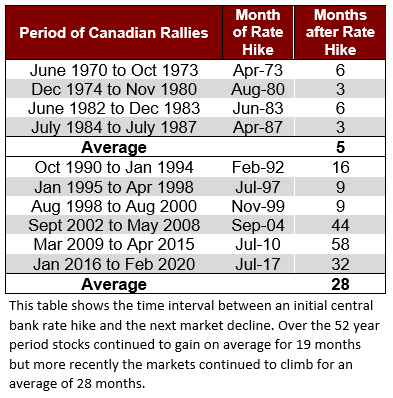

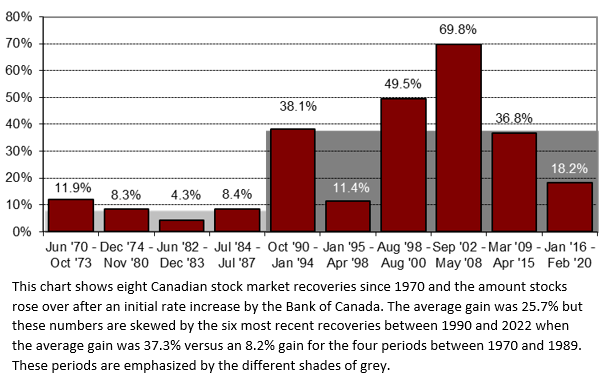

The Bank of Canada (BOC) has kept its benchmark overnight interest rate at 0.25% since March 2020 but is widely expected to reverse its history-making effort to hold down yields in the near future. Investors are antsy about the timing of the rate hike and its implications for the market even though a BOC bank rate increase does not have a direct impact on stock prices. No one can accurately predict a market top or correction. There are many reasons for stocks to drop in a rising interest rate environment and all of these factors are interrelated. As the chart to the left and data to the right show, markets continued to appreciate after an initial interest rate hike. Looking at ten Canadian stock market recoveries since 1970, (with the exception of the recovery from May 1988 to August 1989 which was excluded because no interest rate hike occurred) there are two distinct periods (from 1970 to 1989 and from 1990 to 2020), as reflected by two factors; the time interval between the initial rate hike and the next stock market decline, and the amount stocks rose over that interval. Over the entire 52 year history stocks continued to gain on average for 19 months after the initial rate hike and gained 25.7%. However, these numbers are highly skewed by the six most recent recoveries when the average time interval from rate hike to market decline was 28 months, versus 5 months in the first period, and an average gain of 37.3%, versus 8.2% gain in the first period. It is not clear why there is such a pronounced difference, but the first interval was subject to high inflation which could be a factor. These distinct periods are highlighted by two different shades of grey in the chart and table. Clearly investors should be hoping that the nearer term history is more likely to repeat itself.

The direction of interest rates is extremely important when considering economic growth and predicting equity prices but it is by no means the only one. While a rising interest rate environment may not be detrimental to equity market returns initially, there is no disputing the ultimate outcome. Despite this reality there are many defensive stocks and measures that can be taken to mitigate a downturn and it comes down to acting appropriately as new information presents itself.

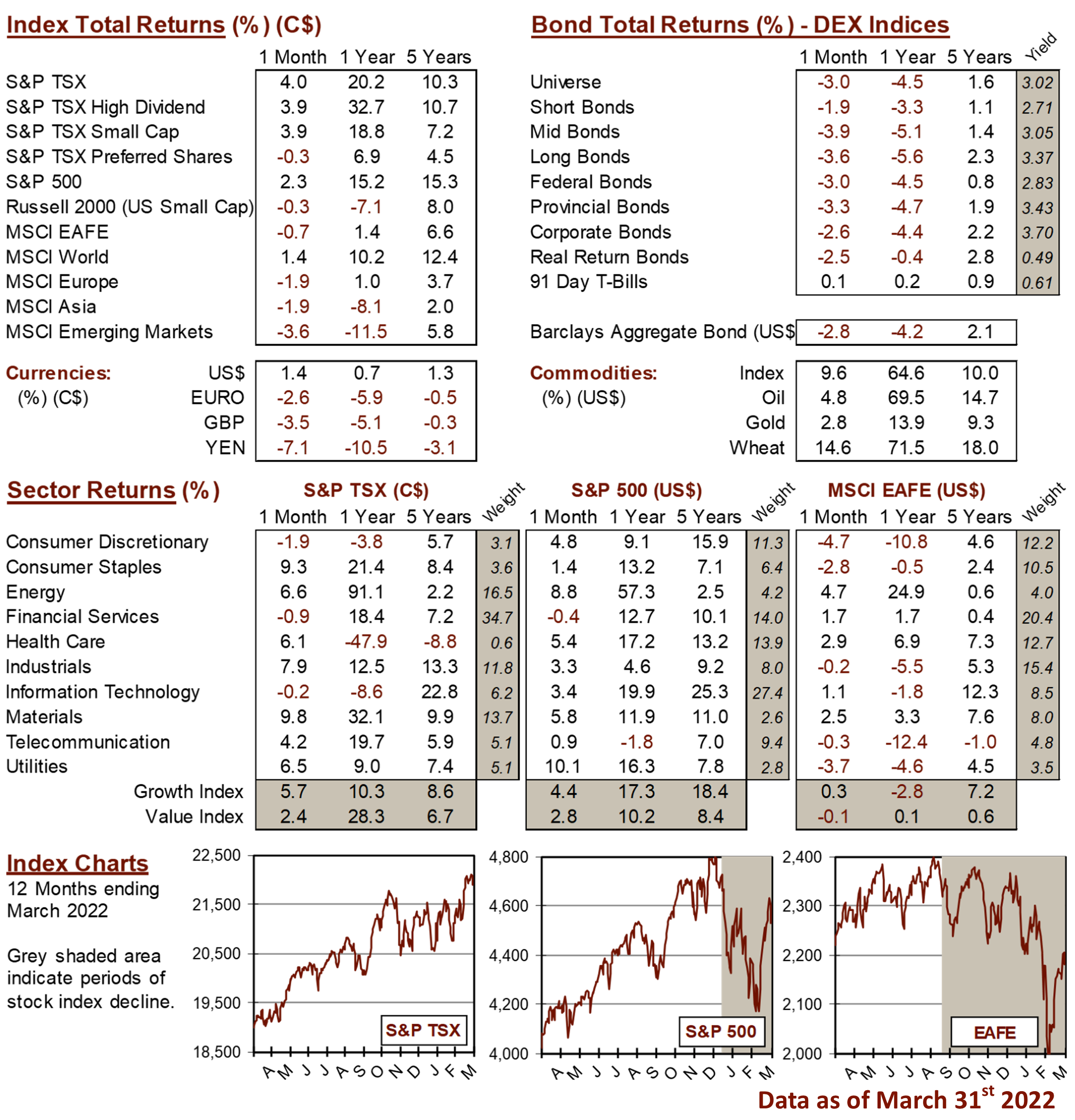

MARKET DATA

This report may contain forward looking statements. Forward looking statements are not guarantees of future performance as actual events and results could differ materially from those expressed or implied. The information in this publication does not constitute investment advice by Provisus Wealth Management Limited and is provided for informational purposes only and therefore is not an offer to buy or sell securities. Past performance may not be indicative of future results. While every effort has been made to ensure the correctness of the numbers and data presented, Provisus Wealth Management does not warrant the accuracy of the data in this publication. This publication is for informational purposes only.

Contact Us

18 King St. East Suite 303

Toronto, ON

M5C 1C4