Knowledge Centre

Post-Pandemic Performance

June 2020

The future is always unknown and the past is subject to interpretation and perspective. However, if the past is categorized appropriately then making honest subjective estimates about how the future could unfold would be very helpful to investors. Investors should be open to the possibility that although the current COVID-19 pandemic is truly wretched, it will end. In fact, there is a very good chance it will end more quickly that most prognosticators would have you believe.

The future is always unknown and the past is subject to interpretation and perspective. However, if the past is categorized appropriately then making honest subjective estimates about how the future could unfold would be very helpful to investors. Investors should be open to the possibility that although the current COVID-19 pandemic is truly wretched, it will end. In fact, there is a very good chance it will end more quickly that most prognosticators would have you believe.

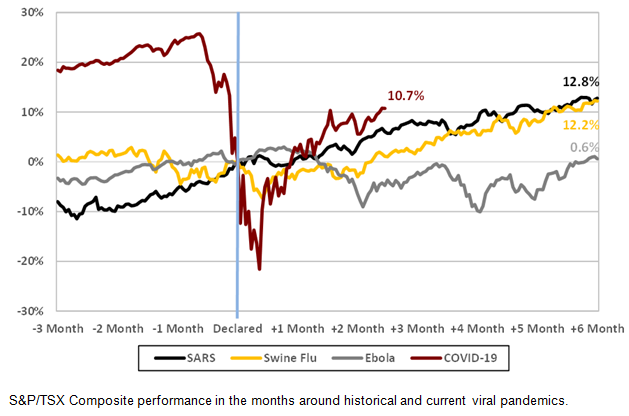

Since the beginning of this century there have been four pandemics declared by the World Health Organization (WHO): SARS – July 5, 2003; Swine Flu Epidemic – June 11, 2009; Ebola Crisis – August 8, 2014; and COVID-19 – March 11, 2020. Each has taken its toll to varying degrees of pain and hardship. The current COVID-19 crisis has produced the most severe underperformance in financial markets of any of these pandemics. However when looking back at the previous pandemics this century, it becomes clear that once the markets turned upward they tend to continue to gain on a steady basis.

Obviously, there are still many unknowns with this pandemic and what lies ahead for the markets. However, the financial markets will likely come to a conclusion long before health concerns have been fully resolved. The chart to the right shows the cumulative return for the S&P/TSX Composite Index for the 3 months prior and 6 months following the declaration date for each of the four pandemics. Three main conclusions can be drawn from the current COVID-19 turbulence: the market decline clearly began before the pandemic was declared; the current market action has been much more extreme and volatile than anything experienced before; and lastly, the Canadian stock market has gained back everything lost and more since the pandemic’s declaration.

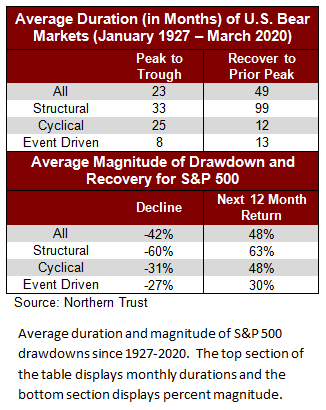

Historically, bear markets can be categorized into three groups (as shown in the data to the left): Structural - the 2008 global financial crisis; Cyclical - the 1980 recession; and Event Driven - the 1987 Black Friday decline. Since 1927, the S&P 500 has experienced 12 bear markets with an average -42% decline over 23 months and it has taken 49 months to regain its prior peak. Structural bear markets have occurred most frequently and tend to result in the most severe durations and drawdowns. Event driven bear markets have the shortest period of decline and recovery is the most rapid (similar to those of cyclical bear recoveries).

The current downturn is likely an event driven bear market. The decline has been one of the fastest in history, while producing a similar decline to historical event driven bear market declines, -27%. Clearly, the risk is that today’s bear market begins to show characteristics of cyclical or structural bear markets and push out the duration and magnitude of the recovery. However, based upon the gathering evidence, it appears that a turning point has been reached putting the worst behind us.

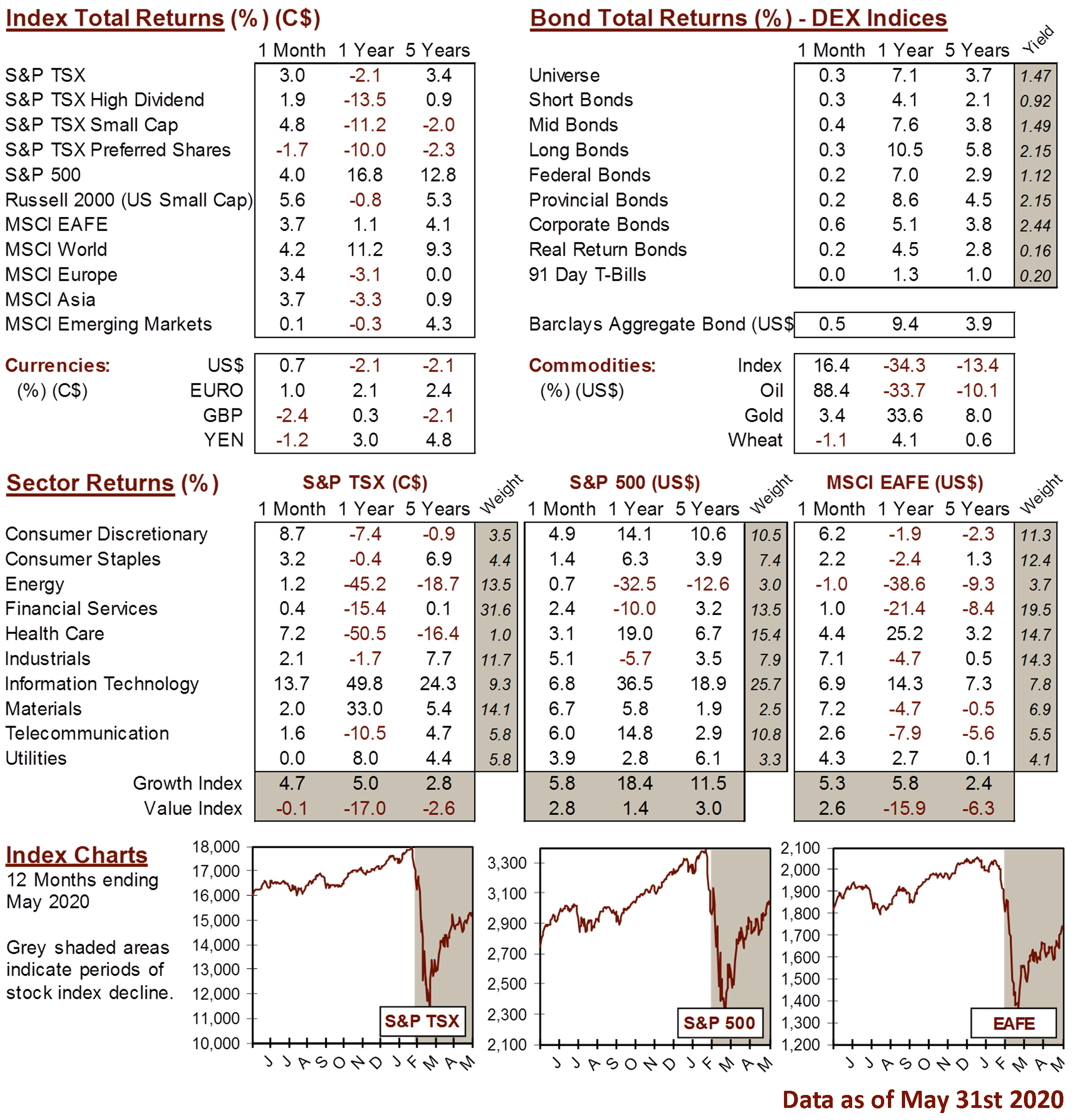

MARKET DATA

This report may contain forward looking statements. Forward looking statements are not guarantees of future performance as actual events and results could differ materially from those expressed or implied. The information in this publication does not constitute investment advice by Provisus Wealth Management Limited and is provided for informational purposes only and therefore is not an offer to buy or sell securities. Past performance may not be indicative of future results. While every effort has been made to ensure the correctness of the numbers and data presented, Provisus Wealth Management does not warrant the accuracy of the data in this publication. This publication is for informational purposes only.

Contact Us

18 King St. East Suite 303

Toronto, ON

M5C 1C4