Knowledge Centre

Peak Volatility = Market Bottom

May 2025

Investors are living through turbulent markets so far during 2025; the S&P/TSX stock index seems to drift aimlessly and then is randomly jarred into violent reactionary mode, all the while trading between 22,500 and 26,000. Investors who closely follow the market can see the volatility as it seems to be moving in all kinds of directions; falling for a week, rallying for two and jumping about like a chicken on a hot tin roof the rest of the time.

If investors were to glance at volatility measures, they would not come away yawning. The so called “fear gauge” has not been a sea of tranquility. The Chicago Board Options Exchange's CBOE Volatility Index (VIX), is a popular measure of the stock market's expectation of volatility based on S&P 500 index options. The VIX is a good proxy of investor sentiment for the U.S. and Canadian equity markets: the higher the Index, the higher the risk of market turmoil. A rising Index therefore reflects the heightened fears of investors for the future. A high VIX is not necessarily bearish for stocks as it measures the fear of volatility both to the upside as well as the downside. The highest VIX readings will occur when investors anticipate large moves in either direction. Only when investors anticipate neither significant downside nor significant upside will the VIX be low.

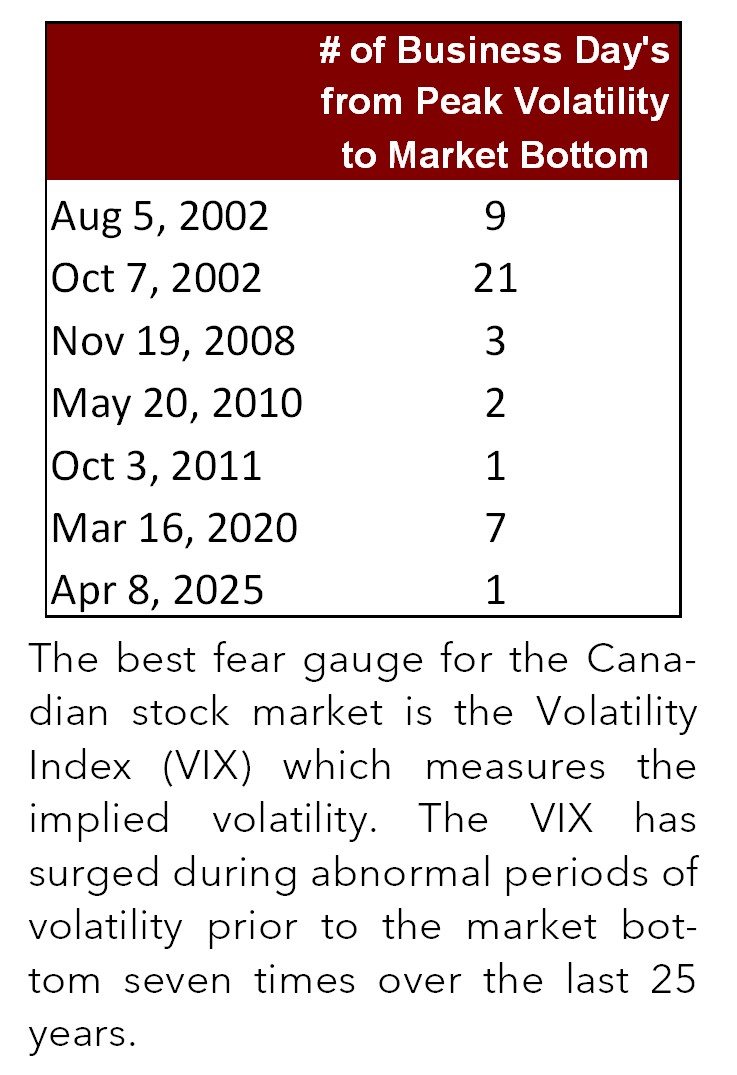

Abnormal spikes in the VIX can be defined as a 3 times standard deviation event or an event that does not occur during 99.7% of the time (it only happens 3 business days out of every 1,000 or once every four years). The table to the left shows the VIX averaged 17.6, with a standard deviation of 8.1. Therefore, a 3 times standard deviation event would be triggered when the VIX surged above 41.8 (17.6 + 8.1 x 3). The table also shows the dates of the seven peak spikes in the VIX since 2000 and the number of days from the peaks prior to the bottoms of the S&P/TSX Stock Index; it ranged between 1 to 21 trading days. So peak volatility usually signals market bottoms.

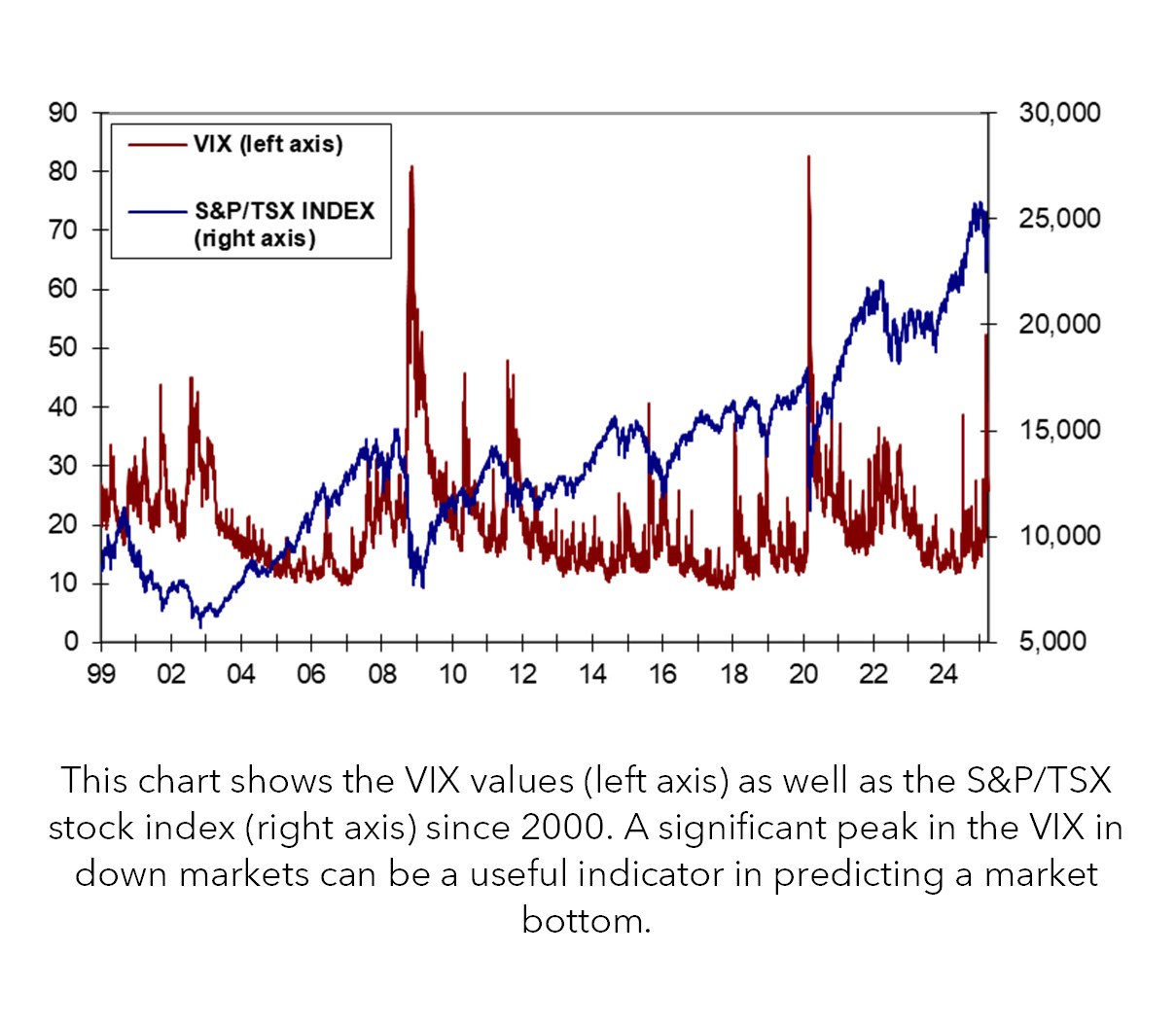

The chart to the right shows the VIX values as well as the S&P/TSX stock index since 2000. Currently, the VIX is trading around 26.3, after peaking at 52.2 on April 8, 2025 which is also the day the current bout of volatility caused the S&P/TSX Stock Index to hit a new 6 month low. Low levels of implied volatility are often good periods to enter the market as the risks are relatively low. Conversely, equity markets tend to disconnect from their underlying values in periods of high volatility as investors scramble quickly to trade those shares that are coming in or going out of favour. Following the years the Canadian stock market experienced significant declines, the VIX shone the light on the pending stock market recovery.

One factor to consider when assessing the timing of a move into equities or adding to existing holdings is the cash on hand. Back in 2009 hedge funds and experienced investors were well ahead of the retail crowd in buying up equities early in the rally. The amount of cash on the sidelines currently has the potential to drive forward a long term equity rally. While it is difficult to say when a rally will occur or if a new rally has already begun with an absolute level of certainty however, savvy investors will look back in time and react to triggering events when they appear.

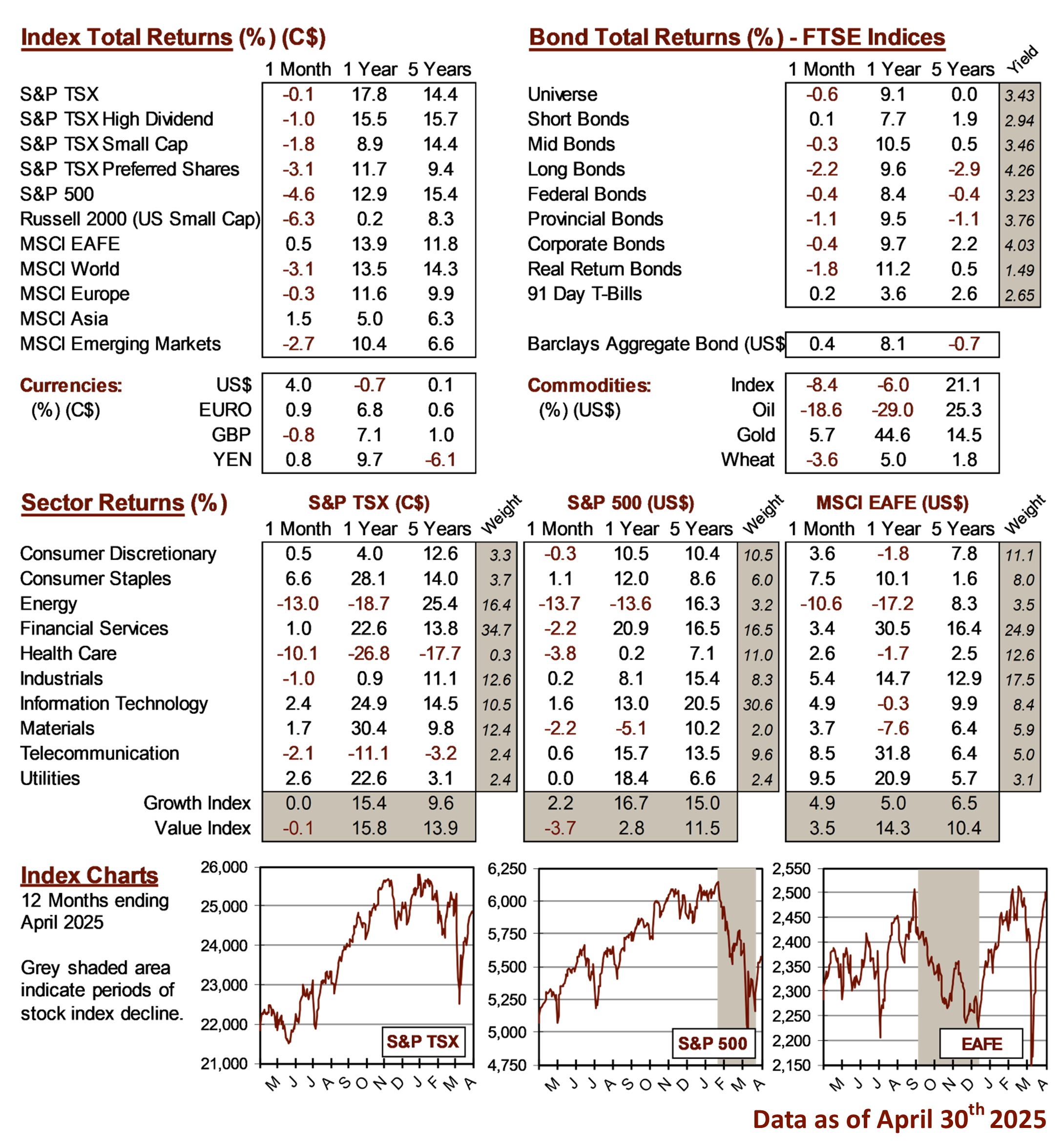

MARKET DATA

This report may contain forward looking statements. Forward looking statements are not guarantees of future performance as actual events and results could differ materially from those expressed or implied. The information in this publication does not constitute investment advice by Provisus Wealth Management Limited and is provided for informational purposes only and therefore is not an offer to buy or sell securities. Past performance may not be indicative of future results. While every effort has been made to ensure the correctness of the numbers and data presented, Provisus Wealth Management does not warrant the accuracy of the data in this publication. This publication is for informational purposes only.

Contact Us

"*" indicates required fields

18 King St. East Suite 303

Toronto, ON

M5C 1C4