Knowledge Centre

Inflation vs. Returns

July 2021

The demand for safe haven assets has surged as inflation fears begin to grow. Inflation is defined as a rise in the general price level so that the real value of money’s purchasing power declines. High and accelerating rates of inflation are typically associated with poor economic conditions and have an adverse impact on stocks. Investors have become keen on relatively safe securities; bidding up prices on low-risk bonds to a level such that returns are approaching zero.

While inflation reduces the value of money over time, deflation can also be harmful. Deflation reflects a fall in prices and has afflicted many countries such as America during Great Depression in the 1930s, Japan’s deflation from the early 1990s to the present and Hong Kong’s post-Asian crisis deflation and slump from late 1997 until late 2004. However, it is still inflation that can truly decimate nations. For example, over the past 112 years in 19 developed countries inflation has hit a maximum of 361% in Japan (1946), 344% in Italy (1944); 241% in Finland (1918) and 65% in France (1946). The recent median annual inflation rate across developed countries was just 2.8%, with Canada averaging 3.0%. During 22 individual years (1915-20, 1940-42, 1951, and 1972-83) a majority of the 19 developed economies experienced inflation of at least 6.4%. More recently, extreme moves in price levels have occurred more frequently in emerging markets.

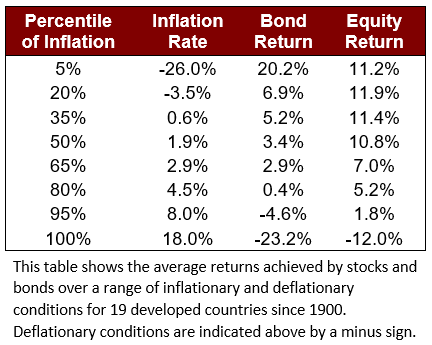

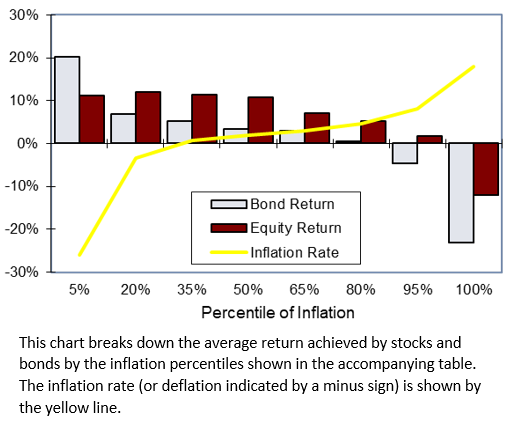

Investors don’t like to be exposed to volatility and the persistence of volatility is very undesirable. So, if inflation is the main concern, the question from an investor’s perspective is which assets can provide some expectation of a favorable return? The chart to the right and data to the left show the average returns achieved by stocks and bonds during a range of inflationary conditions since 1900. During high inflation, equities returned 12.0% on average. Though harmed by inflation, equities were resilient relative to bonds. After years of extreme inflation however buying bonds was rewarded by higher long run rates of return.

When deflation was more than 3.5% (shown with a minus sign in the inflation data) the return on bonds averaged 20.2%. Obviously, the average return from bonds varies inversely with contemporaneous inflation. In periods of high inflation, bond returns were particularly poor. As an asset class, bonds suffer under inflation but they provide a hedge against deflation. During marked deflation (more than 3.5%), equities had a real return of 11.2%, dramatically underperforming bond returns. Overall equities had a higher return, averaging a premium relative to bonds of more than 5% per year. Generally, equities performed well when inflation ran at low levels, while high inflation impaired equity performance.

Inflation erodes the value of most financial assets. When inflation is high, equities are impacted, though to a lesser extent than bonds or cash. Since the start of the 20th century global equities have performed best with an annualized return of 9.2%. There are few assets that provide a hedge against deflation and only bonds can do this reliably. The bottom line is that, although equities are thought to provide a hedge against inflation, their capacity to do so is limited. The real case for equities is that, over the long term, investors have enjoyed the largest rewards.

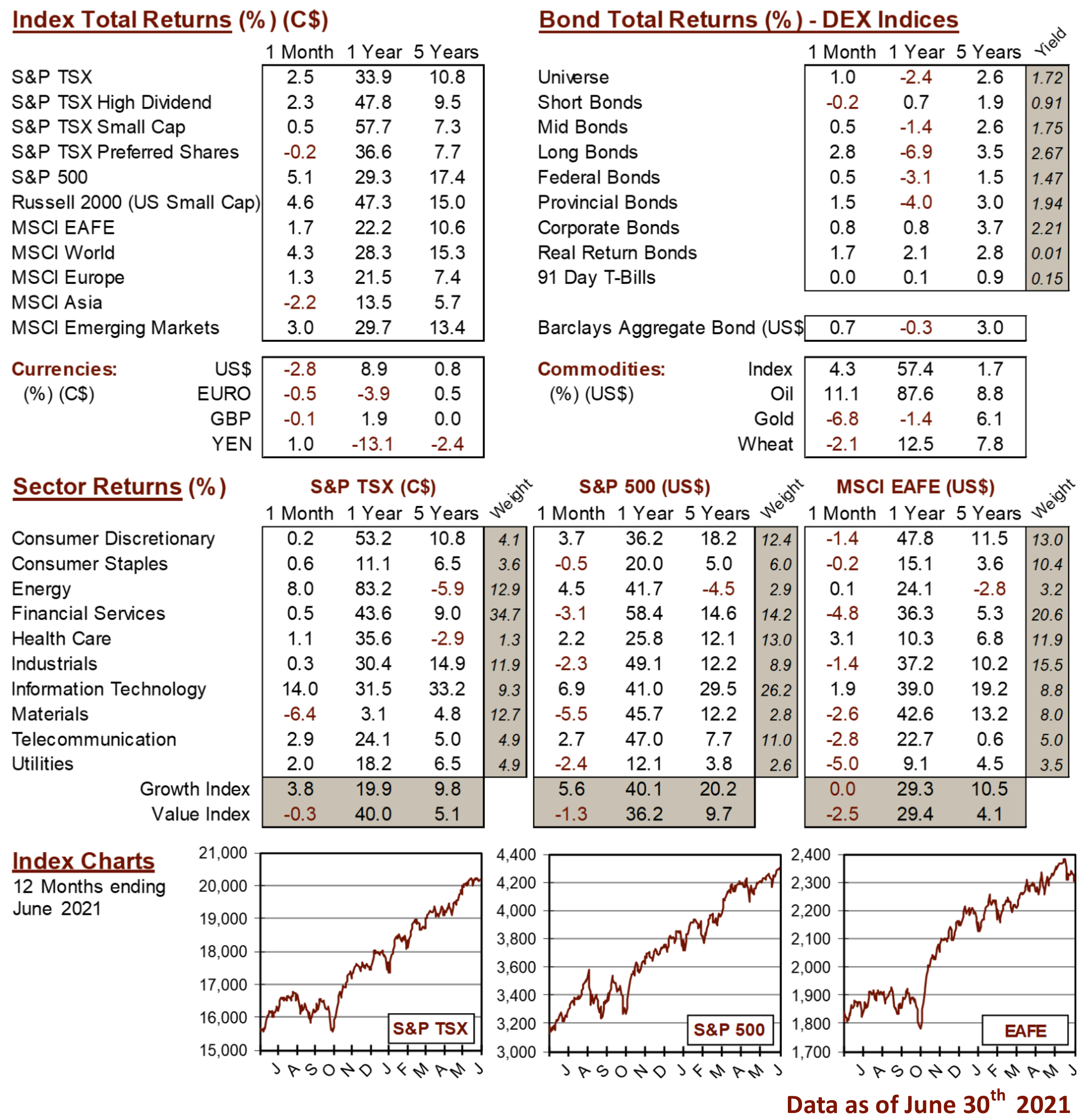

MARKET DATA

This report may contain forward looking statements. Forward looking statements are not guarantees of future performance as actual events and results could differ materially from those expressed or implied. The information in this publication does not constitute investment advice by Provisus Wealth Management Limited and is provided for informational purposes only and therefore is not an offer to buy or sell securities. Past performance may not be indicative of future results. While every effort has been made to ensure the correctness of the numbers and data presented, Provisus Wealth Management does not warrant the accuracy of the data in this publication. This publication is for informational purposes only.

Contact Us

18 King St. East Suite 303

Toronto, ON

M5C 1C4