Knowledge Centre

Huge One Day Stock Changes

December 2023

Huge one day stock rallies are surprisingly more common than expected during bear markets. Also, as would be expected, huge one day stock declines are more common in bear markets. The bottom line for most investors is that one day of big positive gains does not necessarily indicate a major uptrend. Bullish stock investors should temper the enthusiasm with which they greet the stock market’s explosive changes in the wake of what appears to be seismic economic or fiscal events.

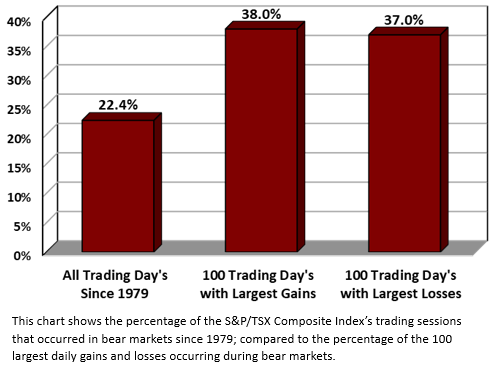

For the S&P/TSX Composite Index (and the TSX 300 before it) since 1979, just under one quarter (22.4%) of all trading sessions have occurred during bear markets. If huge one day spikes occurred randomly across the calendar, investors should expect that just under one quarter of them would occur during bear markets.

However, this is not the case as you can see from the accompanying chart. Taking the 100 best trading sessions in which the S&P/TSX Composite Index had its biggest one day gains, 38% occurred during bear markets which is almost two times the proportion you would expect on the assumption of randomness. A similar pattern emerges when we focus on the 100 worst trading sessions as 37% of the biggest losses occurred during bear markets. A similar general pattern also exists in the S&P 500 dating back to 1928 and the Dow Jones Industrial Average DJIA dating back to its creation in the late 1800s. So, this is just not a Canadian phenomenon.

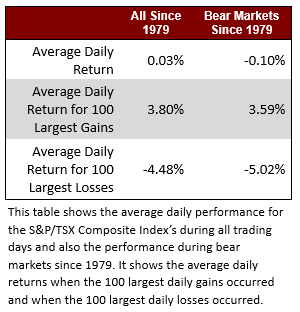

The data to the left provides a slightly different perspective of what happens to the average daily returns of stocks in bear markets. Over the entire 44 years, or more than 11,100 days since 1979, the daily average return for stocks was 0.03% per day (performance for all numbers shown does not include the impact of dividends) versus -0.10% for every day on average during bear markets. Furthermore, during the 100 best days with the largest rallies stocks returned 3.80% versus only 3.59% during the days in this time span that occurred during bear markets. Conversely, during the worst 100 trading sessions with declines all 100 stocks lost -4.48% versus -5.02% for those days in the 100 that occurred during bear markets. This indicates that bear markets are bad for investors which is not earth shattering news.

There are three reasons why this otherwise surprising pattern actually makes sense:

1) Sentiment: bear markets thrive on the desire to believe a new bull market is beginning. So, when investors are given even a small reason for hope, they instinctively jump right back on the bullish bandwagon. Historically, bear markets typically do not end until investors throw in the towel and disavow equities altogether.

2) Volatility: bear markets are more volatile than bull markets. Historically, during bull markets stocks tend to rise at a leisurely and thoughtful pace, like a person without a care in the world walking in the sunshine.

3) Compensation for risk: in order to compensate investors for bear markets’ additional volatility, the stock market must offer a greater expected return and to do that it must first decline to lower levels which would represent that greater upside potential. So, it makes sense that bear markets and periods of high volatility occur simultaneously.

Clearly, one day does not a major uptrend make, even if it is an impressive rally. So do not get carried away and think the next big raging bull market is just around the corner since, as all long term investors know, markets enjoy nothing more than luring investors to jump back into the fray before pulling out the rug. Patience is always rewarded.

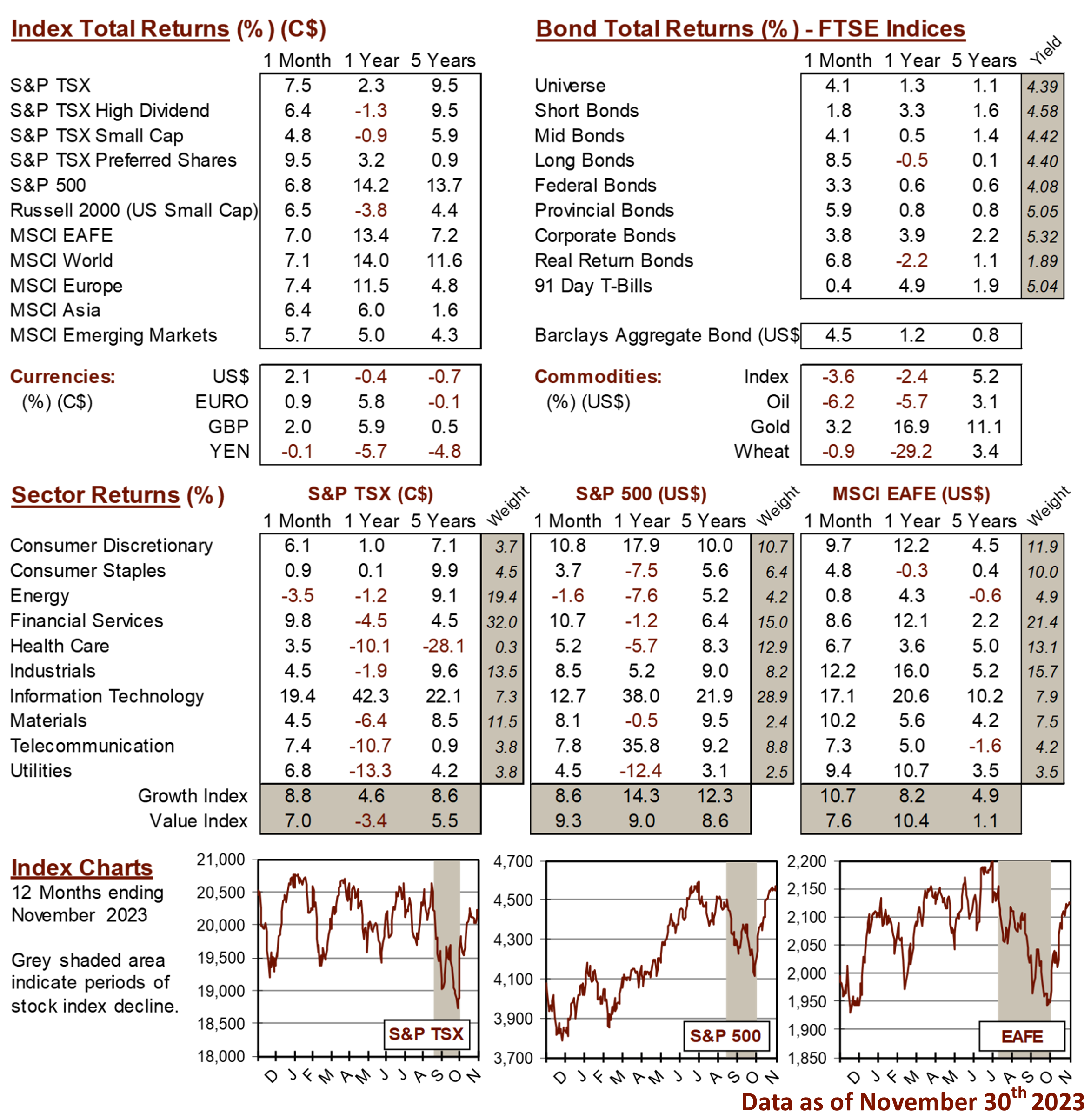

MARKET DATA

This report may contain forward looking statements. Forward looking statements are not guarantees of future performance as actual events and results could differ materially from those expressed or implied. The information in this publication does not constitute investment advice by Provisus Wealth Management Limited and is provided for informational purposes only and therefore is not an offer to buy or sell securities. Past performance may not be indicative of future results. While every effort has been made to ensure the correctness of the numbers and data presented, Provisus Wealth Management does not warrant the accuracy of the data in this publication. This publication is for informational purposes only.

Contact Us

18 King St. East Suite 303

Toronto, ON

M5C 1C4