Knowledge Centre

Great Expectations?

April 2018

Asset allocation is one of the most important decisions investors will likely make. There are a number of risk factors related to the type of investments used as well as their mix which makes determining the appropriate capital market assumptions necessary. There are many firms which provide investment assumptions to investors with each making their own risk and return calculations so that clients can evaluate their investment decisions. Of course, these assumptions are not permanent and need to be changed over time.

Empirical evidence has not been favourable to market forecasters. Studies have shown that the vast majority of financial gurus do not do better in their predictions than simply flipping a coin. So, on the face of it, being able to accurately forecast markets 10 years out is extremely difficult. In a world of seemingly random events, all of which could affect assumptions, it is hard to figure out where to turn. Fortunately, in Canada, there is one semi-independent organization that touches upon almost every adult's life to varying degrees; the Canada Pension Plan (CPP). The CPP operates throughout Canada (except in Quebec, where the Québec Pension Plan serves the same function) to provide pension benefits to Canadians. It is the responsibility of the Chief Actuary of CPP to form the capital markets assumptions used in the modeling that serves as foundation for their strategic asset allocation. So, it makes sense that their primary projections should be the bedrock of the return on investments for most investors. Fortunately, these are updated periodically and publicly available.

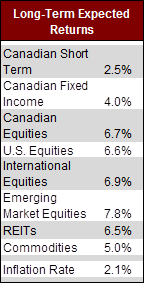

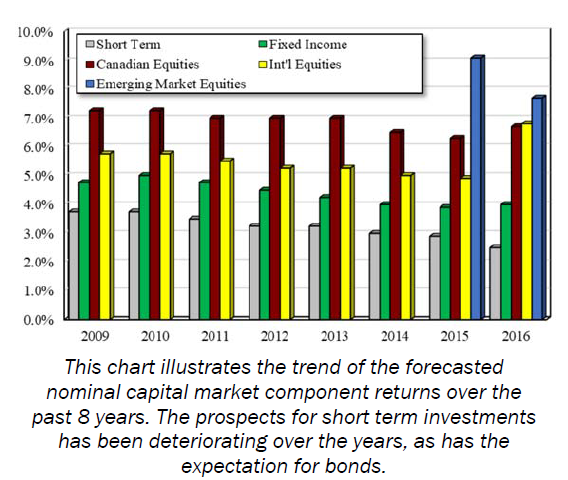

The data to the left illustrates the most current forecasted long term nominal returns for capital markets in Canadian dollar terms (i.e. returns before the impact of inflation). The chart to the right shows the historical evolution of those previous projections from the past 8 years. Clearly, the prospects for cash and/or other short term investments has been deteriorating over the years; as has the expectation for bonds since the significant tightening of credit spreads have lowered yields, thereby reducing the potential for future returns. These conditions could be made worse if the yield curve inverts as is broadly expected. Still not all bonds are created equal with government bonds expected to return just 3.0%, corporates 3.5% and high yield instruments 5.25%.

Similarly, assumptions for equities in general have trended lower; falling behind what history would suggest. Interestingly, Canadian stocks are no longer considered the shining light for forecasted performance. Increases in expected earnings growth and corporate profit margins outside of Canada has seen the expected returns for both major foreign and emerging market stocks jump, such that investors should be relatively indifferent as to which markets to invest for the best results. Although, the returns investors do actually receive will be ultimately determined by the crucial impact of dividends and buybacks going forward. Of course, most investors are not looking to just match the market but exceed it. Unfortunately, that then becomes a question of determining those that have the necessary skills to add value. However, that is a question for another day.

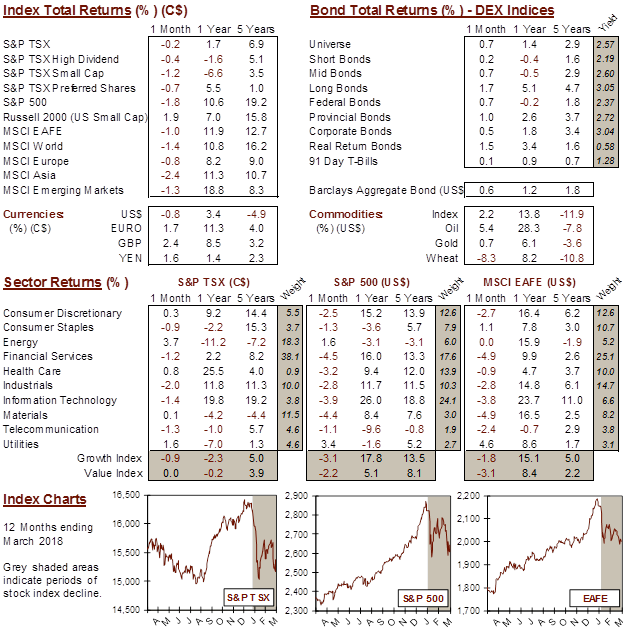

MARKET DATA

This report may contain forward looking statements. Forward looking statements are not guarantees of future performance as actual events and results could differ materially from those expressed or implied. The information in this publication does not constitute investment advice by Provisus Wealth Management Limited and is provided for informational purposes only and therefore is not an offer to buy or sell securities. Past performance may not be indicative of future results. While every effort has been made to ensure the correctness of the numbers and data presented, Provisus Wealth Management does not warrant the accuracy of the data in this publication. This publication is for informational purposes only.

Contact Us

18 King St. East Suite 303

Toronto, ON

M5C 1C4