Knowledge Centre

Fabulous First Quarter and for the Year?

April 2024

The theme for 2024 has been so far, so good. Investors cannot complain about how the Canadian stock market has performed in the first quarter. The S&P/TSX Composite Stock Index has earned the 12th strongest first quarter (Q1) of the year performance since 1977 when it gained 6.6%. The question for investors is will it keep rising and what does that mean for the rest of 2024?

Markets go up and down. Historically, markets have been positive 74% of the time (or conversely negative only 26% of the time). The S&P/TSX has experienced back-to-back negative years only twice over the past 75 years. Of note, in 18 out of the 20 negative years, the market bounced back with positive returns the following calendar year. The average return in years that followed a negative year was 14.6%.

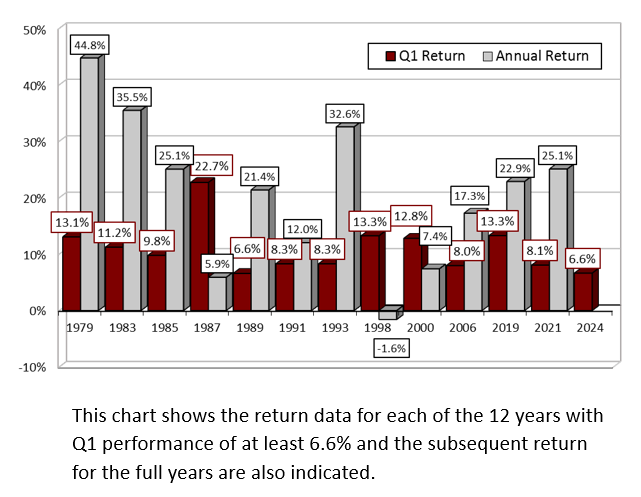

So how has the S&P/TSX historically performed for the full year after starting off with a positive gain in the first quarter? The S&P/TSX delivered a positive Q1 gain in 36 of the last 47 years. The index finished the year in negative territory in only six of those cases. In most years, the Q1 performance of the S&P/TSX was a good predictor of how the index would fare in the full year. Most impressive was the predictive power when the S&P/TSX finished Q1 with a gain of at least 6.6%, as 2024 just achieved. It has happened 12 times over the last 47 years and in all but one case, the S&P ended the year with a positive gain. For the one exception (1998), the S&P/TSX closed out the year at -1.6%, a minuscule decline.

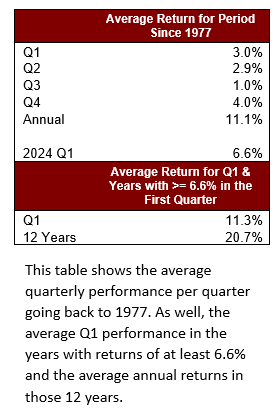

Since 1977, the S&P/TSX has seen an average gain of around 3.0% in the first three months of the year and 11.1% per calendar year. For the 12 years when the index averaged a 6.6% or better return in Q1, the S&P/TSX averages 20.7% (ranging from a low of -1.6% and a high of 44.8% in 1979). The chart shows the return data for each of the 12 years with Q1 performance 6.6% or better and the subsequent return for the full years are also illustrated. The table to the left shows the average quarterly performance going back to 1977.

Having said that, investors should not start singing “Happy Days Are Here Again” just yet. There are no guarantees that 2024 will end as well as it has started. As the old adage says, history does not repeat itself but it rhymes. Just because the S&P/TSX performance in Q1 has been a pretty good predictor of how the full year will go in the past does not mean that it is always a great indicator.

The Canadian economy continues to chug along. Unemployment rates remain low. Inflation is still too high but has shown signs of moderating. While Canada is far from out of the woods when it comes to the possibility of a recession, the overall stock market has held up pretty well. If history is any guide, 2024 could be a decent year for the stock market. Additionally, there are other reasons for optimism. From an economic cycle perspective, the economy appears to be moving into an expansion phase shifting from a painful low point. However, low points provide an opportunity for investors to reconfigure their outlook in anticipation of a recovery and a sustained uptrend.

Reviewing historical returns does not provide investors with a crystal ball. Instead, this analysis provides context about the current situation. By knowing how an asset's price behaved in the past investors can gain insight as to how it might react in the near future with the understanding that the return will not be the same. No one can predict future price movements; however more information can help investors be better prepared for what the future holds.

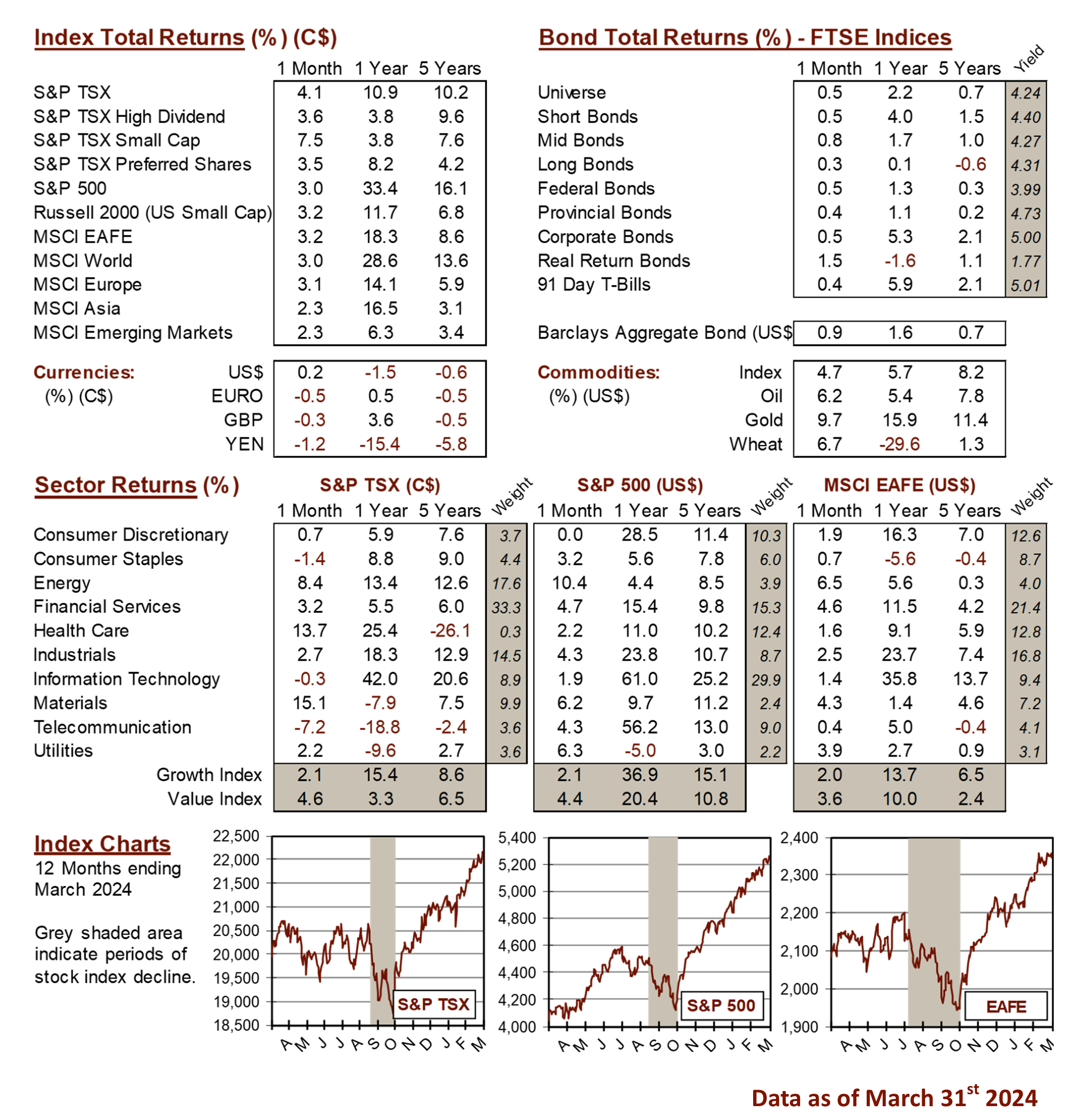

MARKET DATA

This report may contain forward looking statements. Forward looking statements are not guarantees of future performance as actual events and results could differ materially from those expressed or implied. The information in this publication does not constitute investment advice by Provisus Wealth Management Limited and is provided for informational purposes only and therefore is not an offer to buy or sell securities. Past performance may not be indicative of future results. While every effort has been made to ensure the correctness of the numbers and data presented, Provisus Wealth Management does not warrant the accuracy of the data in this publication. This publication is for informational purposes only.

Contact Us

18 King St. East Suite 303

Toronto, ON

M5C 1C4