Knowledge Centre

Crises Are Buying Opportunities

September 2017

While it is sad to say, there is always some sort of crisis cropping up around the world and more often than not they can lead to fear as investors become overly pessimistic. Such crises inevitably lead to panic selling and selling into a panic is always a bad idea. In fact, the panic lows in the wake of a crisis are far more often than not a good buying opportunity.

The growing concerns about North Korean's nuclear threat and terrorist attacks in Europe have caused many investors to try and gauge the risks to the stock market. While every event is different and no one knows which crisis will escalate and which ones will fizzle, stock markets have generally sloughed them off and recouped initial losses. The Canadian stock market has proven remarkably resilient, so doing nothing is almost always the best investment strategy during a geopolitical crisis.

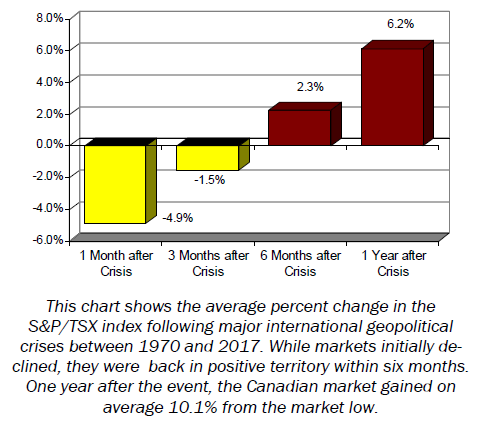

The clear conclusion that can be drawn from the most momentous geopolitical crises of the last 47 years is that stock markets strongly rebound from their post-crisis panic lows, so much so that within six months they are actually higher than where they stood before that crisis erupted. And one year after the event, markets have gained on average 10.1% from the market lows. The average percent decline in the S&P/TSX Canadian Stock index following major international geopolitical crises from 1970 to 2017 was -4.9% for the 17 crises listed to the left. Obviously the list of crises can be debated, but even going further back in time, the pattern of sell-off and recovery holds during such crises as the Fall of France 1940; Attack on Pearl Harbor, 1941; Outbreak of Korean War, 1950; Cuban Missile Crisis, 1962; and the Kennedy assassination, 1963. Canada has had its share of domestic crises as well: Munsinger Affair - Canada's first national political sex scandal, 1960; Airbus Affair - PM Mulroney was implicated in a kickback scheme, 1995; and the Sponsorship Scandal - a major misuse of funds by the Liberal governments of the 1990s, yet none of these had a major impact internationally.

Of course, the Canadian stock market did not quickly recover in all 17 cases. However, even in those that did not, the market still rallied meaningfully from the lows. As the chart to the right illustrates, major crises can be disconcerting but they do not spell the end for markets or investment strategies. It seems clear that staying invested through volatile episodes can help keep portfolios on track to achieve long term goals.

Perhaps the most valuable lesson from this analysis is that business cycles have far more influence on the market's reaction than periods of crisis. The crises that took place during healthy economies are more the exception than the rule. The conflicts that have triggered the biggest declines tend to be associated with economic weakness, something that is not on the horizon at the moment.

The bottom line is that history tells us that the stock market tends to be resilient to crises. So even if a military conflict with North Korea does erupt, investors should not compound the crisis by doing something ill-advised with their portfolio. As always, patience is often rewarded.

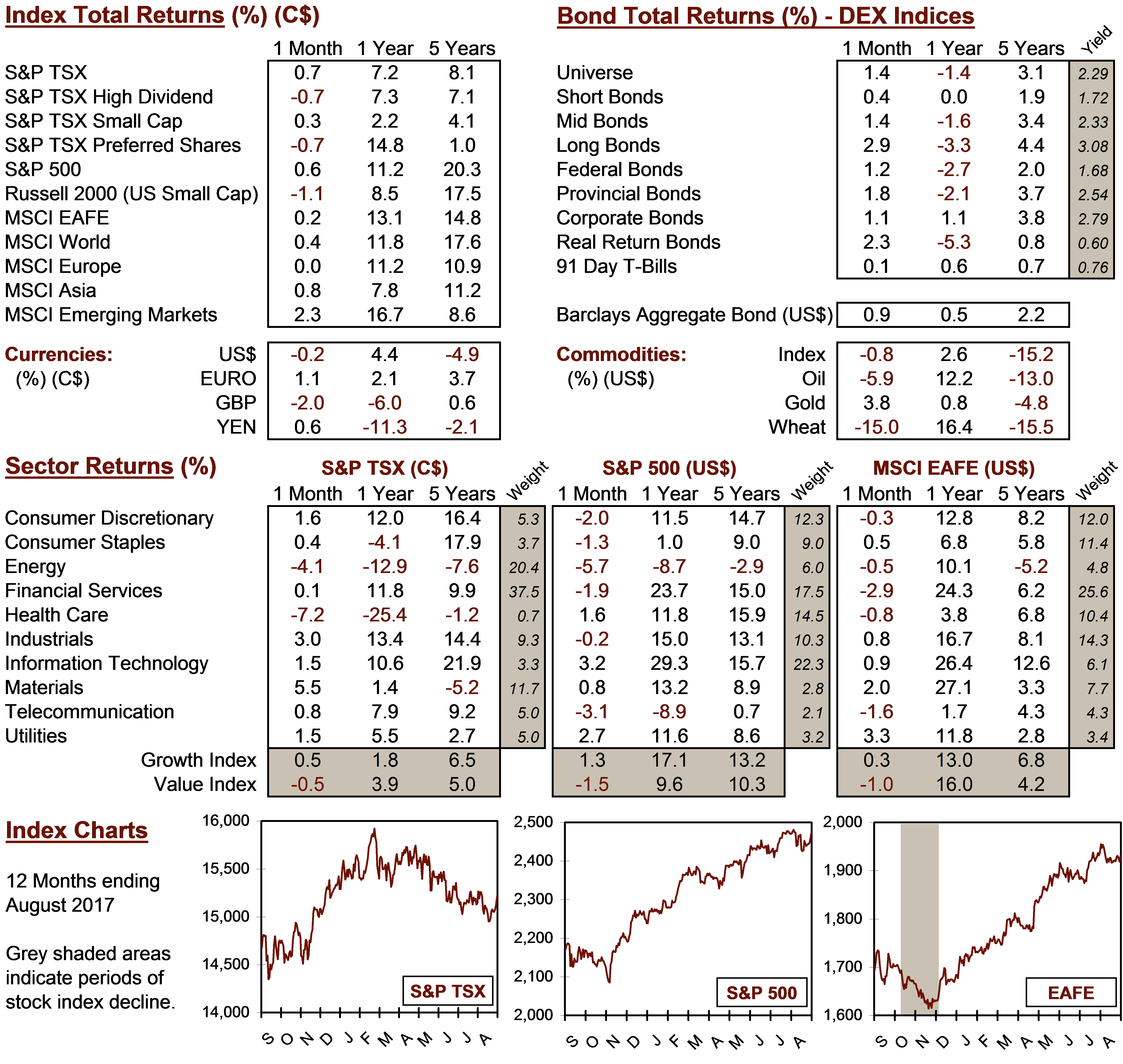

MARKET DATA

This report may contain forward looking statements. Forward looking statements are not guarantees of future performance as actual events and results could differ materially from those expressed or implied. The information in this publication does not constitute investment advice by Provisus Wealth Management Limited and is provided for informational purposes only and therefore is not an offer to buy or sell securities. Past performance may not be indicative of future results. While every effort has been made to ensure the correctness of the numbers and data presented, Provisus Wealth Management does not warrant the accuracy of the data in this publication. This publication is for informational purposes only.

Contact Us

18 King St. East Suite 303

Toronto, ON

M5C 1C4