Knowledge Centre

Closing The Gap

May 2018

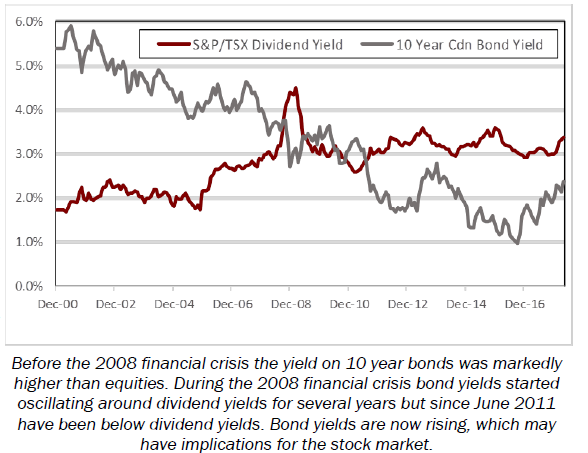

Dividend paying stocks have been very popular with investors in recent years due to weak returns in the bond market. That picture appears to be shifting in Canada for the first time in almost a decade. As the Bank of Canada has slowly tightened monetary policy, bond yields have naturally risen, yet still remain well below the levels seen before the financial crisis. As bond yields rise, investors may cut their exposure to equities. Historically bull markets tend to end once interest rates have risen too much, too fast. The current long-lasting uptrend is beginning to show signs of entering the euphoria stage. If dividend yields drop below bond yields it could be another indication that the high-flying stock market is headed for a correction.

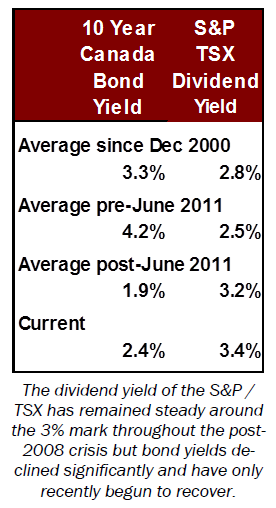

The ‘Yield Gap’ is the difference between the S&P / TSX Stock Index dividend yield and the 10 year Government of Canada bond yield. The yield differential between stocks and bonds has historically been one of the more attractive signals for many investors. It has signaled when equities were good value relative to bonds. However in the last few months that spread is becoming less favorable to equities and is giving many investors pause for thought. Higher bond yields could make stocks look more expensive. Additionally, higher borrowing costs could have an impact on corporate earnings as it becomes more expensive for companies to finance projects. Lower profits could result which would boost the price-to-earnings ratio and raise equity valuation concerns.

Before the 2008 financial crisis the yield on 10 year bonds was markedly higher than equities, before abruptly changing course during the depths of the crisis. In fact, for most of history, dividend yields have stayed below 10 year bond yields. During the 2008 financial crisis bond yields started oscillating around dividend yields for several years but have spent significant time below dividend yields since June 2011, as economic growth recovered and inflation concerns faded. As the chart above and data to the left illustrates, the dividend yield of the S&P / TSX has remained steady at around the 3% mark throughout the post-2008 crisis recovery period as companies have grown their dividends to keep up with increasing share prices.

For the past decade, investors have flocked to the stock market for higher yields as government bond yields have hovered at historic lows. The increase in asset prices can be partly attributed to low yielding debt instruments. Still dividend paying stocks tend to be a poor defense when rates are rising and stocks could be facing yield competition from bonds for the first time since the financial crisis. If and when the S&P / TSX yield falls below bonds it will not necessarily be bad news as most equity investors generally buy stocks for capital appreciation and not for steady income.

At this juncture, the case for stocks still appears to be favourable compared to owning bonds so yield seekers currently invested in stocks do not necessarily need to jump ship yet. As with all market measures, the consequences of the narrowing yield gap are hard to predict. While some risk averse investors might switch to bonds, for most investors dividend yield is simply one factor contributing to the total performance of owning stocks.

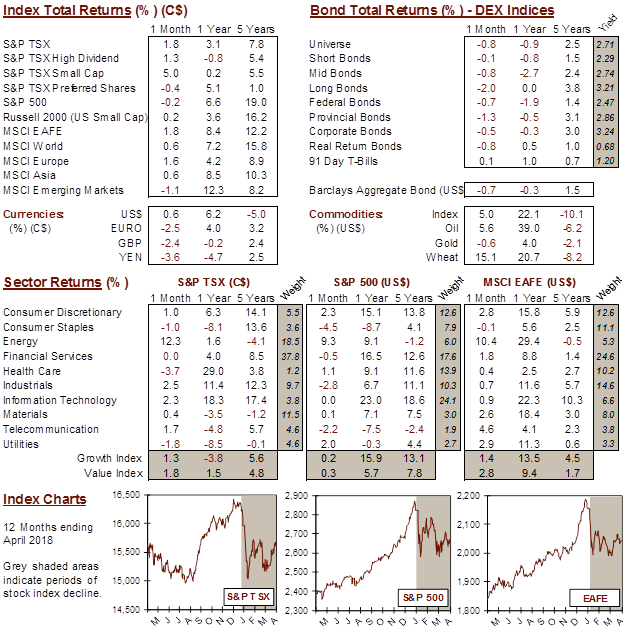

MARKET DATA

This report may contain forward looking statements. Forward looking statements are not guarantees of future performance as actual events and results could differ materially from those expressed or implied. The information in this publication does not constitute investment advice by Provisus Wealth Management Limited and is provided for informational purposes only and therefore is not an offer to buy or sell securities. Past performance may not be indicative of future results. While every effort has been made to ensure the correctness of the numbers and data presented, Provisus Wealth Management does not warrant the accuracy of the data in this publication. This publication is for informational purposes only.

Contact Us

18 King St. East Suite 303

Toronto, ON

M5C 1C4