Knowledge Centre

Bond Yields Always Fall before First Rate Cut

January 2024

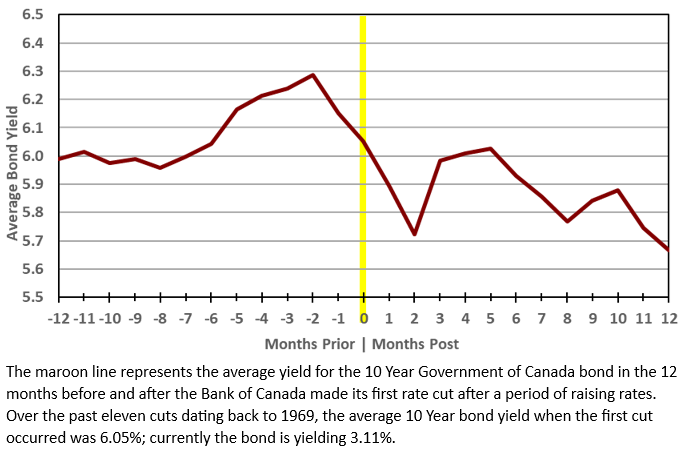

Bond yields always fall before the Bank of Canada (BOC) pivots to cut interest rates. This is occurring today just as it has over the past 50 years. Without fail, the 10 Year Government of Canada bond yield has fallen in the months before each pivot to rate cuts since the 1970s. There is still too much noise to predict with any degree of certainty when the first rate cut will officially occur but occur it will.

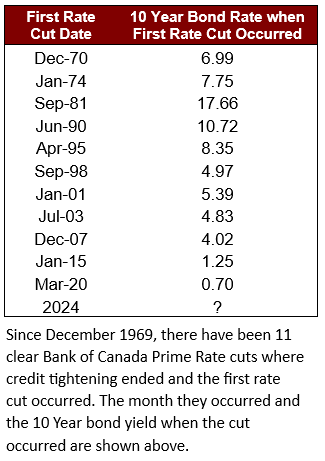

The 10 Year Government of Canada bond is used to finance much of the Canadian economy with higher rates often translating to tighter financial conditions and slower growth. It is the perfect bond to gauge the future course of short term interest rates. The 10 Year bond yield closed 2023 at 3.11%, and is continuing to pull back from a cycle peak of 4.28% which occurred on the 3rd of October. The chart to the right tracks the path of the average 10 Year bond yield around past easing cycles. It shows the average path of the 10 Year bond yield in the year before and in the 12 months after each Bank of Canada pivot. The move lower tends to intensify three months ahead of each initial cut. The data to the left shows the number of times the Bank of Canada has raised the Bank rate, when they occurred and the rate before the increase began.

The Bank of Canada is not expected to change its short term rate policy (from a 22 year high at 5.0%) in the near term as it still is leaning heavily on the notion that rates will have to remain “higher for longer”; but that rhetoric will have to change at some point. Initially, changes to the rate outlook in September were pegged as a catalyst for a sharp selloff that hit stocks and bonds in October as it was believed that inflation was picking up steam again. However, since October pricing pressures have eased again, resulting in tumbling bond yields and the S&P/TSX Stock index setting a string of new closing highs to end 2023 as investors have become more optimistic about rate cuts coming in 2024.

The Bank of Canada is likely about to embark on an interest rate cutting journey in 2024; but what is most important about the potential easing for markets is that it maintains a relatively smooth path. The history of policy cycles over the last 50 years shows that rates are often raised and lowered cautiously and ; However, the current inflation-busting campaign could be the exception to the rule and rates rose fast and cuts could also occur quickly and aggressively this time around.

Policymakers are usually wary of breaking something (asset markets, the labour market, or the economy) when raising rates and are probably all too aware that something may already be broken by the time they are actually cutting rates. Of course, it is almost impossible to predict when a market, financial or economic shock might force the BOC to act boldly. Once rate cuts start, moves of 0.50% or more are pretty common. The most obvious exception was the mid-1990s, when the economy managed that elusive soft landing and the first three rate cuts were only 0.25% each.

The Bank of Canada is preparing investor for a Goldilocks scenario in which nothing else gets in the way. The markets are anticipating a smooth, gradual path to equilibrium; the sort of path that central banks always aim at but rarely hit. It is unlikely that the economy will decelerate as smoothly and painlessly as forecasts imply, as history shows that unforeseen events tend to arise and disrupt things along the way. Wage pressures will likely remain a focus at the Bank of Canada as it works to get inflation down to a 2% annual rate, reaffirming that despite the significant progress on inflation, the labour market still needs to cool for the Bank of Canada to ultimately be successful. Time will tell what the appropriate level for interest rates really is but the market and the BOC may be getting ahead of themselves. Nobody is a perfect predictor or arbiter of where interest rates will go.

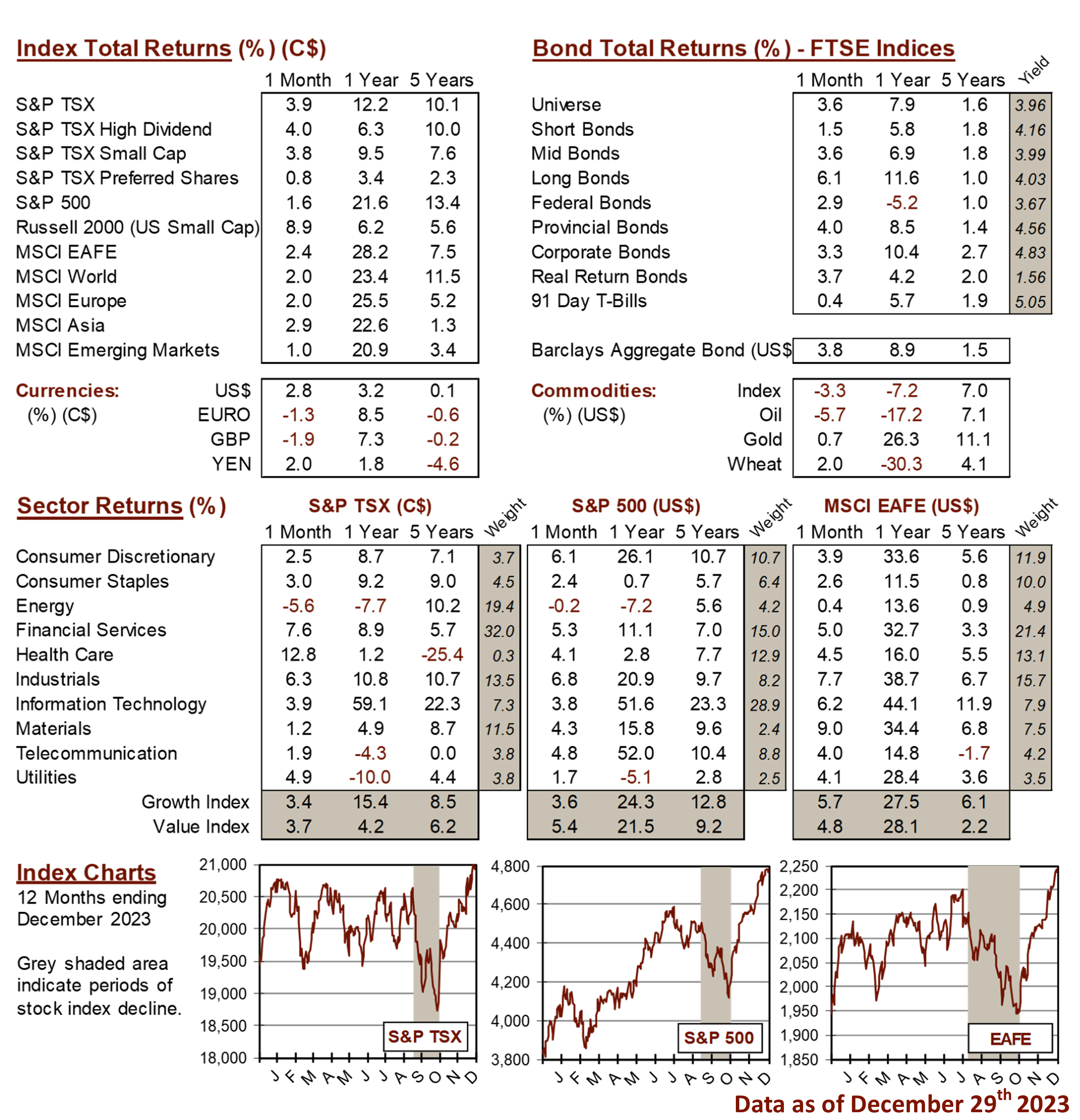

MARKET DATA

This report may contain forward looking statements. Forward looking statements are not guarantees of future performance as actual events and results could differ materially from those expressed or implied. The information in this publication does not constitute investment advice by Provisus Wealth Management Limited and is provided for informational purposes only and therefore is not an offer to buy or sell securities. Past performance may not be indicative of future results. While every effort has been made to ensure the correctness of the numbers and data presented, Provisus Wealth Management does not warrant the accuracy of the data in this publication. This publication is for informational purposes only.

Contact Us

18 King St. East Suite 303

Toronto, ON

M5C 1C4