Knowledge Centre

Bargain Hunting

August 2016

The financial markets are producing very few bargains these days for investors. Everybody likes a bargain but with current valuations across the financial markets ranging from fair to very expensive, the keys to success are in choosing the right entry point and the best securities.

Investors are forever searching for cheap securities; unfortunately not all types of cheap are equal. Cheap can always get cheaper; and cheap has gotten cheaper in recent years. Meanwhile the seemingly expensive markets like the U.S. stock market have continued to appreciate.

Attempting to measure value is useful for investors because it provides an indication of whether they are buying into a stock at a price that is higher or lower than its historical value. Most successful indicators do a far better job forecasting the market's direction over the intermediate and longer terms. Additionally, higher valuations generally mean greater downside risk, but anytime securities move above their fair value or become overvalued, it is smart to be suspicious.

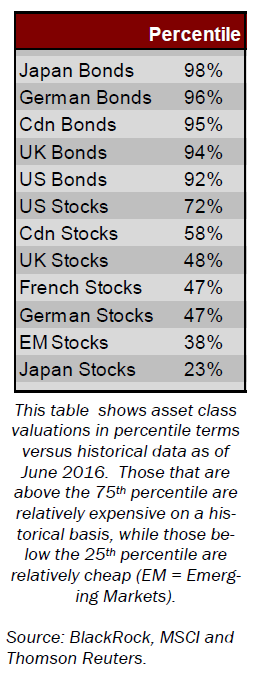

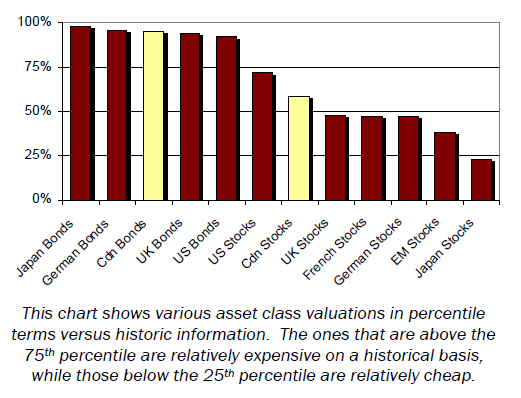

By using percentile analysis investors are able to put today's market valuation in a historical perspective. A percentile is a measure that indicates the number of observations that fall below the percentage indicated. For example, the 20th percentile is the value below which 20% of the observations can be found. Markets that are above the 75th percentile should be considered expensive on a historical basis, while those below the 25th percentile can be considered cheap. The 50th percentile indicates an average value since data will normally range between the 75th and 25th percentile. The chart to the right and the data to the left (which are based upon information provided by BlackRock, MSCI and Thomson Reuters) illustrate the valuations in percentile terms for various markets and security types on June 2016 versus historic information.

Government 10 year bonds are very expensive compared to their history, as a very large portion of this universe is offering low or negative yields. Valuations for equities on the other hand appear more reasonable on a relative basis. Canadian equities in particular are currently in the 58th percentile. This means that Canadian equities are trading at a valuation that is equal or greater than 58% of their history. This means they are not too expensive nor are they true bargains at this stage.

Holding bonds makes sense in a portfolio as a hedge against risk, but low or negative yields on bonds come with a hefty cost. Investors are becoming nervous about what lies ahead and rightly so. The yield on bonds have sunk in most cases to record lows, with central banks either holding off raising rates or maintaining an unprecedented stimulus. Low and negative yields are a problem for investors that rely on bonds to generate income. Still, the latest turbulence provides a stark reminder that having some fixed income can have defensive benefits.

Searching for cheap investments is important and can be very rewarding. However, as with any other hunting, it is critical to know the target, its behavior and its risks. An investor who focuses on the right kind of cheap for his or her goals can do well in the market, but it is just as important to avoid the wrong kinds of cheap securities.

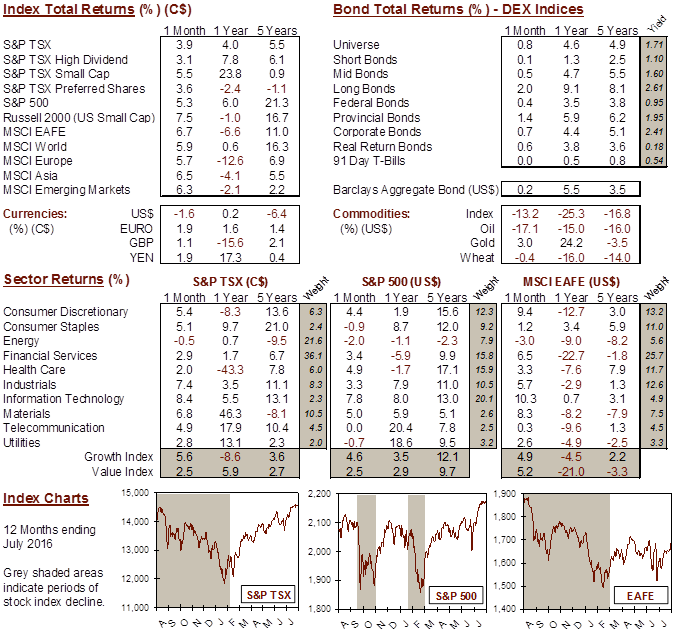

MARKET DATA

This report may contain forward looking statements. Forward looking statements are not guarantees of future performance as actual events and results could differ materially from those expressed or implied. The information in this publication does not constitute investment advice by Provisus Wealth Management Limited and is provided for informational purposes only and therefore is not an offer to buy or sell securities. Past performance may not be indicative of future results. While every effort has been made to ensure the correctness of the numbers and data presented, Provisus Wealth Management does not warrant the accuracy of the data in this publication. This publication is for informational purposes only.

Contact Us

18 King St. East Suite 303

Toronto, ON

M5C 1C4