Knowledge Centre

Monthly Melancholy

September 2022

When investors discuss the worst month for stock market performance, most think of October. After all, October is the month Black Monday and Black Tuesday occurred marking the crashes of 1987 and 1929. Or maybe they think of May in keeping with the old adage “sell in May and go away”. However, in reality, the worst month in Canada, the U.S., Japan, a number of European markets, and the U.K. is September. Looking as far back as 1928, the average September return for the S&P 500 Index in the U.S. has been a loss of 1.0%, which has also been the worst month of the year.

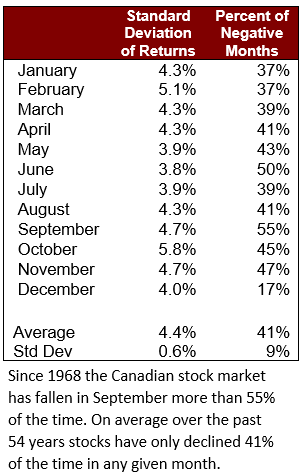

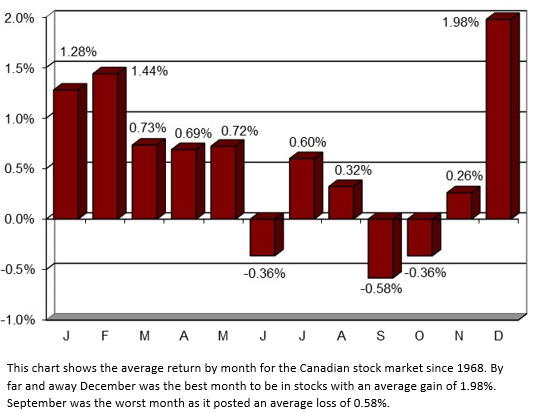

Taking a broader look at the Canadian stock market (see chart to the right and data to the left), the S&P/TSX has posted an average decline of 0.58% in September since 1968 (all figures unless explicitly mentioned do not include the positive impact of dividends). Considering that the only two other negative months, June and October, both showed an average loss over that period of 0.36%, September sticks out. September is the worst month as the market falls more than 55% of the time, while over the same 54-year period stocks have only declined 41% of the time. October, feared as the month of crashes, is the second most volatile month of the year (after February, which has been highly skewed by the negative impact of COVID-19 in 2020), but September is not far behind. At the head of the pack was December with an average 1.98% gain: by far the best month to be in stocks and even better that the famed January effect. Historically, the seven months starting in November have been the best of the year with average gains during this time frame of 7.1%.

Theories for September’s weakness are abundant: there is less money flowing into investments in the latter half of the year as bonuses and tax refunds came in early and frequently go into RRSPs; investors begin to pay more attention to investments after spending their summer relaxing; psychologically, when the leaves turn in the fall, vacations end and the days are getting shorter, there is a tendency for impatient investors to get rid of shares they had been thinking about selling; and lastly, if investors believe September is going to be bad they may sell in anticipation so it becomes a self fulfilling prophecy. Then again it could be no more complicated than the fact that there are only 12 months in the year and there has to be a best and a worst one. Some month had to be September.

Right now, there is a tremendous amount of positive and negative data out there that is confusing the marketplace. Not only do we have the historical month of September staring investors in the face, but the economy appears to be at a crossroads. The economic and inflation crisis appears to have bottomed and a recovery might be in the early stages. Still, there is so much money on the sidelines right now that should the market begin to head south investors are poised to jump in quickly, softening the downward impact.

Whether or not investors believe in historical stock market seasonal patterns, the September data is a useful warning. However, reading too much into past trends can be a mistake. After all, from 1970 to the end of 2021, the S&P / TSX Stock Index has risen an average of 10.6% annually (including dividends). The September market downturn is ultimately just a sort of emotional malaise. Still, the judgment of history is that investors should be a little leery of this month.

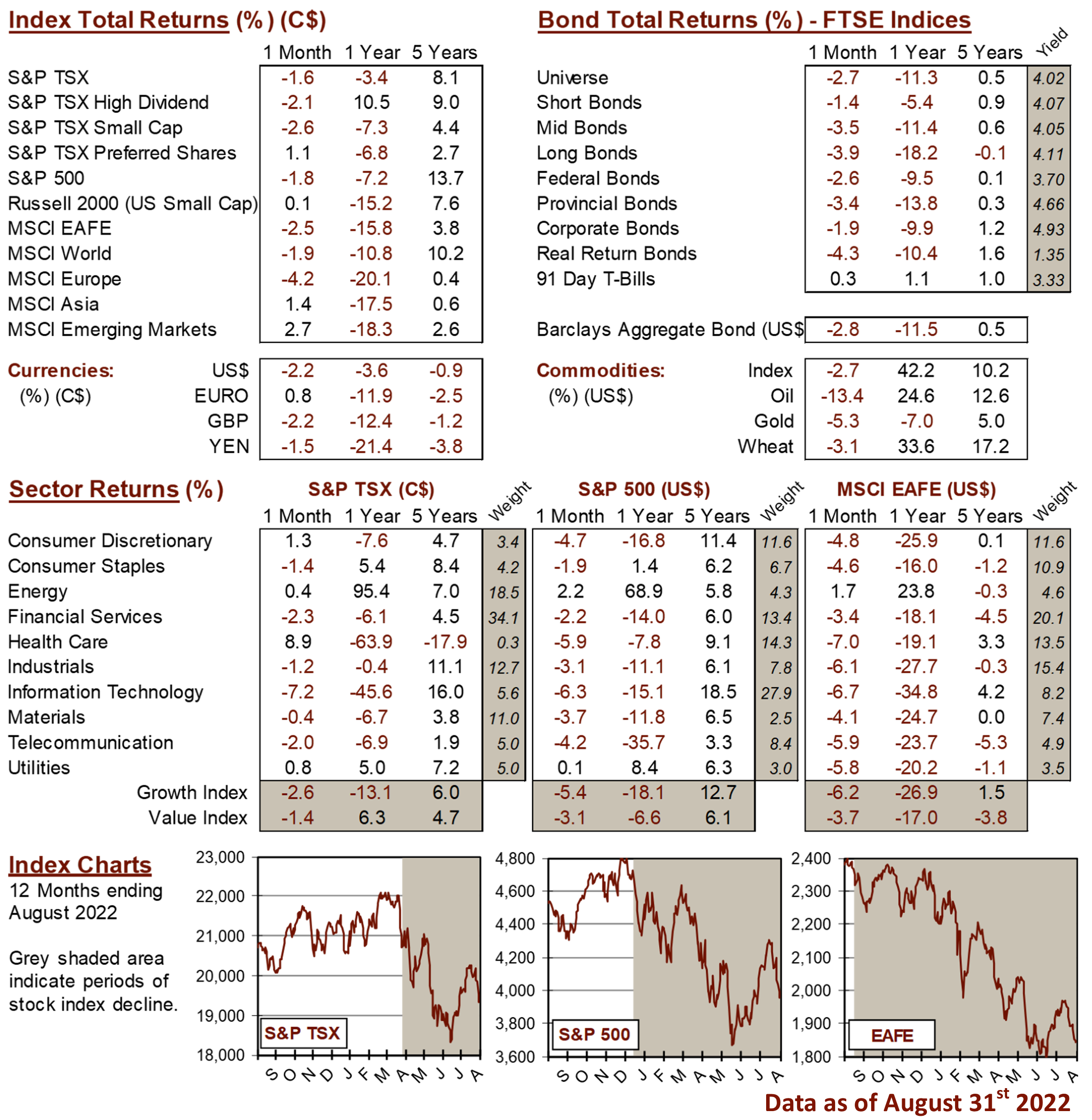

MARKET DATA

This report may contain forward looking statements. Forward looking statements are not guarantees of future performance as actual events and results could differ materially from those expressed or implied. The information in this publication does not constitute investment advice by Provisus Wealth Management Limited and is provided for informational purposes only and therefore is not an offer to buy or sell securities. Past performance may not be indicative of future results. While every effort has been made to ensure the correctness of the numbers and data presented, Provisus Wealth Management does not warrant the accuracy of the data in this publication. This publication is for informational purposes only.

Contact Us

"*" indicates required fields

18 King St. East Suite 303

Toronto, ON

M5C 1C4