Knowledge Centre

Value and Growth Stocks Diverge

February 2022

Alarm bells have been ringing across trading desks as the Federal Reserve indicated that it would slow down its policy support. Looking back to the early days of the pandemic, when stocks fell off a cliff, people lost their jobs at a record pace across the globe and the world seemingly came to a halt amid the outbreak of COVID-19. Something had to be done. To alleviate the crippling pressure on equity markets, central banks began quantitative easing, a method of quickly increasing money supply and spurring economic activity. The result was a V-shaped recovery in equity markets across the spectrum; Small Cap, Large Cap, Value and Growth. The recovery was on and simply put, astonishing.

Now fast forward to 2022; jobs have come roaring back to normalized levels, companies are recording record profits and earnings, and although COVID-19 and its variants still pose a real threat, much of the western world has been immunized. Unemployment in Canada has been cut in half. During the peak of the COVID-19 pandemic, nearly 10% of Canadians found themselves out of work. Those jobs have largely come back as unemployment was recorded at just 6% in November. Inflation, this year’s hottest topic, rose 6.8% from a year ago in November, slightly higher than estimates according to the consumer price index released Friday. This was enough to cause a pullback of the extremely accommodative support given to market and leading to economists forecasting several interest rate hikes in the near future. Investors took the hint and triggered a market rotation, selling high multiple stocks hand over fist.

Value stocks have been able to benefit from this rising environment. A value stock is one that trades at a lower price relative to its fundamentals, such as dividends, earnings or sales. They can be an attractive proposition as they are essentially discounted relative to their peers (most commonly, on a price-to-earnings ratio). Value stocks create real cashflow streams and tangible earnings. These companies possess the ability to pass on higher costs of production to consumers, expanding profit margins and eventually their stock price.

Growth stocks fall on the other side of the spectrum. They typically trade at higher valuations, and investors expect growth stocks to grow exponentially in the future. As rates rise, the future expected earnings of these securities are further discounted; leading to a lower valuation and therefore price contraction in markets. These companies need funding and they need it often. As rates rise, it becomes increasingly more expensive to fund operations, conduct research and develop products and technology.

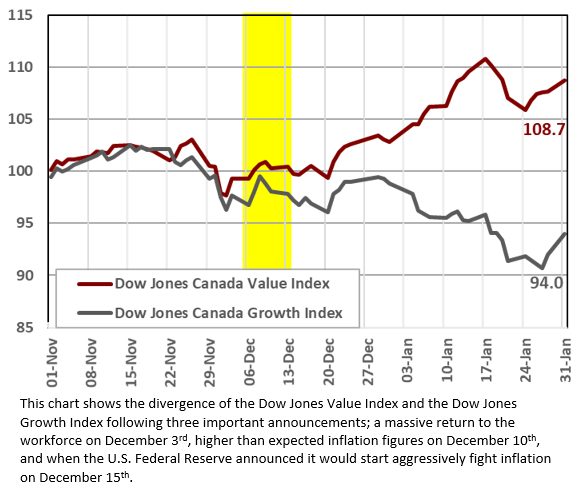

As you can see in the chart to the right, value and growth stocks started to diverge with value noticeably outperforming the growth index. Companies with real earnings are able to weather the storm and even outperform while growth companies, which need to borrow large amounts of cash at higher rates, will struggle to keep up with their peers. It is Value’s time in the sun. Since the beginning of November 2021, the Dow Jones Canada Value Index has appreciated nearly 8.7% while the Dow Jones Canada Growth Index fell 6.0%. The two indices appear to have diverged sometime between December 10th and December 15th as indicated by the yellow column in the chart.

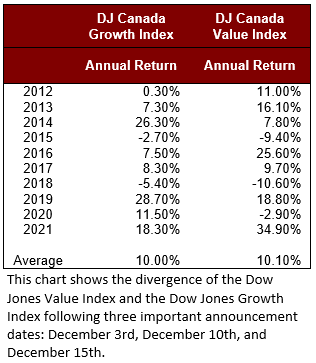

The all important word here is “trend” as rates cannot keep rising forever and will eventually need to come back down. The table shows that although there are years in which value or growth stocks dominate, over time (in this case a decade) they average out to nearly identical returns. For long term investors, the noise around interest rates and inflation should not be ignored, nor should it force the investor to make a fateful choice between Value and Growth. A well balanced portfolio and a commitment to stay the course has historically yielded great results and the current environment should be no exception.

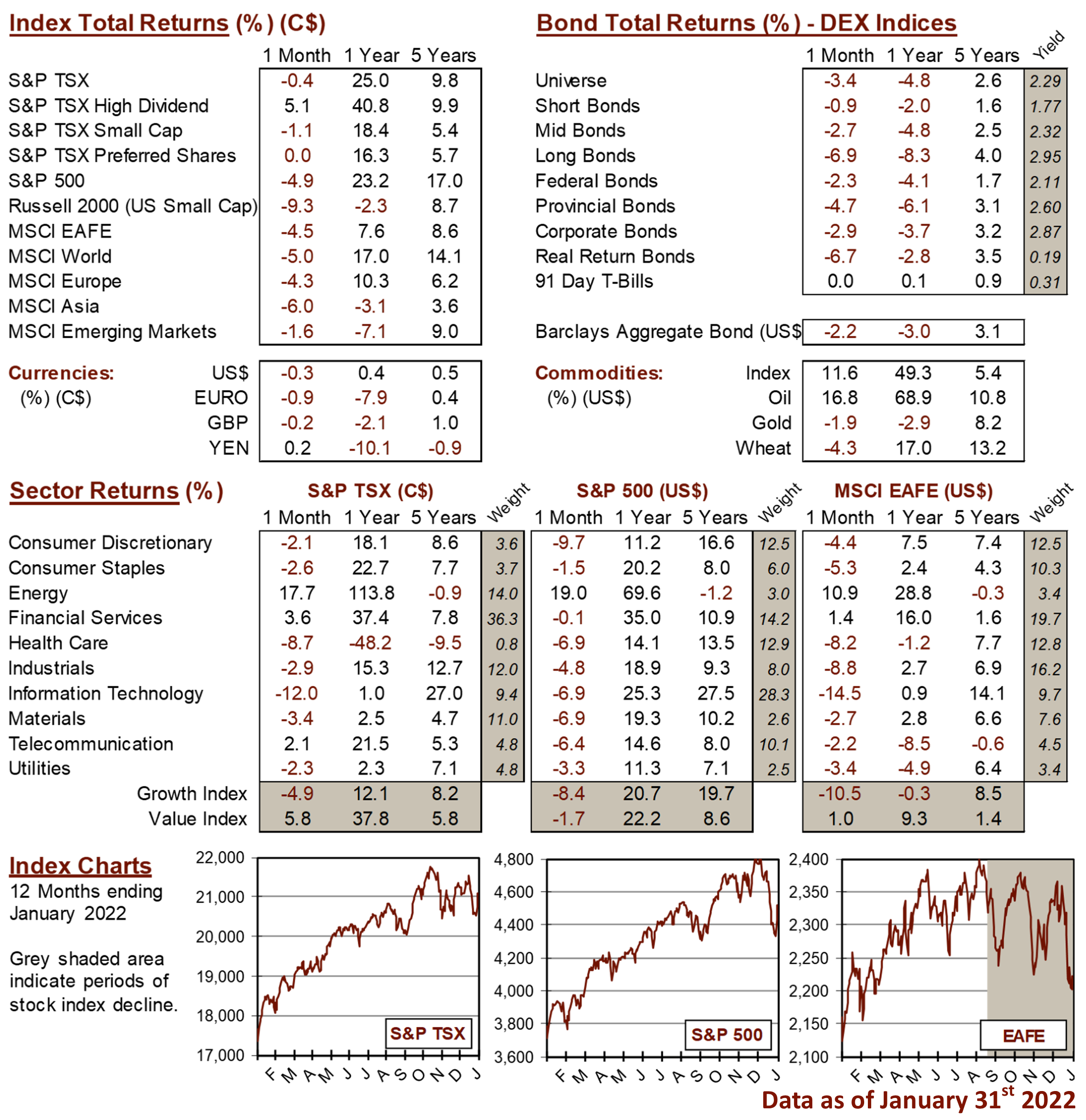

MARKET DATA

This report may contain forward looking statements. Forward looking statements are not guarantees of future performance as actual events and results could differ materially from those expressed or implied. The information in this publication does not constitute investment advice by Provisus Wealth Management Limited and is provided for informational purposes only and therefore is not an offer to buy or sell securities. Past performance may not be indicative of future results. While every effort has been made to ensure the correctness of the numbers and data presented, Provisus Wealth Management does not warrant the accuracy of the data in this publication. This publication is for informational purposes only.

Contact Us

18 King St. East Suite 303

Toronto, ON

M5C 1C4