Knowledge Centre

Large Cap Equities Reward Patience

January 2022

2021 was certainly an eventful year to say the least. Investors were faced with a barrage of negative headlines throughout the year resulting in increased volatility across global markets. Those who stayed resilient through the onslaught of negative sentiment on equity markets in 2020 have been rewarded with strong returns in their stock portfolios over the last two years. This has been especially true for Canadian small capitalization (small cap) equities which have generally outperformed coming out of every major market correction over the last 52 years. Small cap stocks are a relatively higher risk asset class and are generally more sensitive to economic conditions than their larger market capitalization counterparts and have historically shown to outperform as economies recover.

However, what about the other side of the equation? While small cap outperformance during times of economic recovery is encouraging for investors who want more exposure to small cap equities, it is vital to consider what happens when the economy and markets take a turn for the worse or simply meander along. Over the last 52 years, both large and small cap equities have generated nearly identical total returns on average (10.6% and 10.4%, respectively). However, during down markets over this same time period, small cap equities have outperformed large cap equities on only two occasions (1992 and 2002) while being 42% more volatile over the period.

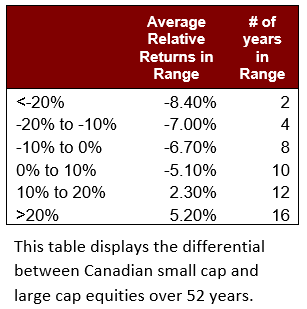

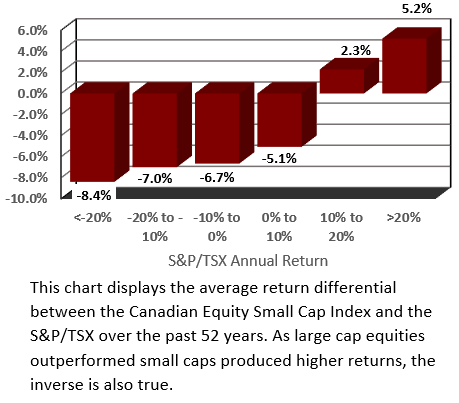

The chart to the right shows the relative return difference between small cap and large cap stocks over the past 52 years. There have been 38 years with positive performance and 14 years with negative for large cap stocks over this period. During these negative years, performance disproportionately favours large cap equities. In years where the S&P/TSX Index lost more than 20%, on average, the Small Cap index lost 28.4%, or -8.4% on a relative basis. In years where the S&P/TSX composite lost between -10 and -20%, small cap equities faired on average, 7.0% worse than large cap equities. Only during very strong bull markets, where large cap stocks returned greater than 20%, did small cap equities fair materially better, outperforming large cap equities by 5.2%. In fact, small cap stocks only outperformed large cap stocks on average when the overall market gained more than 10% per year, which only occurred 54% of the time. Interestingly, small cap equities have had a high correlation with large cap equities, making diversification minimal relative to other asset classes.

It is not all negative when it comes to small cap stocks as most successful large cap companies started as small businesses. These small businesses hold the potential to bring disruptive products to markets, earning investors exuberant returns in the process and growing their portfolios. Their small size gives them room to grow in ways that larger companies simply cannot. However, unless investors have a great deal of time on their hands or are very experienced, they are inherently at a disadvantage when investing in the small cap space compared to the comfort, transparency and reliability of large caps.

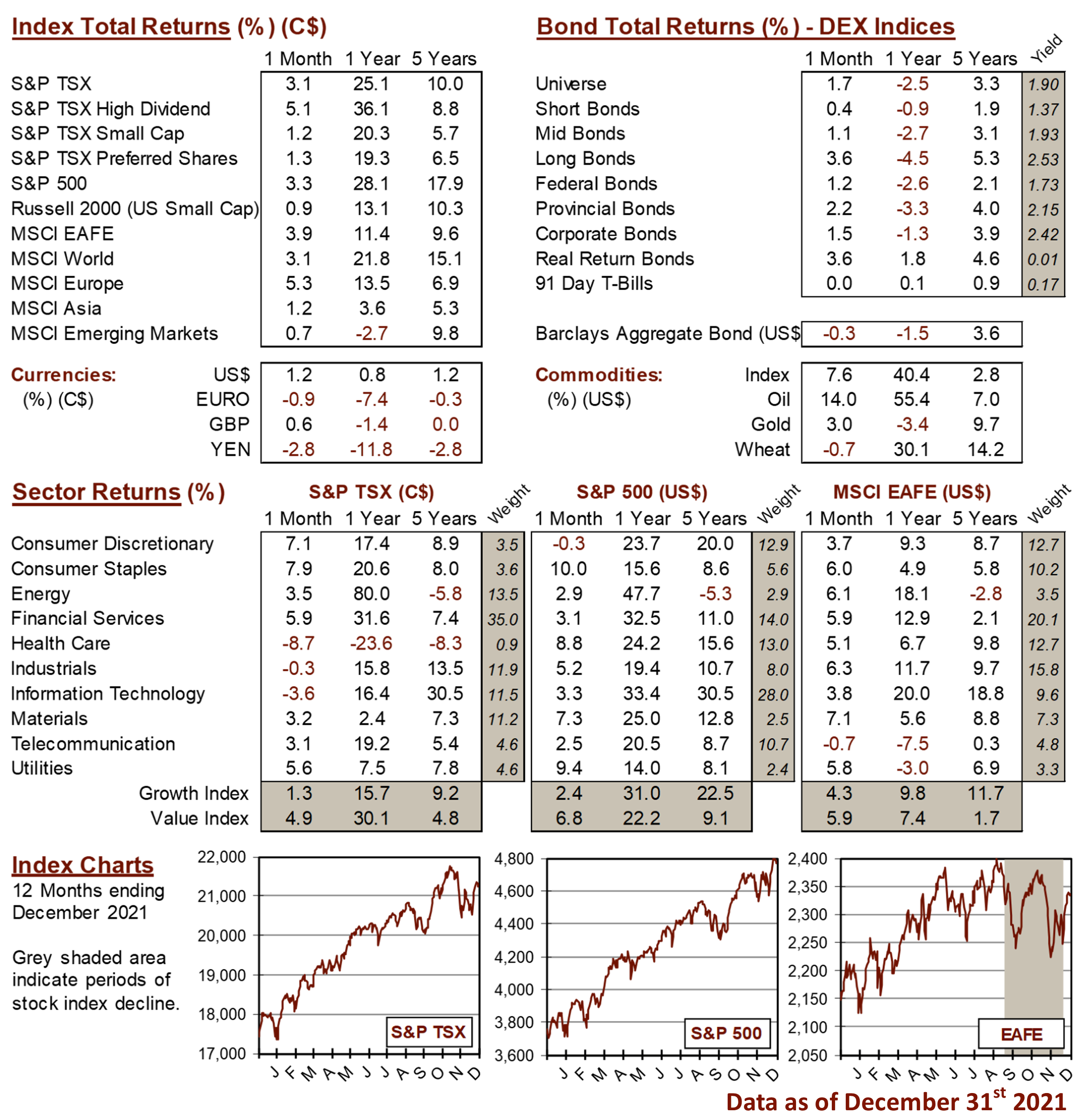

MARKET DATA

This report may contain forward looking statements. Forward looking statements are not guarantees of future performance as actual events and results could differ materially from those expressed or implied. The information in this publication does not constitute investment advice by Provisus Wealth Management Limited and is provided for informational purposes only and therefore is not an offer to buy or sell securities. Past performance may not be indicative of future results. While every effort has been made to ensure the correctness of the numbers and data presented, Provisus Wealth Management does not warrant the accuracy of the data in this publication. This publication is for informational purposes only.

Contact Us

"*" indicates required fields

18 King St. East Suite 303

Toronto, ON

M5C 1C4