Knowledge Centre

Yield Thirsty Investors should look at Stock Dividends

November 2020

Interest rates are hitting all-time lows due to COVID-19 fears. There is a very distinct possibility that interest rates are going to stay low for much longer than was previously anticipated. This will create extreme challenges for many investors. Therefore, income seeking investors who were used to relatively safe bond investments with decent yields will have to look elsewhere to generate the income they crave.

Bonds in the late 1950s entered a devastating inflation-induced bear market that lasted more than two decades as bond yields rose by several orders of magnitude. Since their apex in the early 1970s bond yields have been on a steady decline, rewarding investors with stable performance. Unfortunately, meaningful returns from bonds have more than likely reached their crescendo in 2020 as the COVID-19 pandemic has distorted the bond market beyond recognition. The net result is extreme divergence between the yields investors can receive from bonds and stock dividends.

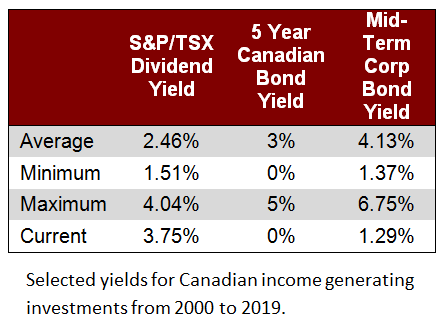

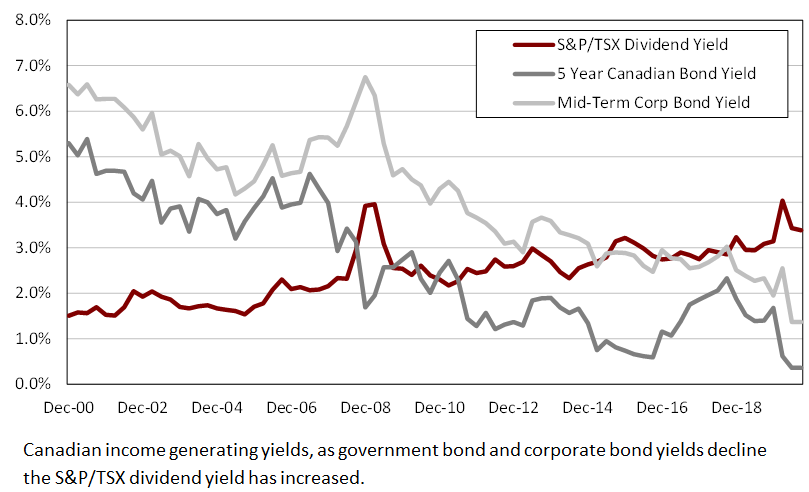

If income generation is the overriding concern, then bond investors need to fall in love with dividend paying stocks. The dividend yield on the S&P/TSX Index now exceeds the yield on 5 Year government of Canada Bonds by its highest margin (9.5 times) in nearly five decades after a flight to safe haven assets compressed government bond yields to record lows. The COVID-19 selloff has lifted the S&P/TSX’s dividend yield to 4.04%, the highest since the Financial Crisis of 2008/09.

Historically, 5 Year Canadian and Mid-Term Corporate Bonds have almost always been higher than the S&P/TSX dividend yields. That changed for short term government bonds after 2008 and in the case of corporate bonds the change occurred in 2019. Dividend stock yields are towering over 5 Year Bank GICs, which are currently only paying a 1.3% yield at best. As the chart and data show, the S&P/TSX dividend yield has not looked this attractive relative to bond payouts in at least two decades.

Not only are these dividend yields remarkable on their own right, they stand out in today’s environment of ultra-low yields bonds. Of course, Government bonds are also ultra-safe and the attractive dividend yields may not last, as companies vulnerable to the economic shock of COVID-19 may need to cut or scrap dividends. In fact, there have already been 34 dividend cuts in 2020, the most in 15 years, although the degree of the cuts has been relatively benign so far.

With bond yields at such extreme lows, the potential for returns both in absolute terms and relative to the negative impact of inflation are likely quite minimal going forward. If the economy bounces back then there is a distinct possibility that bond yields will climb and weaken bond prices. While a protracted bear market for bonds is not immediately imminent, these challenging times will make investors start to consider the appeal for dividend stocks.

There is no correct way to construct a portfolio that works for everyone. Bonds and stocks are income producing assets classes that each have their own strengths and weaknesses. So, the optimal mix for investment portfolios will depend on numerous personal factors. Over the long term dividend growth stocks have proven to be one of the best asset classes to generate growing income and preserve wealth. Despite their weaker outlook for long term returns, bonds can add a critical component to a portfolio by reducing risk.

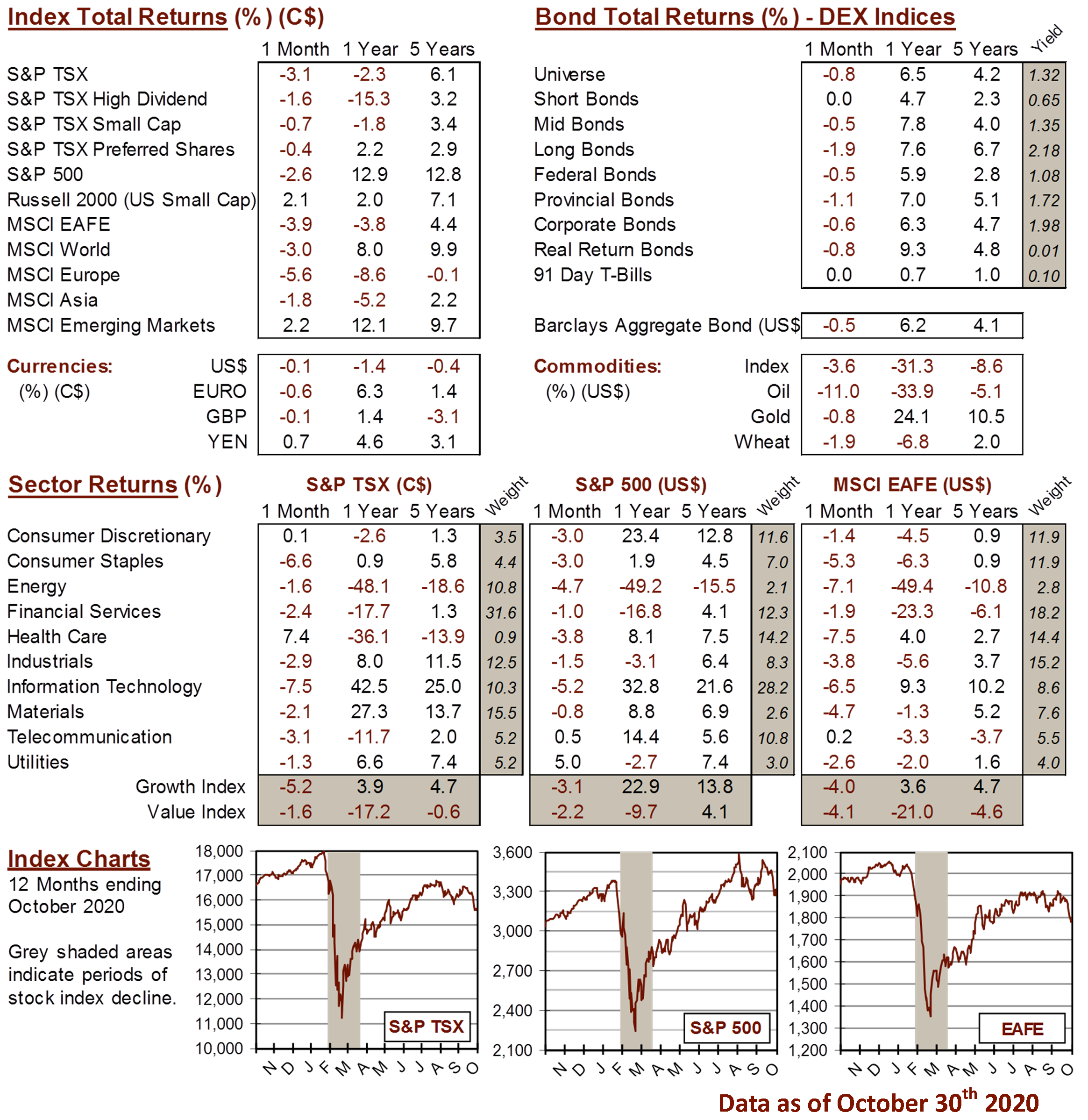

MARKET DATA

This report may contain forward looking statements. Forward looking statements are not guarantees of future performance as actual events and results could differ materially from those expressed or implied. The information in this publication does not constitute investment advice by Provisus Wealth Management Limited and is provided for informational purposes only and therefore is not an offer to buy or sell securities. Past performance may not be indicative of future results. While every effort has been made to ensure the correctness of the numbers and data presented, Provisus Wealth Management does not warrant the accuracy of the data in this publication. This publication is for informational purposes only.

Contact Us

"*" indicates required fields

18 King St. East Suite 303

Toronto, ON

M5C 1C4