Knowledge Centre

Rate Hikes Do Not Mean Doom

January 2016

In theory rising interest rates spell trouble for stocks but history confirms that equity market returns have varied significantly following an initial central bank rate hike. This is because not all interest rate hikes are equal. An increase is more meaningful if the starting point is 0.5% as opposed to 5.0%. When 10 year bonds yield 5%, then bond yields are viewed as potential replacements for stock returns, but since 10 year Government of Canada bonds are currently yielding 1.4% the worry is less.

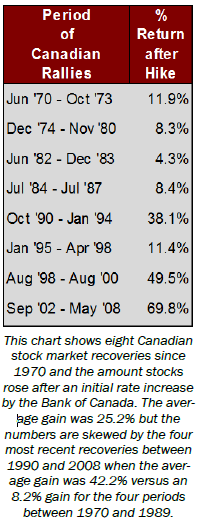

Equity bull markets do not usually end at the first rate hike. Stocks tend to peak much later as can be seen in the table to the left. For the eight Canadian stock market recoveries since 1970, stocks continue to gain 25.2% on average for 12 months. This is split into two distinct periods: 1970 to 1989, when stocks gain 8.2% on average before peaking 5 months after the first hike; and 1990 to 2008, when stocks gain 42.2% on average before peaking 20 months after the first hike.

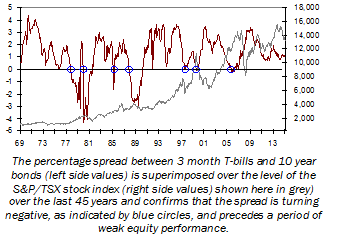

Twitchy investors should look beyond rate hikes and focus on the yield curve. The yield curve is one of the most reliable economic indicators and one that savvy market watchers keep on their radar. Most other economic data is backwards looking, so it is no wonder that the track record of forecasters using other signals is abysmal. The yield curve has an excellent record of predicting stock market peaks over the past 45 years and it is not signaling a bear market now. A yield curve inversion usually takes place about 12 months before the start of a recession, but the lead time ranges from about 5 to 16 months. The peak in the stock market usually occurs near the time of the yield curve inversion and just ahead of a recession.

The yield curve describes the difference between short term Canadian cash yields and long term bond yields. Typically short term interest rates are lower than long term rates so the yield curve slopes upwards, reflecting higher yields for longer term investments. This is referred to as a normal yield curve. When short rates move above long term rates and the curve becomes inverted, this is a clear sign that a slowdown is likely. It is no wonder that an inverted yield curve often incites fear in equity markets.

The yield spread between 3 month T bills and 10 year Canada bonds is shown in the chart above for the past 45 years. It also shows when the differential has turned negative, as indicated by the blue circles, and also shows the S&P/TSX stock index for ease of comparison. The yield curve has been flattening over the last three years but the good news is that the curve is still steep and certainly a long ways from inverting. If the Bank of Canada aggressively hikes its key policy rate and short term yields rise swiftly, the central bank would have to increase yields by 0.93% (assuming bond yields stay the same) before the yield curve becomes inverted.

An inverted yield curve is the best indicator of pending stock market trouble. Rates are usually increased to cool an overheating economy but in the current situation an increase would simply be the normal process of raising rates from the low levels they have been at following the financial crisis. Based upon what the yield curve is currently telling investors, this bull market has more room to run because a bear market will not come until the yield curve says so.

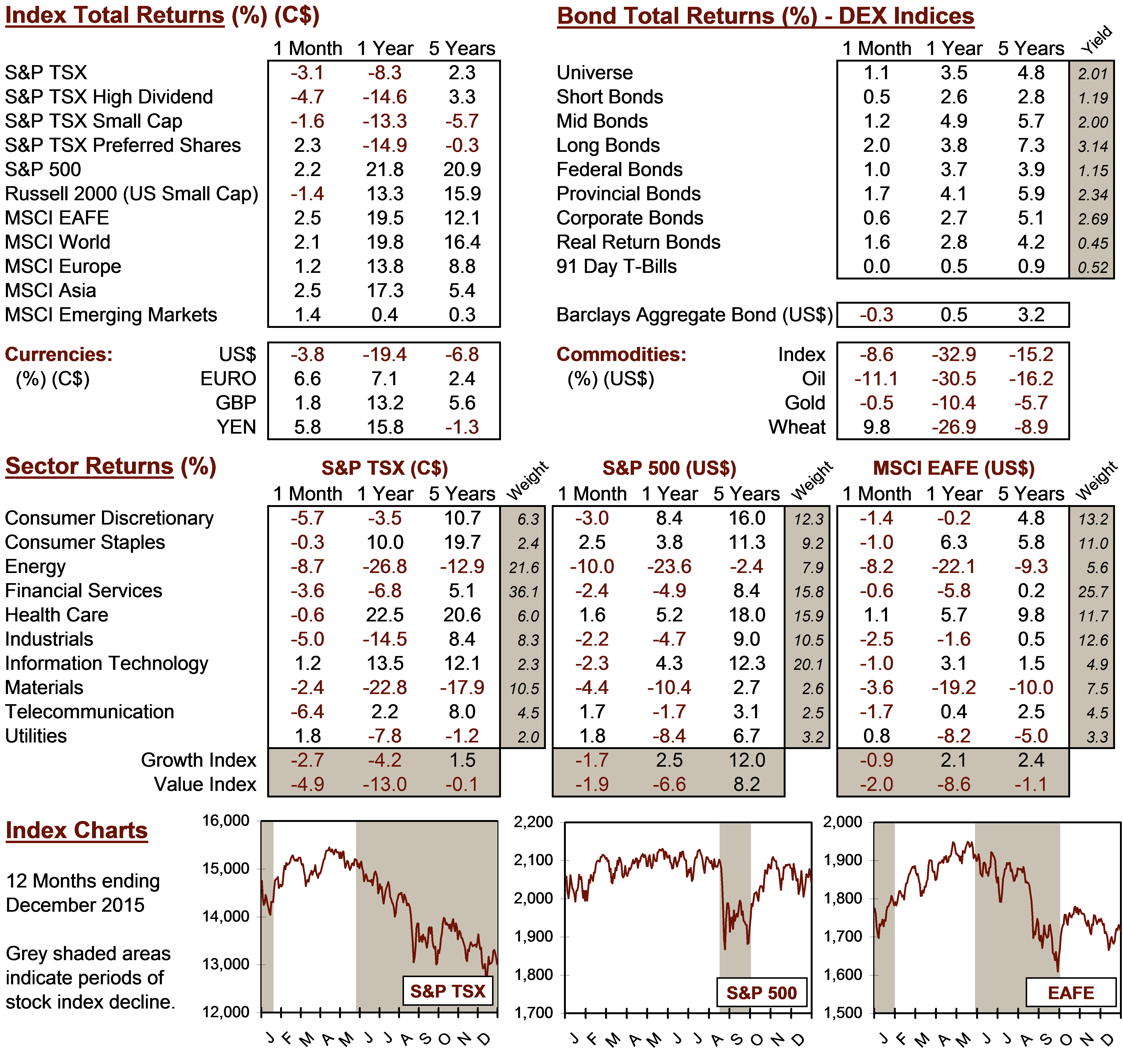

MARKET DATA

This report may contain forward looking statements. Forward looking statements are not guarantees of future performance as actual events and results could differ materially from those expressed or implied. The information in this publication does not constitute investment advice by Provisus Wealth Management Limited and is provided for informational purposes only and therefore is not an offer to buy or sell securities. Past performance may not be indicative of future results. While every effort has been made to ensure the correctness of the numbers and data presented, Provisus Wealth Management does not warrant the accuracy of the data in this publication. This publication is for informational purposes only.

Contact Us

"*" indicates required fields

18 King St. East Suite 303

Toronto, ON

M5C 1C4