Knowledge Centre

Bottom Fishing

February 2016

History has a way of repeating itself and it might be about to deliver a welcome relief from the Canadian stock market turmoil in the form of a turning point in what has been a one-sided slide since mid-April of 2015. Investors who are fearful should keep in mind what legendary long term investor Warren Buffet has long maintained; investors should, "be greedy when others are fearful and be fearful when others are greedy."

Investors' most discussed concern is whether or not we are past the worst or can we expect further downturns? It is impossible to predict the stock market bottom from the current malaise. Eventually confidence in the market will be restored and investors will step forward to take advantage of the lows but markets will continue to be volatile. The cause of the recovery cannot be predicted and may not be particularly evident until after the fact - but it will occur.

Bear markets normally occur in three stages. The first is during a positive run when a few prudent investors recognize that despite the overwhelming bullishness, things will not always be rosy. The second is when most investors recognize the economy is deteriorating, and the third occurs when the consensus is that things can only get worse. On the other side, a bull market also goes through three stages. Initially only a few forward looking investors begin to believe things will get better. In the second phase the majority of investors come to realize that improvement is underway and the final stage is when most everyone is sure markets will get better. Bull markets begin when investors become increasingly forward looking.

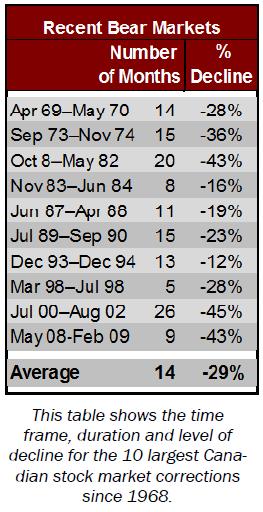

Determining the inflection point is every investor's secret desire. History does provide a range of dates of when rebounds have occurred in the past and the table to the left shows the time frame, duration and level of decline for the previous 10 largest Canadian stock market corrections since 1968. The average length of these bear markets is 14 months, with a standard deviation of 6 months. So from a very simple perspective, the bottom of the S&P/TSX index's current slump could occur anytime from November 2015 to November 2016, with the most likely bottom occurring in May 2016 based upon the April 2015 peak.

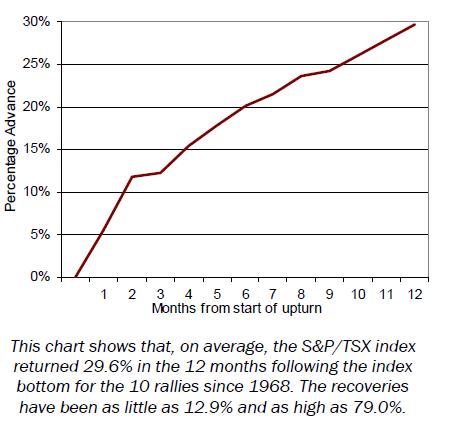

Whatever the actual date of the current selloffs bottom, it will occur and when it does a rally will ensue. Just as there have been 10 bear markets, they have been followed by 10 bull markets. By using month end data for these 10 rallies in the S&P/TSX index from 1968, the above chart shows that on average the S&P/TSX index returned 29.6% in the 12 months following the market bottom. The recoveries have been as little as 12.9% and as high as 79.0%.

Even though there is uncertainty about what lies ahead for the economy and the stock market it is hard not to feel that the worst is close to being over. However caution must be taken and not swept away on a tide of optimism. History has also shown that rallies emerging from the depths of bear markets are often followed by a period of uncertainty. Stock markets tend to temporarily decline after the initial rebound, as the market digests what it gained. Investors should use the time before any meaningful rally to think about the kind of returns they want and the kind of risk they can tolerate.

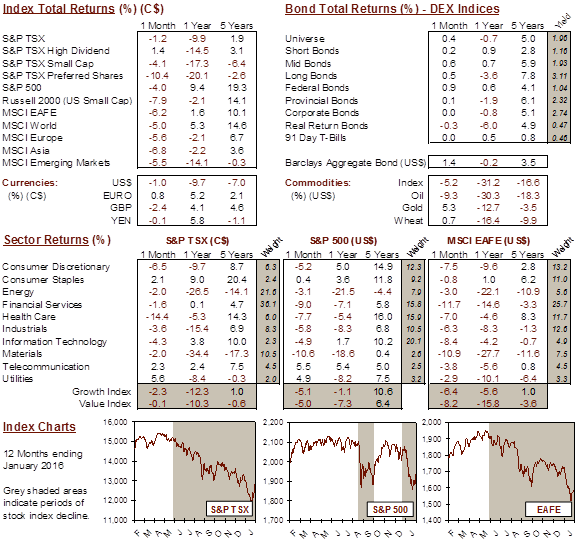

MARKET DATA

This report may contain forward looking statements. Forward looking statements are not guarantees of future performance as actual events and results could differ materially from those expressed or implied. The information in this publication does not constitute investment advice by Provisus Wealth Management Limited and is provided for informational purposes only and therefore is not an offer to buy or sell securities. Past performance may not be indicative of future results. While every effort has been made to ensure the correctness of the numbers and data presented, Provisus Wealth Management does not warrant the accuracy of the data in this publication. This publication is for informational purposes only.

Contact Us

18 King St. East Suite 303

Toronto, ON

M5C 1C4