Knowledge Centre

What will Trigger a Recession

November 2018

A recession is normally defined as “a significant decline in economic activity spread across two consecutive quarters.” While this is the precise technical definition, the nature and cause of recessions are for the most part less obvious and certain. Many factors contribute to an economy’s fall into a recession as it is rare for economic downturns to be caused by a single factor.

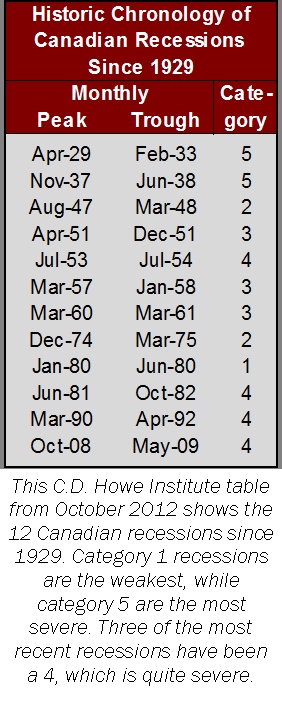

Canada has experienced a total of twelve recessions since 1929, excluding the very minor downturn in 2015 as it just squeaked into the definition. The average recession lasted 22 months versus 27 months of expansion after each recession. However, since 1945 recessions have only lasted an average of 10 months and expansions an average of 57 months. For the past 25 years, Canada has experienced only three recessions and prior to 2008 the economy had grown uninterrupted for 16 straight years. On the other hand, the three most recent major recessions have been quite severe as rated by the C.D. Howe Institute in a 2012 study, as shown in the table to the left. Category 1 recessions are the weakest as they are a short, mild drop in real GDP with no decline in quarterly employment, while category 5 are the most severe as they involve extremely rapid contractions in both GDP and employment over an extended period of time. With the exception of the Great Depression of 1929 and the 1953/54 recession, the past three recessions have been among the most severe of the past 100 years. The bottom line is that recessions have been occurring less often, but have been more severe.

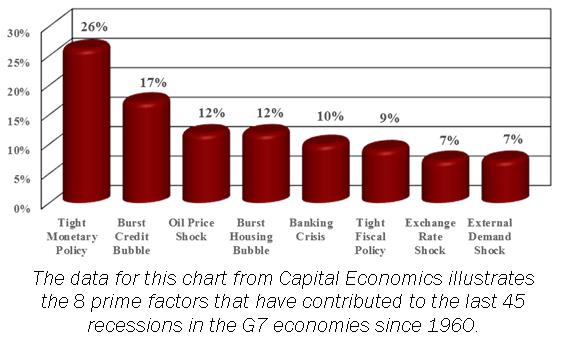

The big question is what causes recessions in the first place? While there are numerous triggers which have been documented ad nauseam, the research firm Capital Economics nicely summarised them in October 2018 by categorizing the factors that have contributed to the last 45 recessions in the G7 economies since 1960, as shown in the chart to the right. Clearly monetary policy tightening contributed most significantly in the majority of the recessions but numerous other factors played a role. And while a trade war has the potential to inflict substantial damage, it would require a significant escalation to be the trigger of the next global downturn.

Still, the traditional warning signs are not present today despite various spooky headlines. The riskiest forms of lending are missing, financial institutions are well capitalized, and while asset prices look stretched, it is difficult to make the case that they are dangerously overvalued. So hopefully the next global downturn is more likely to be relatively mild and short lived. As for the timing, it is more of an art than a science and the global economy could very well continue to slither forward for some time. However, high debt levels could increase the possibility of financial shocks as rising interest rates will have an impact. Also, seemingly unrelated events will collective combine to slow down or decrease the rate of growth for the world’s economy.

The final risk is that a series of events, which on their own would have a relatively small effect on the global economy, interact to produce effects that are much larger than the sum of their parts. It would require a significant escalation in trade protection from the measures seen so far to do serious damage to the global economy. Unfortunately every recession is unique and has an annoying tendency to strike when least expected. After all, economic expansions usually do not die of old age, something needs to kill them.

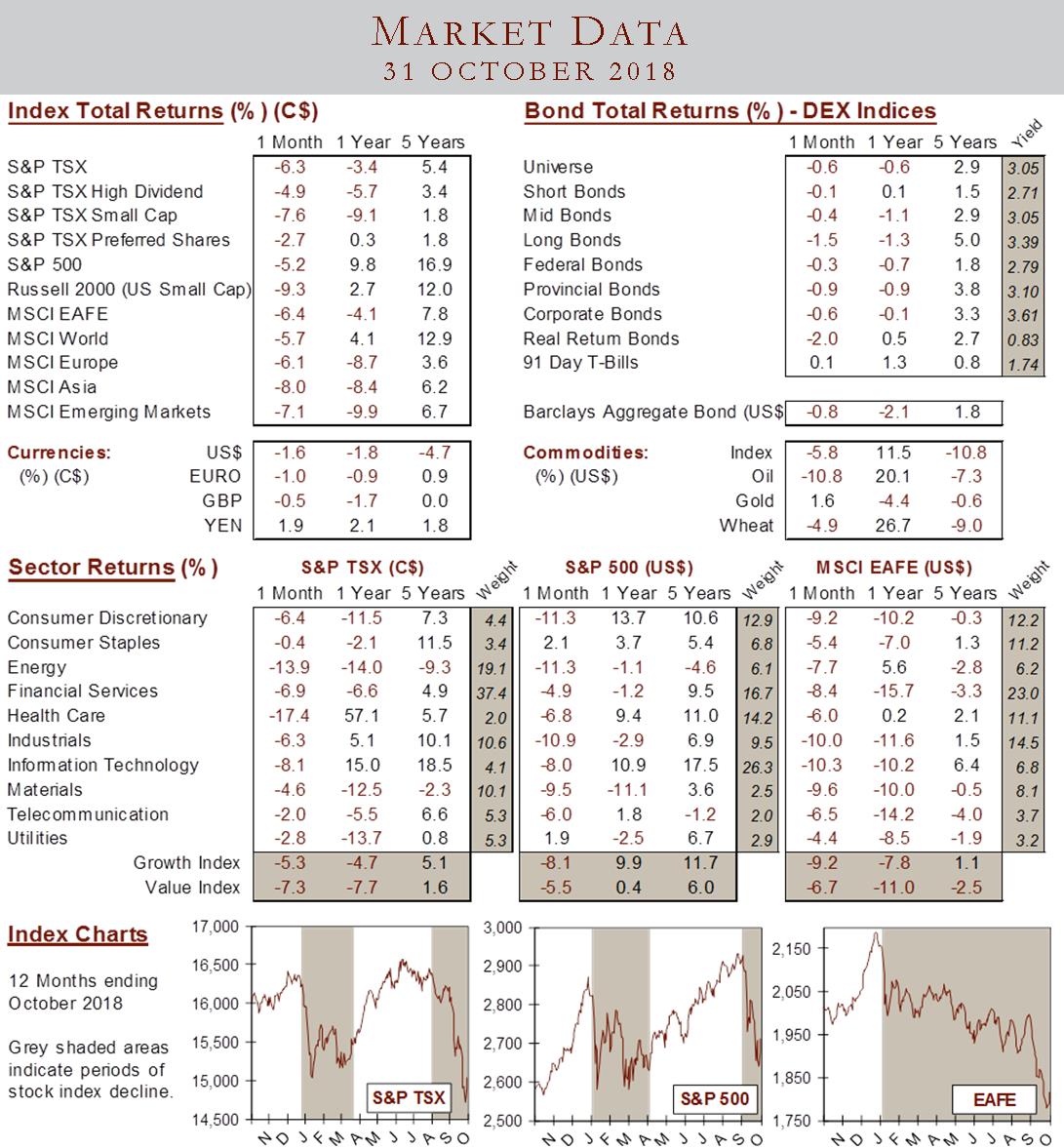

MARKET DATA

This report may contain forward looking statements. Forward looking statements are not guarantees of future performance as actual events and results could differ materially from those expressed or implied. The information in this publication does not constitute investment advice by Provisus Wealth Management Limited and is provided for informational purposes only and therefore is not an offer to buy or sell securities. Past performance may not be indicative of future results. While every effort has been made to ensure the correctness of the numbers and data presented, Provisus Wealth Management does not warrant the accuracy of the data in this publication. This publication is for informational purposes only.

Contact Us

18 King St. East Suite 303

Toronto, ON

M5C 1C4