Knowledge Centre

Size Still Matters

May 2020

One intriguing development in the Canadian stock market since the outbreak of COVID-19 has been the reaction of investors who have not succumbed to panic and the temptation to flee equities. While there were very few outright winners, there were stocks that sidestepped the outright worst declines if you were fortunate to know where to look. The speed with which the correction enveloped markets left limited time to get in front of the selloff and gain from the winners not previously selected, but this drop has also created good opportunities to shift exposure.

One intriguing development in the Canadian stock market since the outbreak of COVID-19 has been the reaction of investors who have not succumbed to panic and the temptation to flee equities. While there were very few outright winners, there were stocks that sidestepped the outright worst declines if you were fortunate to know where to look. The speed with which the correction enveloped markets left limited time to get in front of the selloff and gain from the winners not previously selected, but this drop has also created good opportunities to shift exposure.

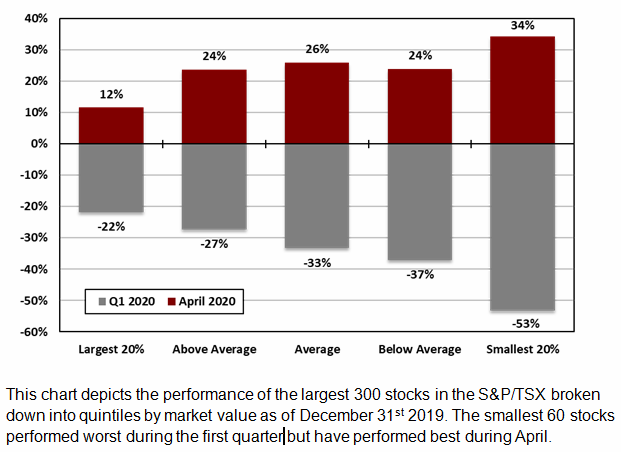

Market capitalization played a significant role in determining the best performers as the largest firms performed best. The very largest firms now account for a huge share of the overall market. In fact, the 19 largest stocks in Canada now account for more than 50% of the S&P/TSX Index market value; the top 50 stocks account for 75%. Collectively, these 50 largest firms in the S&P/TSX have outperformed their smaller counterparts and declined less than the overall market in the first quarter of 2020. Given that only 96 stocks (or 32%) of the largest 300 stocks in Canada fell less that the benchmark’s decline of -20.9%, this clearly illustrates how size mattered in this market downturn.

Certainly, there are several reasons for this phenomenon: the support measures put in place to fight the economic effects of the COVID-19 outbreak will disproportionately benefit larger firms for some time to come; second, a key factor behind the outperformance of the largest firms has been growing corporate concentration making larger firms more stable and less susceptible to liquidity concerns; and third, consumer spending patterns have traditionally favoured strong name brand products that support the big firms and freeze out competitors who are encroaching on recognized products.

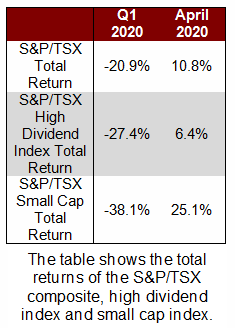

The chart to the right shows how COVID-19 related issues caused a drop in the Canadian stock market in the first quarter of 2020 (grey columns). The data separates the 300 largest stocks into groups of 60 (or 20% quintiles) based upon the market capitalization of the stocks as at December 31, 2019. The very largest firms have collectively held up much better. The equities of smaller firms were hit hardest when worries about COVID-19 first started to put the Canadian stock market under pressure, but that does not mean they are bound to continue to lag if the outbreak is brought under control and the markets recover.

In fact, April has basically flipped the script. The recent rally has been dominated by the little guys (as the maroon columns indicate in the chart). While the nature of the current economic environment makes smaller Canadian businesses most vulnerable, they also tend to be more closely linked to the economic boom and bust cycle and can often be bought up at heavy discounts at the bottom of the market compared to larger peers. Once investors start to focus on the prospect of an economic recovery then the level of confidence in small firms will also likely grow.

Money tends to go to where it can get the biggest return. Currently, small cap stocks are positioned to offer larger gains so we are seeing a reversal as stocks that have been left for dead have come back over the past month. This has historically been the case as smaller cap stocks have generally outperformed coming out of every major market correction during the last 40 years. For example, in the two years after the 2008 Market Crisis bottom, small caps collectively generated nearly twice the returns of the S&P/TSX Stock Index. What goes around comes around. With enough patience and a steady hand investors can be poised to benefit once calm returns.

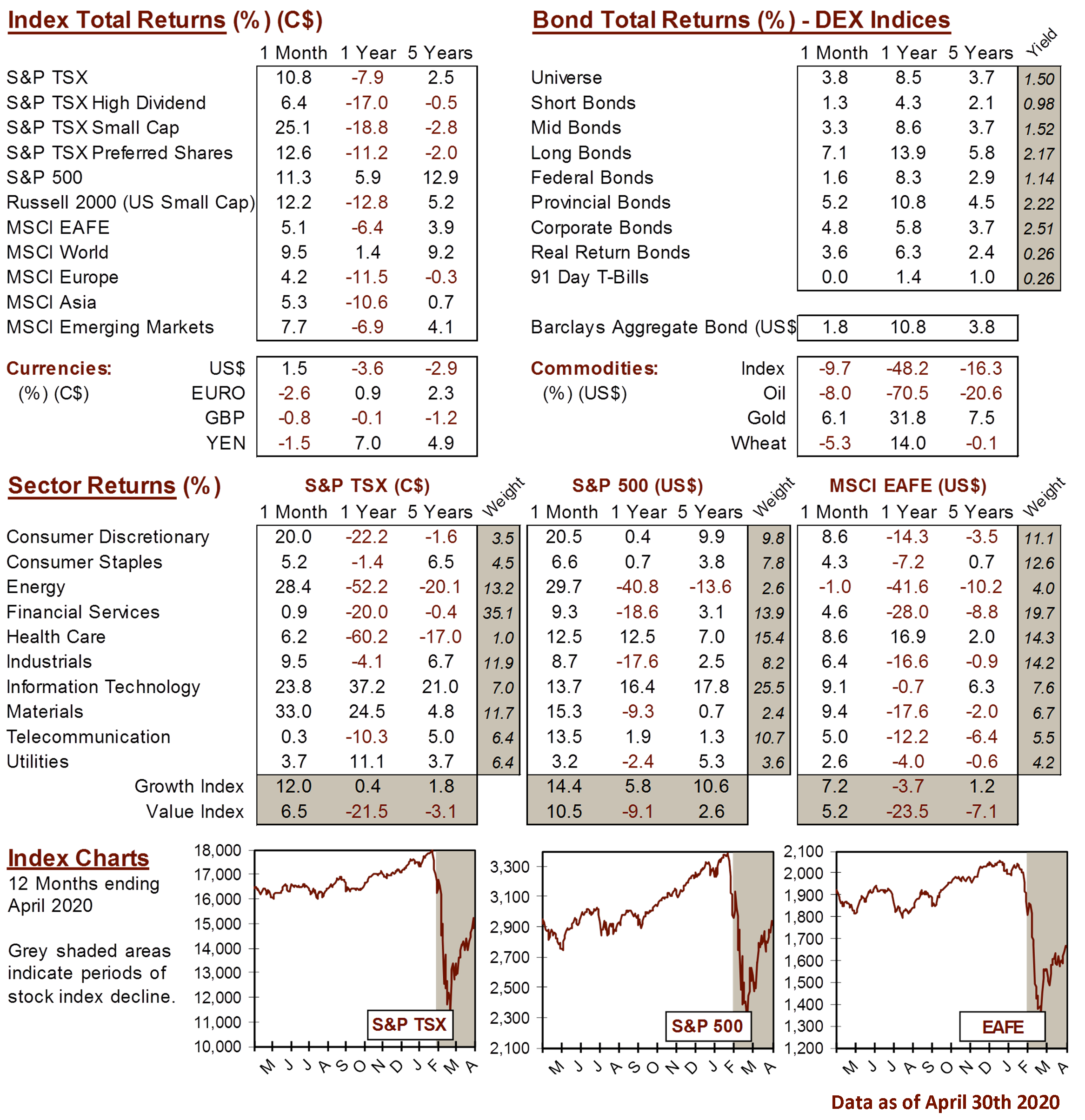

MARKET DATA

This report may contain forward looking statements. Forward looking statements are not guarantees of future performance as actual events and results could differ materially from those expressed or implied. The information in this publication does not constitute investment advice by Provisus Wealth Management Limited and is provided for informational purposes only and therefore is not an offer to buy or sell securities. Past performance may not be indicative of future results. While every effort has been made to ensure the correctness of the numbers and data presented, Provisus Wealth Management does not warrant the accuracy of the data in this publication. This publication is for informational purposes only.

Contact Us

18 King St. East Suite 303

Toronto, ON

M5C 1C4