Knowledge Centre

Prospect for Hope

February 2021

Usually, it is not the most intelligent investors that prevail but the ones who are able to stay calm within the storm. All investors would like to know the future but they never can. Even with the best forecasts, the only certainty is that an unlikely event will occur. These rare events, like black swans, can render predictions obsolete. In hindsight most events are surprisingly logical, predictable and bound to happen. However, there are events that are difficult to predict and can have a damaging impact on financial markets. These events represent major inflection, or turning points, that can lead to significant periods of dislocation and upheaval.

Black swans are considered freaks of nature that were once thought not to exist. Like their namesake, some events are so unpredictable that they come out of nowhere to alter the world and impact the markets: the assassination of Arch Duke Ferdinand which started World War I; the rise to power of Adolf Hitler; the bombing of Pearl Harbor; the collapse of the Soviet Union; the stock market crash of 1987; or September 11, 2001. While nothing in an investor’s collective experience could have predicted any of these events, the results were unimaginable and rendered market timing as nothing more than a wild goose chase.

While not on the same order of magnitude as any of the aforementioned events, something occurred on November 9, 2020 that triggered significant changes for the Canadian stock market which will have long lasting repercussions. On that date, two vaccines for COVID-19 were approved for distribution in Canada. This announcement triggered a state of euphoria in the financial markets as the prospects for victory over the ravishes of the pandemic seemed within our grasp.

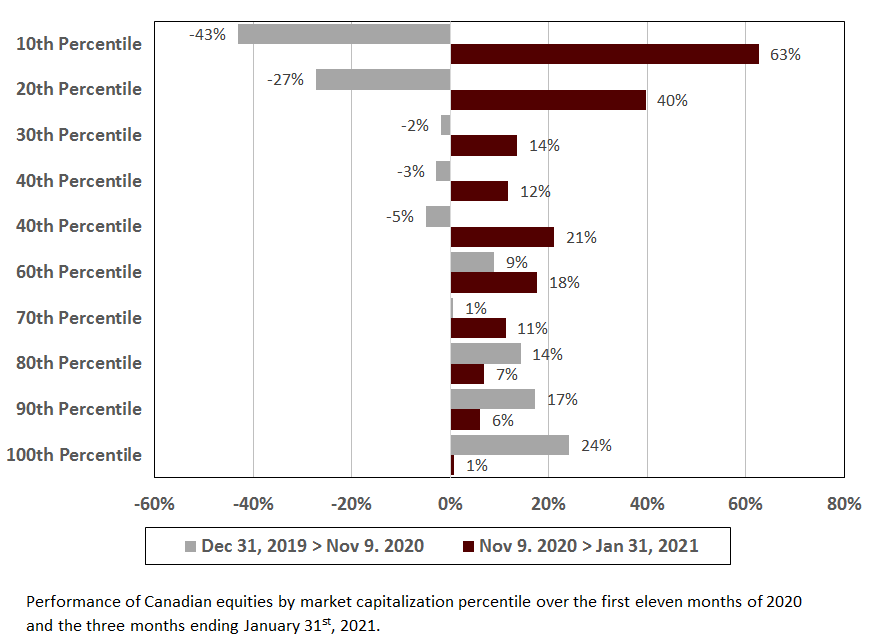

The announcement had an even more pronounced effect on stocks that was visible on the surface. It trigged a complete reversal in which stocks that were winners or losers (i.e. stocks that gained or declined in value), suddenly switched places. The chart to the right shows the average rate of change for stock prices before and after November 9, 2020. The data for this chart is drawn from the 300 largest stocks in Canada based on market capitalization. All the stocks were sorted by share price on November 9, 2020 such that the 30 smallest share-priced stocks were grouped together in the 10th percentile range and the 30 largest share-priced stocks were grouped together in the 100th percentile range.

For the year prior to November 9, 2020, the lowest priced stocks had been taking a significant beating (declining -43%; all return figures in the chart exclude the impact of dividends); whereas stocks with the highest stock prices were generating sizable gains (up 24%). All other stocks won or lost, seemingly in proportion to their ranking (lower priced stocks had larger losses). However after November 9, 2020, things turned dramatically. The previously underperforming stocks became the outperformers and the previously winning stocks then dramatically underperformed (at least up until January 31, 2021). Interestingly, the 150 biggest stocks (i.e. 60th percentile stocks or larger) had positive performance over the entire period.

Investors have to be realistic about what they know. Predicting markets might be possible, but in reality it is as much a matter of luck as intuition or skill. The one predicable factor is that black swan type events will occur so investors need to understand these types of uncertainties and react as judiciously as possible.

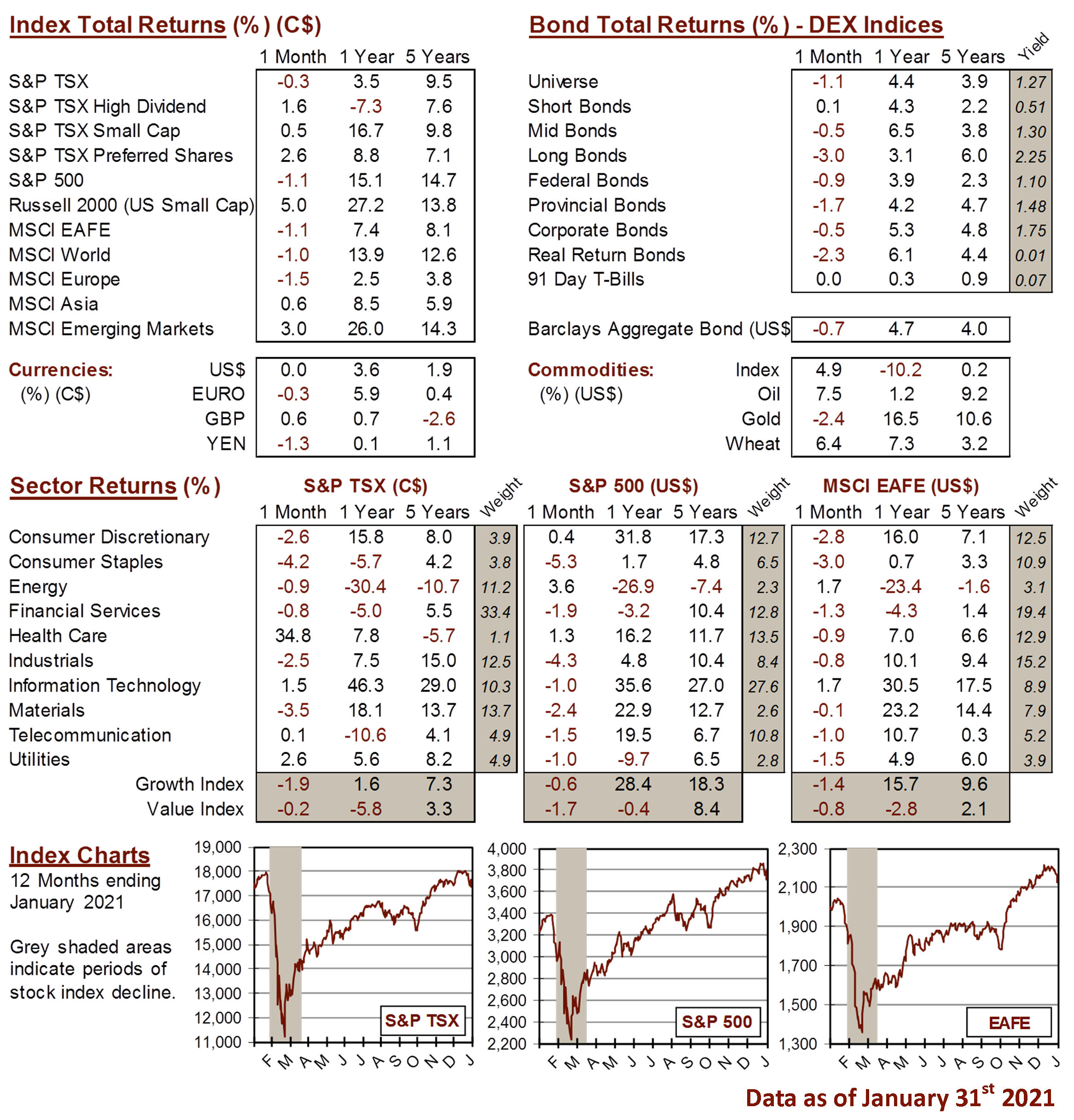

MARKET DATA

This report may contain forward looking statements. Forward looking statements are not guarantees of future performance as actual events and results could differ materially from those expressed or implied. The information in this publication does not constitute investment advice by Provisus Wealth Management Limited and is provided for informational purposes only and therefore is not an offer to buy or sell securities. Past performance may not be indicative of future results. While every effort has been made to ensure the correctness of the numbers and data presented, Provisus Wealth Management does not warrant the accuracy of the data in this publication. This publication is for informational purposes only.

Contact Us

18 King St. East Suite 303

Toronto, ON

M5C 1C4