Knowledge Centre

Painful Interest Rate Increases

May 2022

The biggest threat bonds face is an increase in interest rates, and they will rise eventually. The wake-up call for bond investors could come when investors realize how little money they are earning with low yielding bond portfolios. When interest rates rise, bond prices fall, and investors lose principal value. In the past, falling bond prices have been offset by the yields the bonds generate, thus earning positive overall performance. However, at current yield levels investors will find it difficult to be rewarded for taking on extra duration risk in the market.

The relationship between bond prices and prevailing interest rates is neither simple nor linear. How much bond prices rise or fall depends on the term to maturity and / or duration of the bonds. Bond duration is defined as the weighted average of the time until the fixed cash flow payments (both interest

and principal) are received. Duration measures the price sensitivity to yield changes and is used to determine bond value changes in response to changes in interest rates. Duration is expressed as a number of years and while it may be difficult to conceptualize it is simply a measure of the sensitivity of a bond’s price to a change in interest rates. Because of their longer time horizon, the prices of longer term bonds are more affected by an interest rate change than prices for short term bonds.

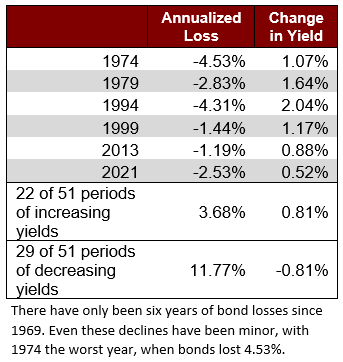

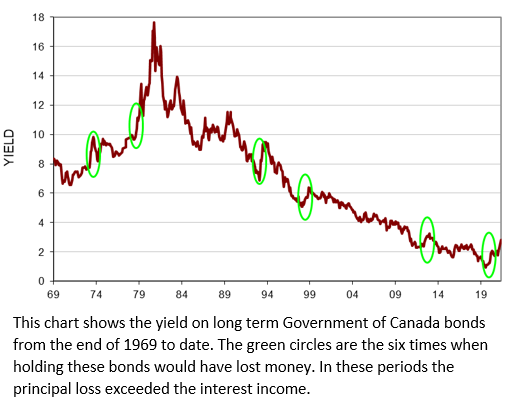

Over the past 51 years, bonds in Canada have produced exceptionally good performance with an average calendar return of 8.35%, based upon the FTSE Universe Bond Index (the most widely used and broadly based fixed income performance benchmark in Canada). Of course, there have been negative years, but they have been rare. In fact, as shown by the green circles in the chart to the right of long Canada bond yields (and the data in the table to the left) there have only been six years of bond losses since 1969. Even these declines have been minor, with 1974 being the worst year as bonds lost 4.53%.

The chart illustrates that the 1970’s and early 80’s were punitive years as rates rose but overall performance was good. Twenty-two of the past 51 years have seen long term bond yields increase annually, with average gains of 0.81% per year, versus average yield declines in the other 29 years of -0.81% per year. As mentioned above, rising yields cause bond prices to fall but since the average bond yield in the years of increased rates was 7.76% this more than offset the decline in bond prices in 23 of the 29 years.

Current bond market conditions are unfavourable. The long term Canadian bond yield is 2.81%, up from its lowest level of 0.95% in July 2020 at the height of the COVID-19 pandemic. This was the lowest it has been since the Bank of Canada started keeping records in 1919. When rates do climb the low yield will not compensate for falling bond prices. For example, the duration of the FTSE Universe bond index is 6.8 years and if bond yields increase at the average amount of the previous 22 negative years, or 0.81%, bond prices will decline 5.8%. Certainly, negative annual performance from bonds could lead to concerns; however, the rarity of this occurrence should give investors comfort that any pain experienced is likely a short term hiccup.

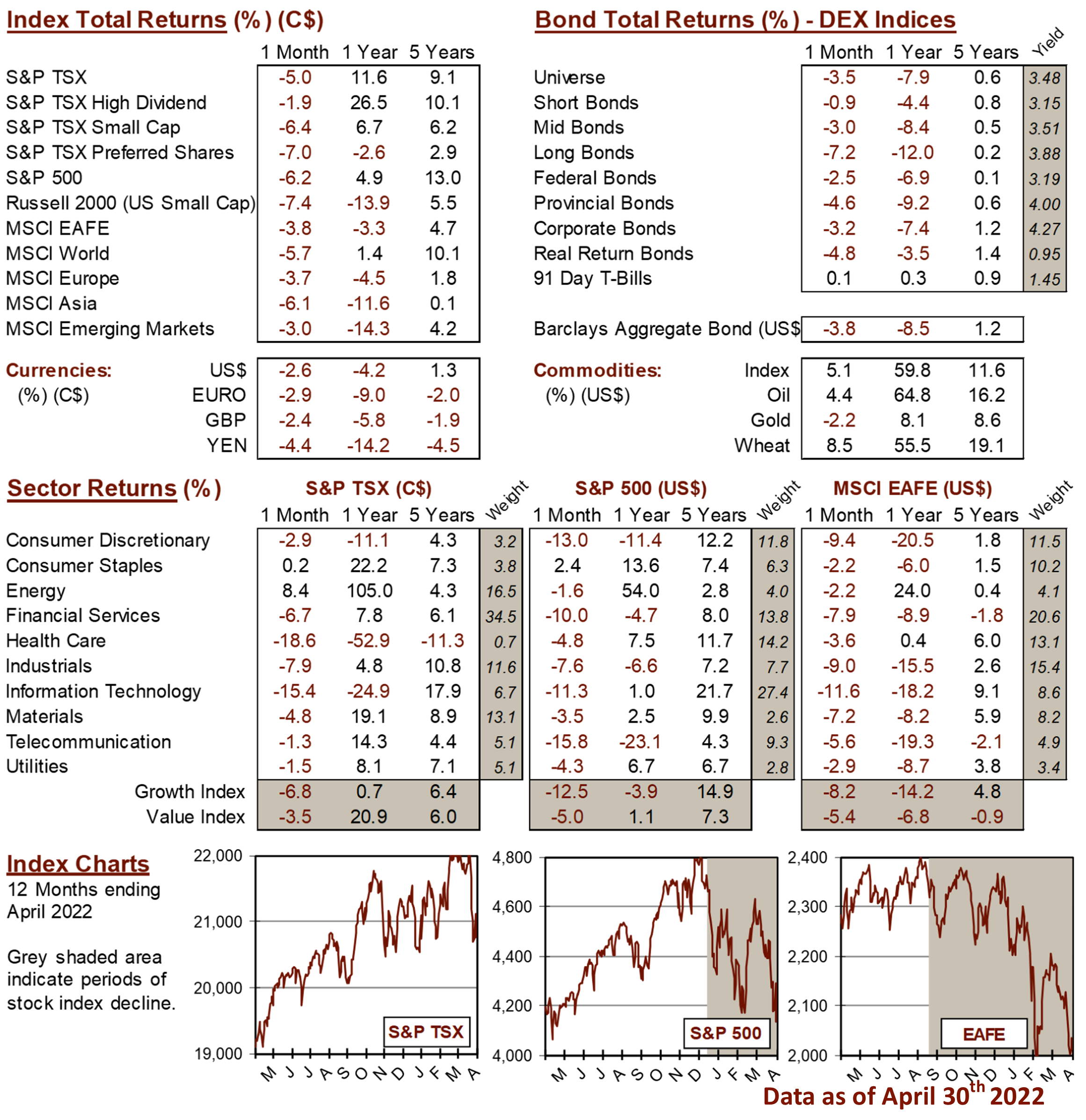

MARKET DATA

This report may contain forward looking statements. Forward looking statements are not guarantees of future performance as actual events and results could differ materially from those expressed or implied. The information in this publication does not constitute investment advice by Provisus Wealth Management Limited and is provided for informational purposes only and therefore is not an offer to buy or sell securities. Past performance may not be indicative of future results. While every effort has been made to ensure the correctness of the numbers and data presented, Provisus Wealth Management does not warrant the accuracy of the data in this publication. This publication is for informational purposes only.

Contact Us

18 King St. East Suite 303

Toronto, ON

M5C 1C4