Knowledge Centre

Monthly Market Enthusiasm

October 2020

When investors discuss the worst month for stock market performance most think of October. After all October is the month Black Monday and Black Tuesday occurred, marking the crashes of 1987 and 1929. Or maybe they think of May in keeping with the old adage “sell in May and go away”. In reality, the worst month in Canada, the U.S., Japan, and a number of European markets including Germany and the U.K., is September. Looking as far back as 1896, the data for the Dow Jones Industrial Average shows that September has been the worst month with a consistent and statistically significant negative bias.

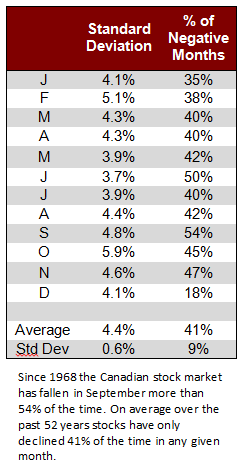

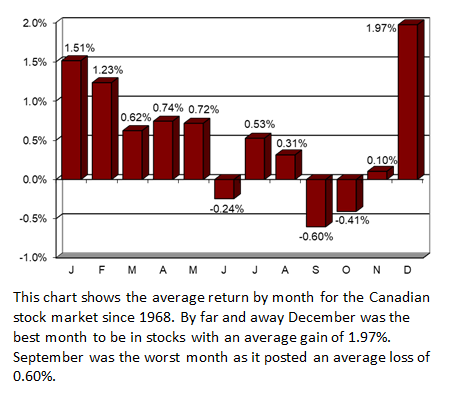

Taking a broader look at the Canadian stock market (see chart to the right and data to the left), it has posted an average decline of 0.60% in September since 1968 (all return figures exclude the impact of dividends). Considering that only two other months, June and October, show an average loss of any size over that period, September sticks out like a sore thumb. September is the worst month as the market fell more than 54% of the time, while over the same 52 year period stocks have only declined 41% of the time. October is perceived as the month of crashes (3 of the 6 largest monthly stock market declines occurred in October over the past 52 years) but if those 3 declines did not occur then the average return would have been up 0.67%). October shows an average loss of 0.41% and is the most volatile month of the year. At the head of the pack was December with an average 1.97 % gain which is by far the best month to be in stocks, better that the famed January effect.

Theories for September’s weakness are abundant: there is less money flowing into investments in the latter half of the year as bonuses and tax refunds came in early in the year and frequently go into RRSPs; investors begin to pay more attention to investments after spending their summer tanning; psychologically, when the leaves turn in the fall, vacations end and the days get shorter, there is a tendency for impatient investors to get rid of shares they had been thinking about selling; and lastly, if investors believe September is going to be bad they may sell in anticipation so it becomes a self fulfilling prophecy. Then again it could be no more complicated than the fact that there are only 12 months in the year and there has to be a best and a worst one so it might as well be September.

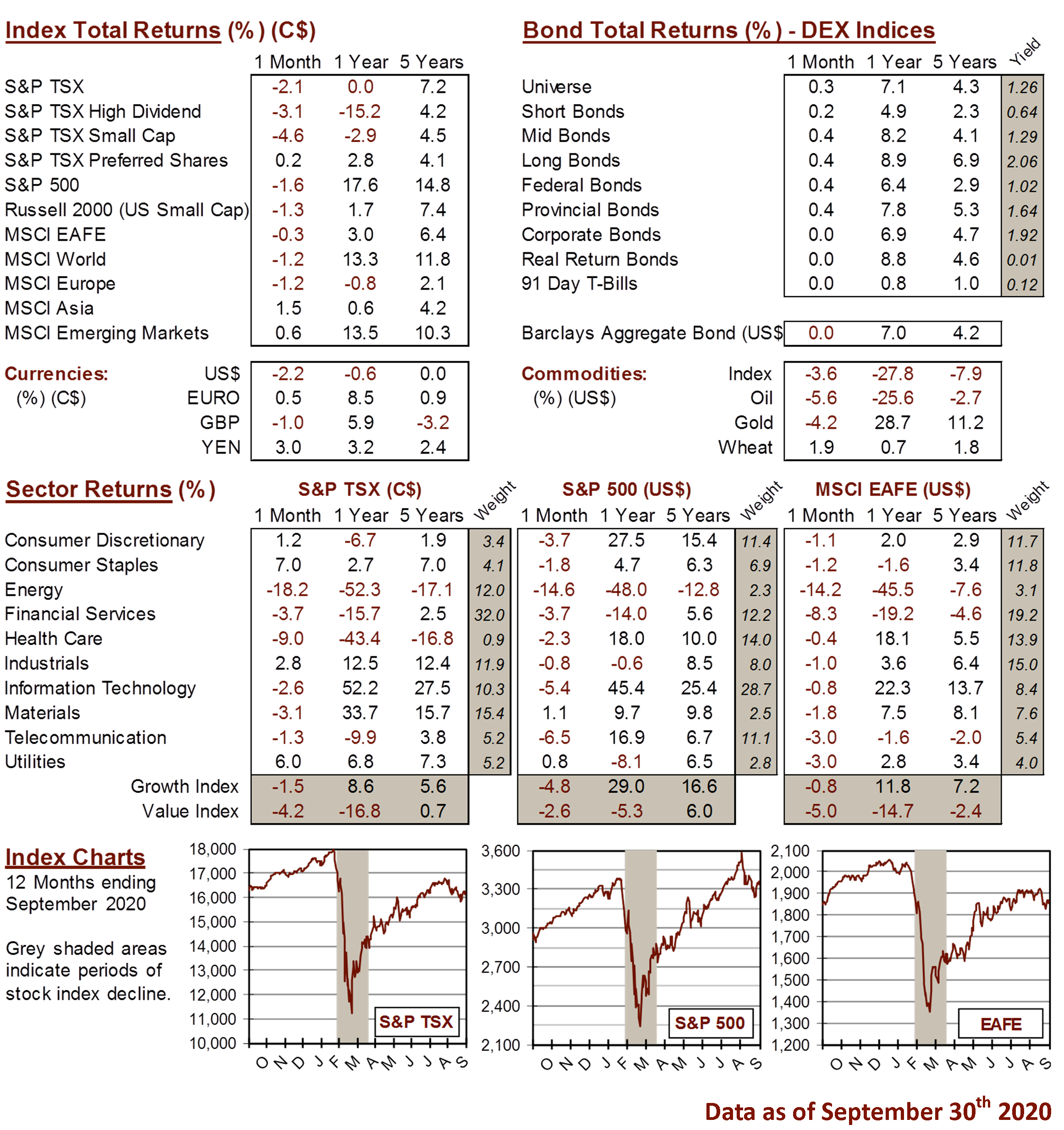

Right now, there is a tremendous amount of positive and negative data out there that is confusing the marketplace. Not only have investors experienced yet another poor September, as the Canadian stock market finished down 3.50%, but the economy seems to be at a crossroads. The COVID-19 crisis appears to have bottomed and the recovery is in the early stages, although a rebound in the number of cases is increasing investor anxiety. Still, there is so much money on the sidelines right now that should the market begin to head south investors are poised to jump in quickly, softening the downward impact.

Whether or not investors believe in historical seasonal stock market patterns this past September data could actually reinforce the notion that the worst is behind us (70% of the time after losses are as severe as they were this September, the following months returns are positive). However, reading too much into past trends can be a mistake. The September market downturn is ultimately just a sort of emotional malaise. It is interesting to note that September’s negative seasonal bias is much less pronounced in years when the market is up year-to-date; unfortunately, Canada is not quite there, yet!

MARKET DATA

This report may contain forward looking statements. Forward looking statements are not guarantees of future performance as actual events and results could differ materially from those expressed or implied. The information in this publication does not constitute investment advice by Provisus Wealth Management Limited and is provided for informational purposes only and therefore is not an offer to buy or sell securities. Past performance may not be indicative of future results. While every effort has been made to ensure the correctness of the numbers and data presented, Provisus Wealth Management does not warrant the accuracy of the data in this publication. This publication is for informational purposes only.

Contact Us

18 King St. East Suite 303

Toronto, ON

M5C 1C4