Knowledge Centre

Maintaining Perspective

March 2022

Stock markets around the world have been getting choppy lately; raising the question, is now the time to panic? Investors understand that market fluctuations are a part of investing but they are nevertheless scary. Investing in stocks to earn superior rewards is challenging because you need to take risks. Unfortunately, returns never come smoothly as there are always ups and downs. Thankfully the ups are much more prevalent.

Investing is never a one way street and investors have to ride out the market slumps. Performance can vary wildly from day to day and year to year so it should not come as a surprise to learn that market declines occur in each and every year. Understanding this provides some perspective about what investors can do to be successful. Corrections occur even during periods where the equity markets experience winning returns for long consecutive periods.

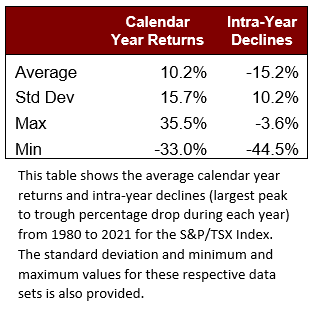

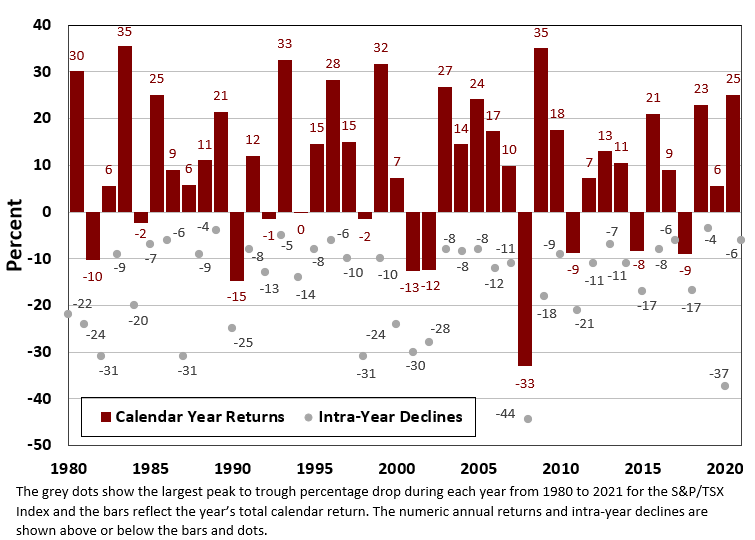

The Intra-year drops are the largest stock market drops from a peak to a trough during the calendar year. The chart shows that market fluctuations are a normal part of stock market investing. The grey dots show the largest peak to trough percentage drop during the year and the bars show the year’s eventual total calendar return for the S&P/TSX Index. The annual returns and intra-year decline figures for the years from 1980 to 2021 are shown above or below the bars or dots. Despite average intra-year drops of -15.2%, the average calendar return was 10.2%; with positive returns occurring in 30 of the 41 years or 73% of the time.

While 5 out of the last 10 years have seen intra-year drops of -10% or more at some point during the year only 2 years ended in negative territory. Sometimes these big intra-year drops obscure the end result even during years when the markets are surging. For example, in 2009 there was a -18% drop but the market ended up 35% for the year. It is amazing to consider that only 11 of the past 41 years ended with a loss yet every single year had a large loss at some point. In fact, 24 years had double digit losses at some point during the year.

Selloffs happen (sometimes they are big, sometimes not) but they are normal and there is no reason to panic. This is especially true during a bad year since it is likely that there is a rebound on the horizon. The true secret is to make these market fluctuations work for you instead of against you by following a few simple steps: never selling during a market correction; rebalance and add to stocks during market corrections if possible; keep some of your portfolio in more conservative investments that will not fluctuate as much during market downturns (i.e. bonds); take a long term perspective; and simply learn to expect and embrace market volatility.

During periods of volatility, short term thinking becomes very risky and market timing can be even more dangerous. Overreacting becomes the real enemy. Every year has its rough patches. It is hard to predict these pullbacks, but despite them, the equity markets have gone on to deliver positive returns in most years. Double digit pullbacks in the markets are normal and a part of life. Investors should expect them and not pay overly close attention to the everyday volatility in the market.

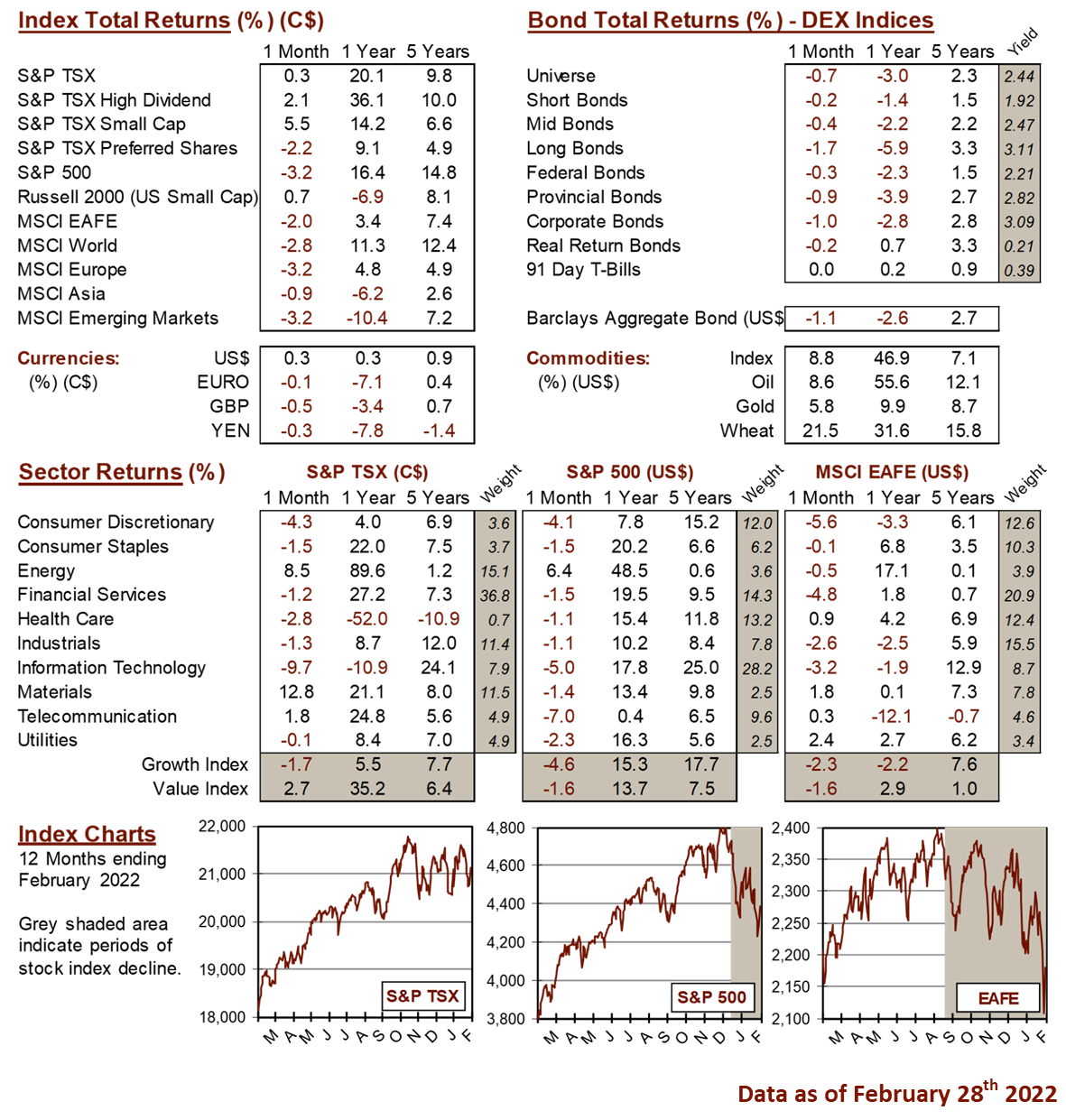

MARKET DATA

This report may contain forward looking statements. Forward looking statements are not guarantees of future performance as actual events and results could differ materially from those expressed or implied. The information in this publication does not constitute investment advice by Provisus Wealth Management Limited and is provided for informational purposes only and therefore is not an offer to buy or sell securities. Past performance may not be indicative of future results. While every effort has been made to ensure the correctness of the numbers and data presented, Provisus Wealth Management does not warrant the accuracy of the data in this publication. This publication is for informational purposes only.

Contact Us

18 King St. East Suite 303

Toronto, ON

M5C 1C4