Knowledge Centre

Investing’s Unicorn

February 2017

All investors want to have their cake and eat it too but you can’t have it both ways. It’s similar to clients who seek high returns with no risk. However, like unicorns, they do not really exist. It’s not an either/or, zero-sum situation, but more like a balancing scale.

A well diversified and structured portfolio more often than not will take care of the return side, especially when the markets are doing well, but it is the other side of the scale, risk, which demands more attention. Of course, everybody loves a bull market but what about when markets go down? Investors feel the sting of loss more deeply than the thrill of a gain.

Volatility is unavoidable. Market declines happen and they tend to happen more often than expected. In fact, the market pulls back 5% on average four times a year. As a result investors need to stay disciplined and stay invested because markets rise more frequently than they fall. This is why downside protection (not losing capital) is vital. Market timing is not the answer since it is generally impossible to do consistently.

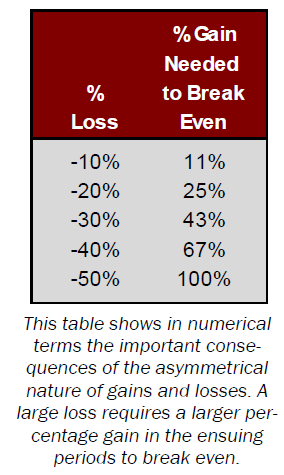

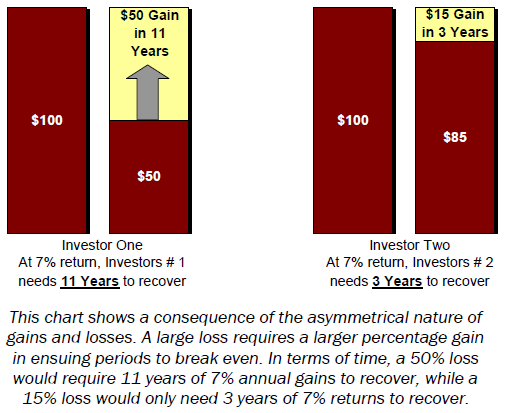

Investors who stay invested for the long run are likely to be more successful than those who move in and out of the market. Of course, by limiting losses and allowing assets to grow over the long term, investors can enjoy the power of compounding. This is very important due to the asymmetrical nature of gains and losses. As the data to the left shows, if an investments declines, it would require a larger percentage gain in the ensuing period just to break even. The larger the loss, the more amplified the impact. The chart to the right shows the journey to recovery takes much longer in normal market conditions with bigger losses to recoup. Therefore, the more effectively an investor can limit losses during down markets, the better shape they will be in the recovery.

Investor behaviour is important when considering downside protection because investors have the bad habit of trying to time the markets and often buy and sell at the wrong time. A 2014 Dalbar report of investor returns showed that over the 20 year period ending in 2013, the typical equity fund investor gained only 1.5% annually, while the S&P/TSX Canadian stock index gained 8.3%, bonds returned 6.5% and even cash earned 3.3%. These returns emphasize the dramatic disparity between what average investors earned and what the markets earned. This market timing behaviour can decimate a portfolio, leaving little chance of recovery.

Many investors place great emphasis on predictability and peace of mind. So emphasising portfolio construction strategies to minimize unpleasant outcomes is imperative and not some fantastical beast. It is never perfectly clear when a market downturn will occur but there is certainty that it will happen. The onus should always be on mitigating the losses by structuring portfolios to balance the long term risk and reward. Downside protection matters, a lot.

MARKET DATA

This report may contain forward looking statements. Forward looking statements are not guarantees of future performance as actual events and results could differ materially from those expressed or implied. The information in this publication does not constitute investment advice by Provisus Wealth Management Limited and is provided for informational purposes only and therefore is not an offer to buy or sell securities. Past performance may not be indicative of future results. While every effort has been made to ensure the correctness of the numbers and data presented, Provisus Wealth Management does not warrant the accuracy of the data in this publication. This publication is for informational purposes only.

Contact Us

18 King St. East Suite 303

Toronto, ON

M5C 1C4