Knowledge Centre

Golden Cross

May 2016

Canadian equities appear to have entered into a new stealth bull market with a cyclical rally apparently having begun on April 28, 2016. The potential reasons for this occurring are as wide and varied as the pundits’ opinions on whether or not there is a new bull market. Of course this is what makes a market; differing points of view and the gumption to stand up for your opinions and investing accordingly. The rational for the current signal comes from the archaic world of technical analysis.

Technical analysis adds a new dimension to the traditional methods of fundamental stock analysis. It is a discipline used for forecasting the direction of stock prices through the study of past market patterns, primarily price and volume information. The reason for the current optimism is a little known technical indicator first created in Japan 50 years ago, the Golden Cross.

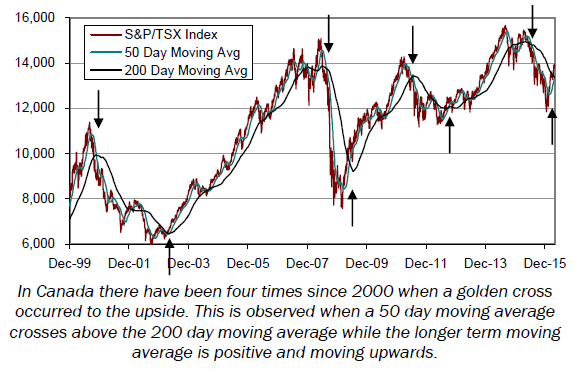

A Golden Cross develops when a shorter term moving average rallies to cross above a longer term moving average which has turned positive and is moving upwards, such as when the 50 day moving average of the S&P/TSX Composite Index crosses above its 200 day moving average. As long term indicators carry more weight, the Golden Cross indicates a bull market is on the horizon. Like most technical analysis signals, Golden Crosses can be excellent at predicting where a market is headed. Being able to successfully take advantage of these signals is what makes a clever and observant investor.

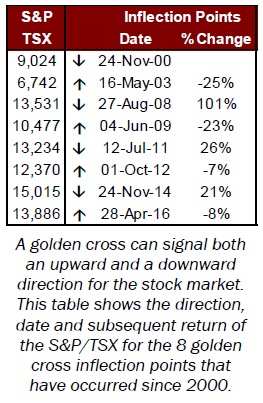

A Golden Cross indicates that the upside momentum may persist. Even though the Golden Cross is defined by what happened in the past, many see it as a forward looking indicator as its track record as a harbinger of higher stock prices is clear. Since 2000 there have been four distinct instances in Canada when the Golden Cross has occurred (2003, 2009 and 2012) and now. Of course, periods of downward stock prices can also be observed when the 50 day moving average crosses below the 200 day moving average (2000, 2008, 2011 and 2014) as can be seen in the chart to the right and the data to the left which shows the percentage change in the index between these periods.

A Golden Cross is not intended to pinpoint the absolute top or bottom of the market. It provides a signal that indicates a trend is changing and implies a potential future direction for the market. As an investor, you should be investing for the long-term, but sometimes you need a spark to push you in the right direction.

Many skeptics believe that the Golden Cross and other technical indicators are simply wishful thinking while others live and die by them. The reality is likely somewhere in between. The usefulness of this type of indicator is left to the interpretation of advocates of various investment philosophies, but it is important to be cautious. One of the reasons why technical indicators such as the Golden Cross garner so much attention is because they can become self fulfilling prophecies if enough investors follow them. And plenty do which may explain concepts such as momentum or the speed at which a rally or sell off occurs. When you roll a boulder down a hill, you do not want to be in front of it, so take technical indicators as a sign that selling momentum is shifting and you might just avoid getting flattened.

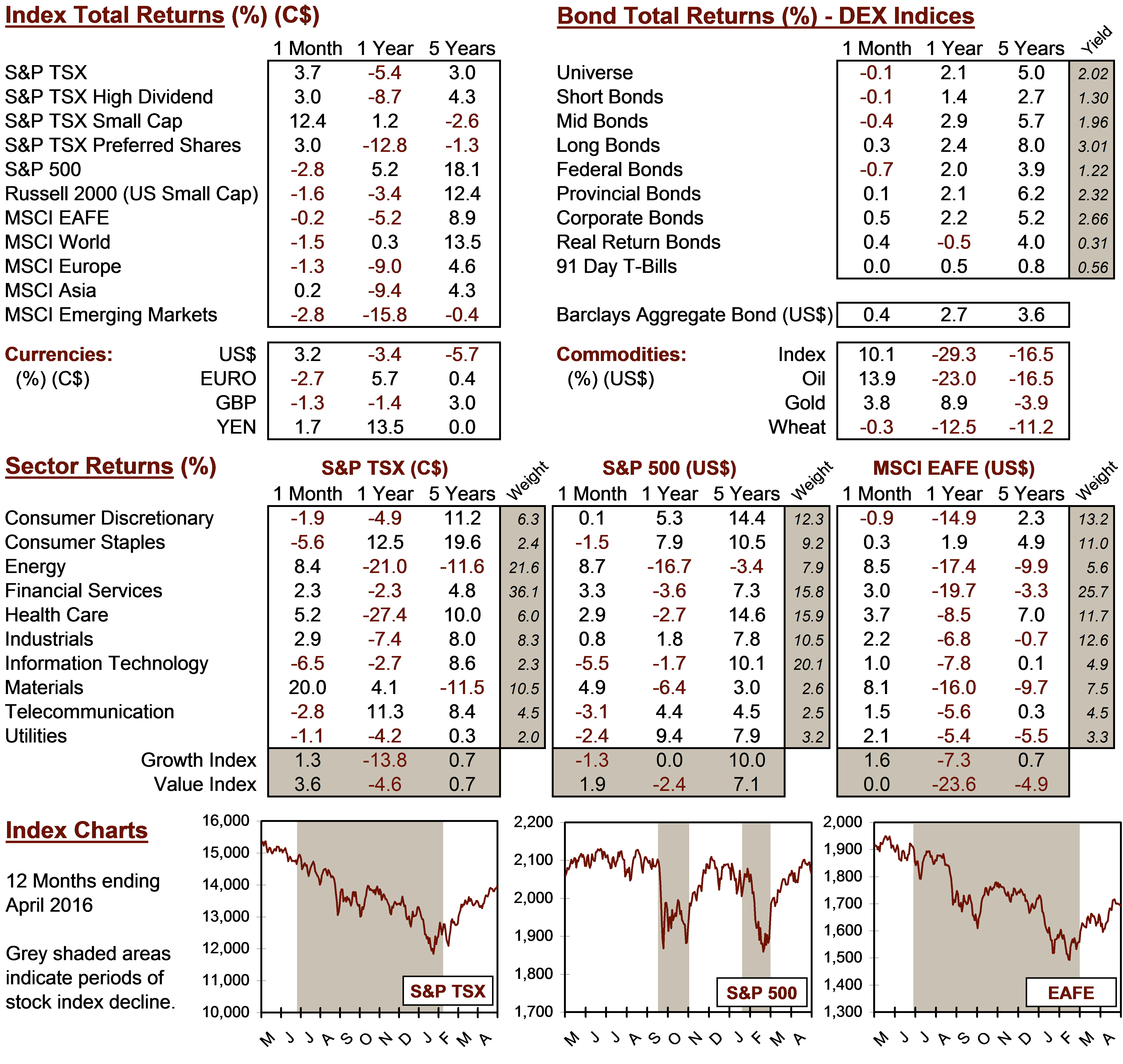

MARKET DATA

This report may contain forward looking statements. Forward looking statements are not guarantees of future performance as actual events and results could differ materially from those expressed or implied. The information in this publication does not constitute investment advice by Provisus Wealth Management Limited and is provided for informational purposes only and therefore is not an offer to buy or sell securities. Past performance may not be indicative of future results. While every effort has been made to ensure the correctness of the numbers and data presented, Provisus Wealth Management does not warrant the accuracy of the data in this publication. This publication is for informational purposes only.

Contact Us

18 King St. East Suite 303

Toronto, ON

M5C 1C4