Knowledge Centre

Canadian Dollar Undergoing Huge Transition

May 2021

The global financial markets are intertwined into one gigantic and convoluted web. This is especially evident with the relationship between currencies and bond spreads (which are the difference between various countries’ bond interest rates). Bond yield differentials play a significant role in determining the direction of a currency and have more influence on currency movement than the underlying bond yields themselves.

Currency valuations reflect economic fundamentals over time although there can be temporary imbalances that disturb the underlying fundamentals, such as what has transpired over the past year as COVID-19 came to define our every moment. The price of currencies can be impacted by the monetary policy decisions of central banks around the world. However, central banks like the Bank of Canada only administer short term interest rates, or the front end of the yield curve. Market forces drive market sentiment and ultimately determine the yields on longer dated bonds. It is the longer dated bonds (10 or more years to maturity) that are the primary force for determining exchange rates.

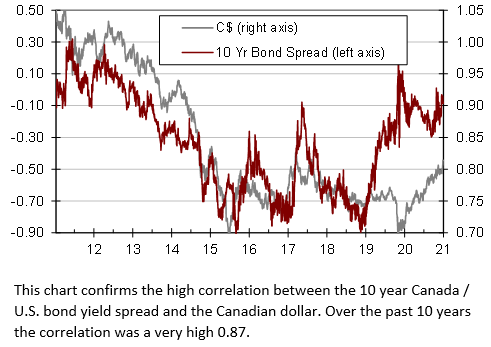

Bond yield differentials usually move in tandem with the corresponding country’s currency as capital flows are attracted to higher yielding currencies. As a general rule when the yield spread widens in favor of a country, then its currency will appreciate more than other currencies. While it is not uncommon for currency movements to lag as much as a year after interest rate differentials have moved significantly, this is not the case between Canada and the U.S. Quite simply, the Canadian and U.S. government 10 year bond spreads accurately dictate the direction of the Canadian dollar better than any other indicator.

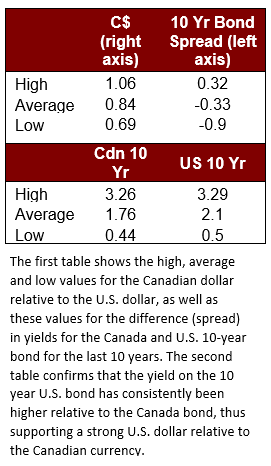

As the chart and data indicate the relationship between the 10 year bond spread and the Canadian dollar is highly correlated. Over the past 10 years of daily activity the correlation is 0.87 (with 1.0 indicating perfect correlation and 0.0 meaning no correlation). To further put this into perspective the correlation between the 10 year Government of Canada bond yields on their own and the Canadian dollar is 0.58; while the correlation between the 10 year U.S. Treasury bond yield and the Canadian dollar is only 0.18. Interestingly, many pundits call the Canadian dollar a “petro-currency” because of oil’s big influence on our economy but the correlation between the currency and the price of oil is only 0.40. Of note, the price of oil hit an all-time low in April 2020 which corresponded to the height of the fear regarding the onslaught from COVID-19.

Canadian and U.S. interest rates are low in absolute terms (although they have been climbing quite dramatically in 2021) but the higher Canada’s interest rates go relative to the U.S., the higher our dollar will go. There certainly is a concerted effort to stimulate the Canadian economy. In the past this was a problem since once momentum is established and a trend develops, it is very hard to reverse its course. In the past 10 years the Canadian dollar peaked at $1.06 and was $0.69 in March 2020 (a 35% decline); just as the COVID-19 pandemic was taking hold.

Now it appears the tide has turned. The Canadian and U.S. government 10 year bond spreads have surged to levels not seen since 2013; and the Canadian dollar has slowly started to follow. However, as a result of the unprecedented impact of the COVID-19 pandemic the climb in the Canadian dollar has been stifled but likely not for very much longer.

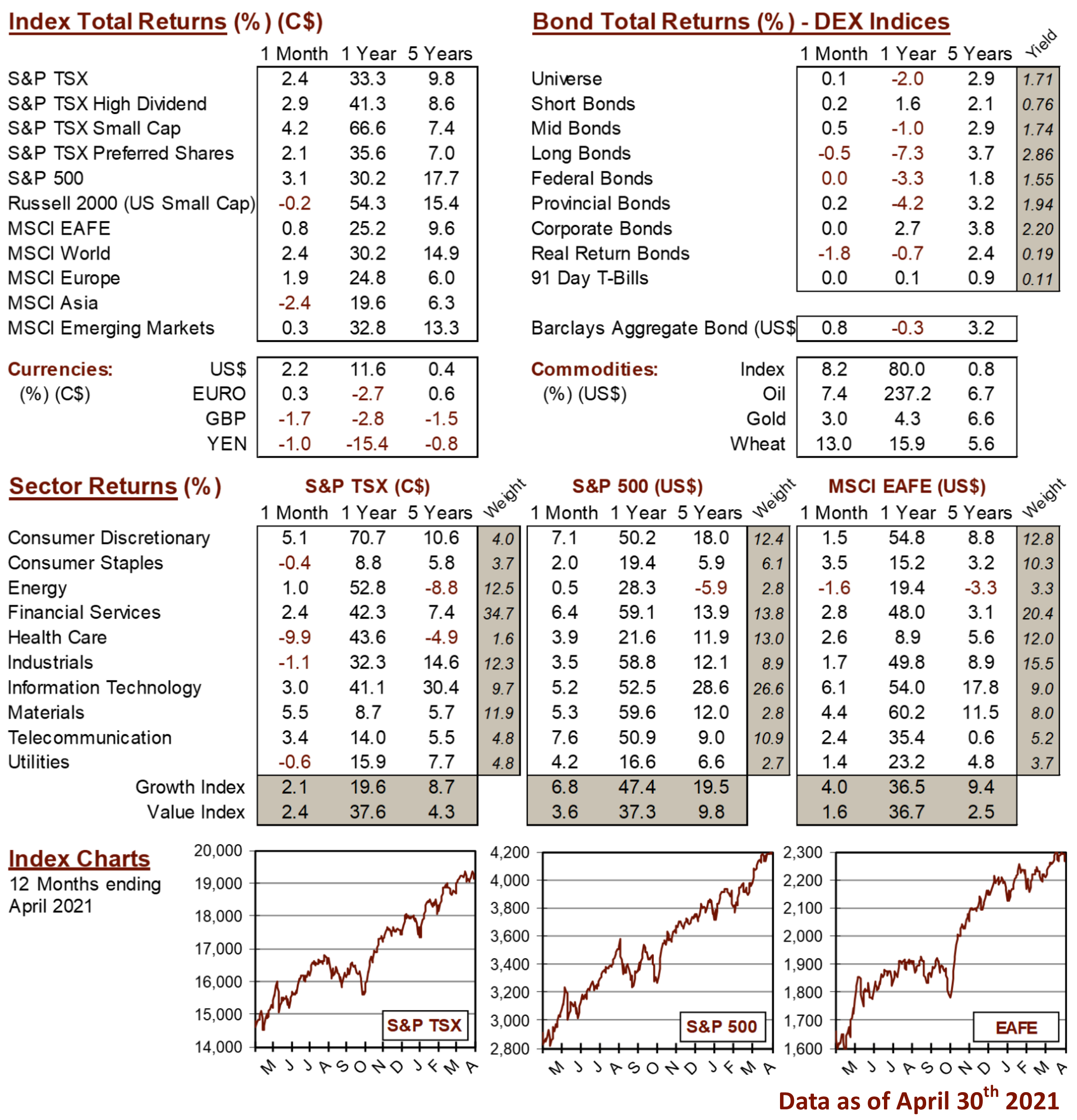

MARKET DATA

This report may contain forward looking statements. Forward looking statements are not guarantees of future performance as actual events and results could differ materially from those expressed or implied. The information in this publication does not constitute investment advice by Provisus Wealth Management Limited and is provided for informational purposes only and therefore is not an offer to buy or sell securities. Past performance may not be indicative of future results. While every effort has been made to ensure the correctness of the numbers and data presented, Provisus Wealth Management does not warrant the accuracy of the data in this publication. This publication is for informational purposes only.

Contact Us

18 King St. East Suite 303

Toronto, ON

M5C 1C4